{australien_flagge} How does a good idea for the environment become a business? This can be observed in the Australian company Parkway Minerals (ASX: PWN; FRA: 4IP), which is systematically working on the commercialization of its sustainable technology portfolio, for the recovery of valuable materials from liquid waste streams, in mining.

In simple terms, the technology is a further development of seawater desalination related technologies, but more sophisticated. Although pure water is a desirable by-product produced through Parkway’s key processing technology, the main goal is to recover the valuable salts or other valuable substances contained in concentrated waste brine or other feedstock. Parkway’s value proposition for large mining companies essentially consists of: You can improve the efficiency of your operations and reduce costs, whilst also reducing waste and protecting the environment.

For more than a decade, research activities were performed in cooperation with university researchers. In late 2019, through an M&A transaction, the technology migrated to the listed Parkway Minerals, which has since reinvented itself under the recently appointed Managing Director, Bahay Ozcakmak. Within a short period after the M&A transaction, Parkway has partnered with internationally renowned engineering services provider Worley. Worley put Parkway’s technology through its paces, most recently in a prefeasibility study. The partnership is based on a global strategic cooperation agreement.

The recent pre-feasibility study for the Karinga Lakes potash project, provided additional validation of the benefits of the technology. The data from this study is now supporting case studies with potential customers, who in turn are now evaluating whether to engage Parkway and Worley to perform a feasibility study for the project in question. Parkway’s recent addition of its own pilot plant, which is capable of processing liquid waste streams on a larger scale, is particularly helpful in the future evaluation of projects. Customers can see under realistic conditions whether and how the process works with their specific problem waste.

Figure 1: Parkway’s new pilot plant allows the testing of representative quantities of brine or other liquid mining waste such as concentrated tailings.

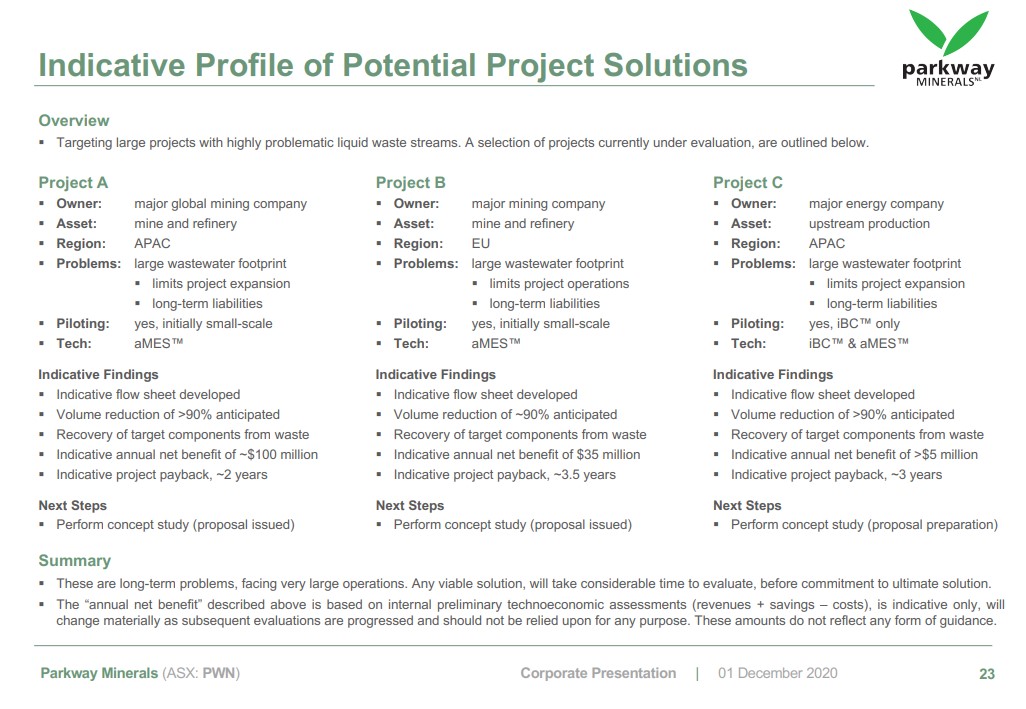

As of December 1, 2020, Parkway has released a new company presentation, which shows the potential of the new technology on some key pages and provides details not previously disclosed. On page 23 in particular, three case studies are presented anonymously, providing a snapshot of some of the projects currently being evaluated.

Figure 2: Comparative overview of 3 projects with case study. Two studies have already been sent to the companies concerned. We understand, a third proposal has recently been issued.

The annual savings potential for the possible target customers is enormous. For project A, the customer could save AUD 100 million per year according to Parkway. In this case, the payback of the required investment would be just two years. While this project is located in the Asia-Pacific region, Project B is located in Europe. Here the annual benefit for the customer is in the order of AUD 35 million and the investment would pay back in 3.5 years. In addition to the purely economic consideration, the environment would be permanently relieved in all the cases mentioned, for example because less waste would have to be pumped into the ground, stored in toxic tailings ponds, or disposed of in water bodies.

In addition to the operational and financial benefits, potential customers would also be attracted by the considerable environmental credentials. At a time when shareholders are always putting ESG on the agenda, this is not to be sneezed at, and likely to become an increasingly important concern.

The sales cycle for such significant capital projects is naturally slow, however, Parkway expects the sales cycle from concept, through to feasibility to take in the order of 9 – 12 months. But it is obvious that once the technology is successfully deployed on a large scale, it will quickly attract the interest of other companies or projects. Environmental authorities may even put pressure on companies to use the newly proven technology (BAT, best available technology) in their projects. It seems almost inconceivable that new projects would be realized without using the new technology.

Over time, Parkway could develop a wide range of applications in various areas. In the end, Parkway could develop into a company that generates its earnings less in the project delivery business than through the annually recurring license income for the use of its technology. It may take some time until then, but if and when the licensing income becomes visible, the company will be highly attractive. Parkway Minerals would effectively become Parkway Royalties. Because of this significant growth opportunity, the company should be put on the watch list today and not be put off by the large number of shares. In the end, more important than the number of shares is the ownership structure and the value that is created.

The link to the new Parkway presentation can be found here: https://9f3902d9-210a-41bd-8f2e-f07bb92684cb.filesusr.com/ugd/4338b8_f37c1ee3eb52408db6a999bcc273ca88.pdf

Folgen Sie uns auf Youtube: https://www.youtube.com/user/GOLDINVEST

Besuchen Sie uns auf Twitter: https://twitter.com/GOLDINVEST_de

Risikohinweis: Die GOLDINVEST Consulting GmbH bietet Redakteuren, Agenturen und Unternehmen die Möglichkeit, Kommentare, Analysen und Nachrichten auf http://www.goldinvest.de zu veröffentlichen. Diese Inhalte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung, es handelt sich vielmehr um werbliche / journalistische Veröffentlichungen. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Der Erwerb von Wertpapieren birgt hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die GOLDINVEST Consulting GmbH und ihre Autoren schließen jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich aus. Bitte beachten Sie auch unsere Nutzungshinweise.

Gemäß §34b WpHG und gemäß Paragraph 48f Absatz 5 BörseG (Österreich) möchten wir darauf hinweisen, dass Auftraggeber, Partner, Autoren und Mitarbeiter der GOLDINVEST Consulting GmbH Aktien der Parkway Minerals halten oder halten können und somit ein möglicher Interessenskonflikt besteht. Wir können nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher dürfte es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen. Ferner besteht zwischen Parkway Minerals und der GOLDINVEST Consulting GmbH ein Beratungs- oder sonstiger Dienstleistungsvertrag, womit ein Interessenkonflikt gegeben ist, da dieser Vertrag beinhaltet, dass Parkway Minerals die GOLDINVEST Consulting GmbH für die Erstellung von Berichten zu Parkway Minerals entgeltlich entlohnt.