{kanada_flagge}Hopefully the hits keep coming: With each additional batch of drill holes that P2 Gold Inc. (TSXV:PGLD; FRA:4Z9) releases from its advanced-stage Gabbs copper-gold project in Nevada, it becomes clearer that historical drill holes may have systematically underestimated the thickness and grade of gold-copper mineralization. P2 Gold has just published the results of twelve 12 reverse circulation (“RC”) drill holes (GBR-001 to 012) from the Sullivan sub-project. The best drill holes intersected 2.30 g/t gold equivalent over 48.77 meters and 2.63 g/t gold equivalent over 38.10 meters.

Joe Ovsenek, President and CEO of P2 Gold commented, “Consistent with the diamond drill results we recently reported, the mineralization intersected in the first 12 RC drill holes is thicker and higher grade than defined in historical drilling.”

In the lab, there are an additional 11 RC holes from the Sullivan zone, as well as three holes from the Car Body zone and one hole from the Lucky Strike zone. All three zones are part of the Gabbs project. Results from these drill holes are expected to be released before the end of the year.

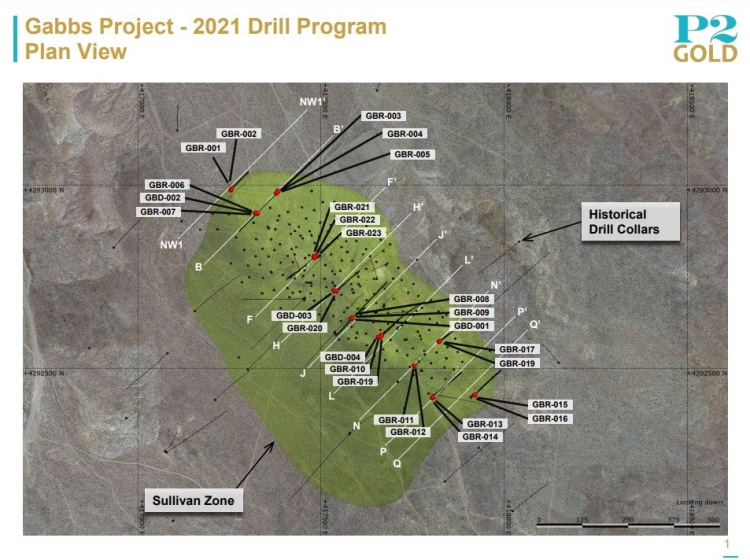

Figure 1: The Sullivan subproject is dotted with drill holes. Each black dot indicates a historical drill hole. P2 Gold’s new drill holes are aimed at confirming, refining and, if necessary, extending the historical results. The latter, in particular, has been very successful to date.

Drill hole highlights include drill hole GBD-008 grading 0.82 g/t gold equivalent (0.56 g/t gold and 0.23% copper) over 163.07 metres, including 25.90 metres grading 1.50 g/t gold equivalent (1.20 g/t gold and 0.26% copper) and drill hole GBD-010 grading 1.62 g/t gold equivalent (1.19 g/t gold and 0.37% copper) over 103.63 metres, including 48.77 metres grading 2.30 g/t gold equivalent (1.76 g/t gold and 0.46% copper) and hole GBD-012 grading 1.51 g/t gold equivalent (1.00 g/t gold and 0.44% copper) over 102.11 metres, including 38.10 metres grading 2.63 g/t gold equivalent (1.74 g/t gold and 0.77% copper), and ended in mineralization.

The RC program began at the northwest extent of the Sullivan Zone, with holes GBR-001 to 007 intersecting footwall lithology where the monzonite hosting the high-grade mineralization was removed. However, there is evidence that it is preserved in the southwest of these drill holes where no historical drilling has been conducted. Future drill holes will test this extension of mineralization.

Holes GBR-008 to 012 intersected the strongly sericite altered monzonite that hosts the high grade mineralization, with copper-gold mineralization extending well into the underlying chlorite altered pyroxenites. As is also evident from the diamond drill results, the grade and thickness of the mineralization in the RC drill holes increases in a southeast direction. Drill holes GBR-011 and 012, drilled furthest to the southeast of these drill holes, ended in significant gold-copper mineralization, indicating that the Sullivan Zone is thicker than interpreted in historical drilling.

Summary: Interest in P2 Gold has been increasing noticeably for the past few weeks, with the stock trading at $0.57 CAD, or nearly 15 percent above the last placement price of $0.50 CAD. Apparently, the positive results from the Gabbs project are slowly starting to have an effect. Historically, 1.8 million gold equivalent ounces have already been confirmed as a resource at Gabbs. If P2 Gold continues at this pace, this resource could grow significantly in the foreseeable future – in terms of volume, but also primarily through higher average grades. At a much earlier stage is the BAM project in British Columbia’s Golden Triangle. It is P2 Gold’s second project. But even there, P2 Gold has made a lot of progress this season with only six drill holes. P2 Gold is currently valued at about CAD 36 million and has issued about 62 million shares.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but explicitly promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH, partners, authors, clients or employees of GOLDINVEST Consulting GmbH hold shares of P2 Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company.

GOLDINVEST Consulting GmbH currently has a remunerated contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages. The above references to existing conflicts of interest apply to all types and forms of publication that GOLDINVEST Consulting GmbH uses for publications on P2 Gold. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.