New resource in the near-term possible

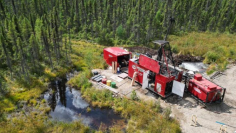

Abitibi Metals (WKN A3EWQ3 / CSE AMQ) has just received the final results of the first phase of its drilling program at the B26 copper project – and they are more than convincing once again!

According to CEO Jonathon Deluce’s company, they have again drilled thick mineralized intersections with strong copper mineralization, and only a short distance from the surface!

The highlights were:

o – 0.75% copper equivalent (CuEq) over 57.75 meters starting at 81 meters depth, including 2.33% CuEq over 11.3 meters (hole #318)

o – 0.97% CuEq over 17.05 meters, starting at a depth of 164.8 meters (hole #318)

o – 1.16% CuEq over 14 meters, starting at 118 meters depth (hole #325)

o – 4.43% CuEq over 5.8 meters, starting at 144.5 meters depth (hole #326) and

o – 3.97% CuEq over 9.75 meters, starting at a depth of 265.85 meters (hole #330)!

CEO Deluce is understandably pleased with these figures. Especially as these figures, taking all the drilling from the first phase together, are likely to have a significant impact on the company’s internal resource model. Considering the fact that the copper price is still up by double digits since the beginning of the year despite its recent setback, it is understandable that Abitibi is considering presenting a new resource estimate in the short term!

Abitibi has thus succeeded in extending the deposit on both the western and eastern boundaries in the first phase of drilling, extending the mineralization to the north of the deposit, which the company says supports the potential for open pit mining, and finally identifying some high-grade extensions of the known mineralization through the definition drilling. As CEO Deluce explains, “The success of these targets combined with our modeling to date, which shows new trends and the strength of alteration in the system, suggests that B26 has great potential for growth.”

The next drill program starts in July

Abitibi Metals is already finalizing the design and planning for the second phase of the drilling program, which is scheduled to begin in July. The aim then, is to extend the deposit to depth and along strike.

Apart from this, as Goldinvest.de readers know, the company also has the Beschefer gold project, which is located just 7 kilometers east of B26. Abitibi is still awaiting the results of a 2,325 meter drilling program, there. In addition, results from a gravity survey covering the entire B26 property are still pending. This survey covered both the deposit and the 8.3 km long priority target trend and should provide further insight for the second phase of drilling.

This indicates that Abitibi Metals will not be short of news flow in the coming weeks and months. The company is also in the enviable position – especially for a resource junior in the current environment – of still having around CAD 17 million in funds available for further work. In addition to all other initiatives, another 16,500 meters of drilling are planned for 2024 and a further 20,000 meters of drilling next year. All of these results will then be incorporated into a preliminary economic assessment (PEA).

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.