{kanada_flagge}Pampa Metals (CSE: PM; FRA: FIRA) has found traces of a deep-seated copper porphyry on its first-ever drill program this summer. The company drilled two projects from its extensive portfolio in Chile: Cerro Buenos Aires (CBA) and Redondo Veronica (RV). Seven RC wells totaling 1,956 meters were drilled this summer on the 6,600-acre Redondo Veronica (“RV”) project in northern Chile. The drill holes were drilled at wide intervals of at least one kilometer to test three target areas within RV. The deepest drill hole is 385 m and the average depth per drill hole is 279 m (see Figure 3 from NR).

Pampa has discovered initial evidence of deep porphyry systems in two of the three targets at Rendondo Veronica: at Cerro Redondo North and at Redondo Southwest. Assay results from the upper portions of the Cerro Redondo North target include copper up to 0.16% Cu along with anomalous arsenic values indicative of the upper portions of a porphyry system. The Redondo Southwest target is characterized by several deep geophysical anomalies (including a deep IP), with drill holes to date only reaching the upper outer margins of the anomaly.

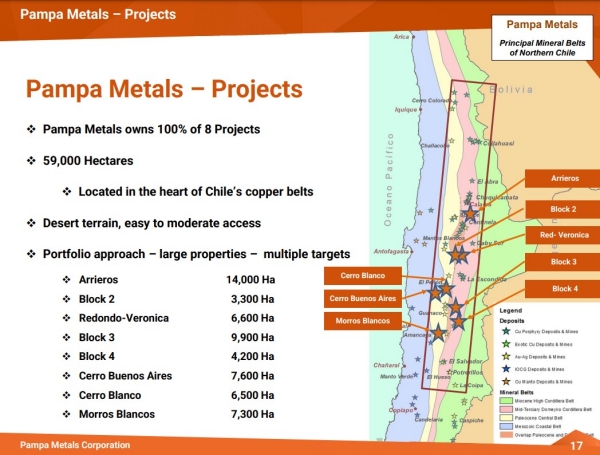

Figure 1: Pampa has a portfolio of eight projects along the copper belt in Chile.

Further deeper diamond drilling over these two targets will be required to test the center of the geophysical targets, which is on a copper porphyry source.

Summary: Pampa’s very technically written press release runs 10 pages. Few investors will likely bother to read the details. At most, a cursory reading will reveal that 0.16% copper has been discovered. That doesn’t sound like much at first. But there are likely to be professional readers who will appreciate Pampa’s technical success. All of Pampa’s drill holes have been “blind”, meaning there are no signs of mineralization at surface because thick layers of gravel cover the mineralization. This is exactly where Pampa’s opportunity lies: obvious targets around super deposits like Escondida have long been discovered. If Pampa geologists are correct in their guess, the copper could potentially lie 700 to 1000 meters. For comparison, Escondida currently mines at 700+ m depth (open pit), Chuchicamata (Codelco) currently mines at 900+m depth, but also there are several profitable underground copper mines in northern Chile, like El Teniente. Pampa has announced plans to advance to the “bowels” of the porphyry systems in the next campaign.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text.

Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Pampa Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in social media, on partner sites or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Pampa Metals. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.