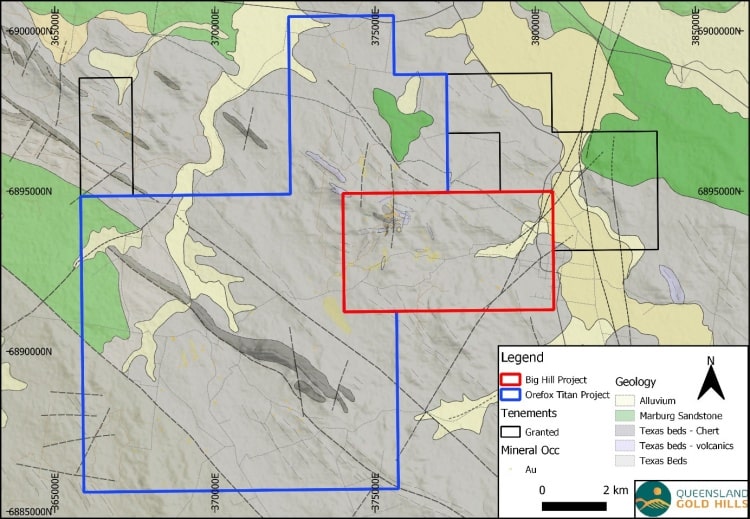

{kanada_flagge}Through a strategic acquisition, Queensland Gold Hills Corp. (TSX.V: OZAU; FRA: MB3) has significantly expanded its footprint in Queensland’s historic mining district. Immediately adjacent to its Big Hill project, the company has acquired the 90-square-kilometer Titan gold project, more than quadrupling its license area in one fell swoop. The Big Hill Gold Project and the Titan Project together comprise 54 historic mines in the Talgai Goldfields in the expanded Warwick Texas District. The Company’s total land holdings in the Warwick-Texas gold district are now 110 square kilometers.

The Titan Project covers 90 square kilometers with over 50 historic high grade mines under a single exploration permit 27507. Like the Big Hill Gold Project, the Titan Project has had limited modern exploration since the 1980’s and provides the Company with a broader range of targets to search for the source of the historic gold mines.

Figure 1: Map of Big Hill (red) with the adjacent Orefox Titan license (blue).

Blair Way, CEO of Queensland Gold Hills, commented, “This is a milestone for the Company as we quadruple our land holdings in the historic Queensland goldfields. This latest acquisition positions the Company as a significant owner of over 110 square kilometers in the Warwick-Texas gold district.”

Pursuant to a share sale agreement entered into between the Company and Orefox Titan Pty Ltd, Queensland Gold Hills will acquire 100% of the outstanding common shares of Orefox from its sole shareholder, Warwick Anderson. In exchange, Queensland Gold Hills will issue 300,000 common shares, subject to the approval of the TSX Venture Exchange. The acquisition of Orefox is a transaction not subject to a third party and the common shares to be issued are subject to a statutory 4-month hold period.

Summary: Queensland Gold Hills has been public for less than a full month and is already reporting its first strategic acquisition. The company is quadrupling its footprint and increasing tenfold the number of historic projects in the license area. That should provide plenty of fodder for geologists for the foreseeable future. They want to investigate the historical mining sites with modern exploration methods, similar to what E79 Resources (CSE: ESNR), for example, has successfully demonstrated in the Australian state of Victoria. Apparently, the vendor has great confidence in Queensland Hill’s capabilities. He is selling his license for just 300,000 shares. At today’s share price of around CAD 0.31, that is just the equivalent of CAD 100,000. The shareholders of Queensland Hill certainly can’t complain about that.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH held or hold shares of Queensland Gold Hills Corp. and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, a contractual relationship exists between Queensland Gold Hills Corp. and GOLDINVEST Consulting GmbH, which includes that GOLDINVEST Consulting GmbH reports on Queensland Gold Hills Corp. This is another clear conflict of interest.