The company is currently planning its first drilling programme in the Salar de Ascotan

At a meeting with US Treasury Secretary Janet Yellen last Saturday, Chilean Economy Minister Mario Marcel announced that Chile plans to bring three or four new lithium projects into operation by 2026. This announcement could mark a turning point for the Canadian lithium explorer First Lithium (TSXV: FLM; FRA: X28), which is active in Chile. The company holds a total of approximately 9,000 hectares of mineral exploration concessions in the Ollague, Carcote and Ascotan salars in the Antofagasta region of northern Chile in its OCA project. It is probably more than a happy coincidence that First Lithium Minerals announced today, Monday of all days, that the company has received the environmental licence for drilling. In addition, a co-operation agreement was signed with the indigenous Cebollar-Ascotan community.

Rob Saltsman, CEO and Director of First Lithium Minerals, commented: “The environmental permit and the signing of the community agreement are important milestones and make our project truly drill ready. With this agreement, First Lithium Minerals confirms its commitment and dedication to the environmental and socio-economic sustainability of the Cebollar-Ascotan Indigenous community. We are very pleased to have signed this agreement with the community, which represents recognition, approval and support for our exploration activities as we continue to advance the OCA project in an environmentally sound and responsible manner, fully focused on a social licence to operate.”

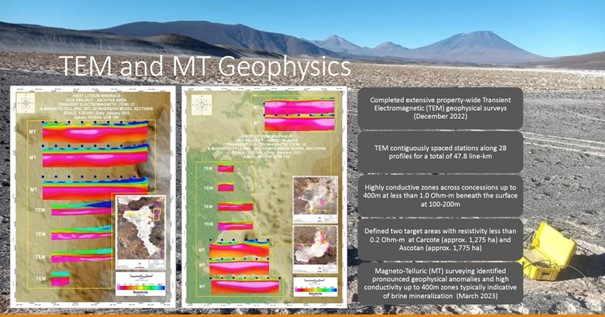

Figure 1: During Q4/22 and Q1/23, First Lithium identified several high priority exploration targets during large-scale geophysical surveys. In particular, distinct zones of extremely high conductivity up to 400m thick were measured, typically indicative of brine mineralisation. The company is currently planning its first drilling programme in the Salar de Ascotan, where it holds a 1,775 ha licence.

Chile, the largest copper producer in the world and the second largest lithium producer, last year introduced a policy criticised by foreign investors to increase state control over the strategic metal lithium. There are currently only two lithium producers in Chile – Albemarle (ALB.N) and SQM (SQMA.SN). Foreign investors are waiting for the left-wing government of President Gabriel Boric to define its national lithium strategy for public-private partnerships to develop lithium brine projects.

At the beginning of last week, the Chilean mining minister stated that the government hoped to finalise tenders for lithium exploration for private companies in the first quarter of this year. Chilean state-owned copper mining company Codelco has been selected to represent the Chilean state in the new public-private model for lithium that Boric is trying to revitalise the industry with.

Janet Yellen visited US lithium producer Albemarle (ALB.N) on Saturday and opened a new licence in northern Chile. According to Reuters, Yellen stated that expanded US-Chilean relations would benefit both countries, improve energy security and help achieve important climate goals.

Conclusion: Since the left-wing Chilean government announced its intention to tighten state control over mining and, in particular, lithium production in the country, most international investors have steered clear of the country for the time being. The fact that Chile is known to have the richest lithium brine deposits alongside Bolivia and Argentina has not helped. By opening up to public-private partnerships in the lithium sector, the government is now formulating an ambitious plan for the first time to increase the number of lithium producers in the country. First Lithium has not allowed itself to be irritated by the political turbulence and has instead qualified its lithium salar projects in the north of the country to the drilling stage. The fact that the company is now receiving its environmental licence could be seen as a sign of a more liberal policy. The dimensions of the First Lithium brine project are world-class, as are the measured exploration values. If drilling is successful, the projects would very likely attract the interest of major investors. First Lithium is currently trading below its IPO price at CAD 0.10 and is valued at CAD 10 million on the stock exchange.

Newsletter Anmeldung

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and in accordance with Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares in First Lithium Minerals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss First Lithium Minerals during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between First Lithium Minerals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.

First Lithium Minerals ist ein kanadisches Explorationsunternehmen, das sich soeben im Nordwesten von Ontario ein 1.900 Hektar großes Lizenzgebiet (Projekt LSL) mit bewiesenen Pegmatitvorkommen zu 100% gesichert hat. Das Unternehmen plant, in der laufenden Feldsaison baldmöglichst mit geologischen Kartierungen sowie Gesteins- und Bodenproben zu beginnen. Dank historischer Bohrdaten liegt First Lithium weit vor vielen Wettbewerbern, die gerade erst mit der Bodenerkundung beginnen.