{kanada_flagge}In a surprise acquisition, Cerro de Pasco Resources (CSE: CDPR; FRA: N8HP) looks set to move up to producer status before the end of the year. For just CAD one million in cash plus 10 million treasury shares, the company is acquiring Trevali’s producing Santander Mine. The Santander mine is the smallest project in Trevali’s portfolio. It is located approximately 215 kilometers northeast of Lima, Peru and is approximately 60 kilometers from Cerro de Pasco’s flagship El Metalurgista project near the town of Cerro de Pasco.

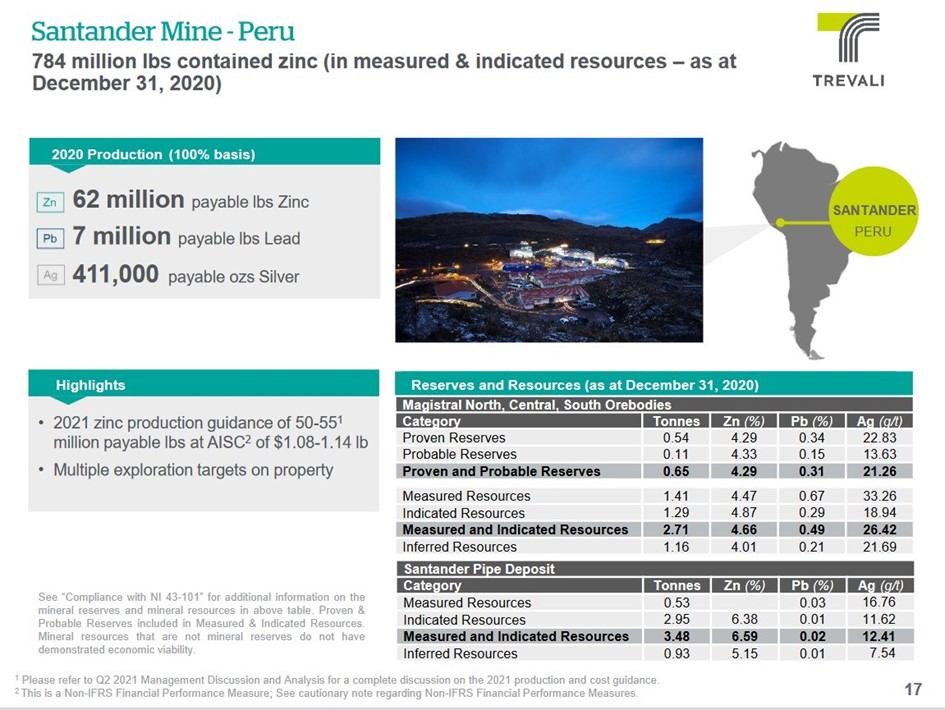

Santander includes the Magistral underground mine, a 2,000 tonne per day processing mill, and a conventional sulfide flotation mill and associated infrastructure. In addition, there is a prospective mining and exploration concession area covering 44 km². Trevali’s projections for Santander’s 2021 operations indicate that the mine will produce approximately 50-55 million pounds of payable zinc, 4 million pounds of payable lead and 282-297 ounces of payable silver per year at a sustained all-in sustaining cost of $1.08-1.14 per payable pound of zinc. Working capital as of the closing date will remain positive and intact at $7.5 million. Sprott Capital Partners LP is acting as financial advisor to CDPR. The transaction is subject to customary closing conditions and is expected to close in the fourth quarter of 2021

Guy Goulet, CEO of CDPR, commented, “The acquisition of this profitable mine is transformational for CDPR as it offers significant potential to increase operating cash flow and significant exploration potential. In addition, the proximity to CDPR’s El Metalurgista concession provides the Company with the opportunity to leverage Santander’s infrastructure for future development.”

Santander has been a non-core asset for Trevali, requiring a high zinc feed rate in current operations to be profitable. Guy Goulet sees an opportunity to increase operating cash flow from the profitable mine. He also sees significant exploration potential. The company plans to extend the operating life of the Magistral orebody while developing access to the higher-grade Santander Pipe orebody in the next 24 to 36 months, which would extend the mine life by five years. In addition, CDPR plans to increase exploration spending on the property.

Cerro de Pasco can build on a stable, fully permitted operation with a stable workforce and good community relations. The modern concentrator with a capacity of 2,000 tonnes per day could eventually be used to treat material from the El Metalurgista concession area 60 km away.

Figure 1: Santander Mine mineral resources as of December 31, 2020 (1,2,3,4), source: Trevali presentation.

The Santander Magistral underground mine mineral resource estimate is based on a US$40/tonne cut-off grade with metal prices of: US$1.15/lb zinc, US$0.90/lb lead, US$25.15/oz silver. The Santander Magistral underground mine mineral resource estimate was prepared by the mine’s geological department and non-independent geological consultants of Trevali Mining Corporation with an effective date of December 31, 2020.

Highlights of the transaction

CAD1 million in cash will be received at closing. In addition, Cerro de Pasco will issue 10 million shares in two tranches. 5,000,000 shares of the first tranche will be freely tradable at closing. An additional 5,000,000 shares of the second tranche will be due 18 months after closing. Trevali retains a net smelter royalty of 1% on all new deposits in excess of the currently defined resources of the Magistral and Santander Pipe deposits. In the event that the average LME zinc price is $1.30/lb or higher in 2022, Trevali will receive a contingent payment of up to $2.5 million.

Cerro de Pasco Resources continues to focus on the development of the El Metalurgista mining concession near the town of Cerro de Pasco. The company is focusing on advanced solutions designed to ensure long-term economic sustainability in harmony with a healthy and prosperous local population.

The bottom line is that in a good deal, both parties, buyer and seller, win. In Trevali’s case, the matter is clear: the company is getting rid of the obligations that were associated with the smallest of its projects. Apparently, the group has decided to put its money elsewhere. The buyer Cerro de Pasco takes over a fully functioning mine just at the moment when the zinc price marks another historic high. Trevali has stipulated that it will be able to profit from the high zinc prices again in the coming year, but after that the cash flow will belong to Cerro de Pasco. Considering how difficult it is to develop, permit and finance a mine, there is a clear winner in today’s transaction and that winner is Cerro de Pasco. Congratulations!

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice, but rather represent advertising / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold or hold shares of the mentioned companies and therefore a conflict of interest may exist. Furthermore, we cannot exclude that other stock exchange letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, between the mentioned companies and GOLDINVEST Consulting GmbH directly or indirectly a consulting or other service contract may exist, which may also cause a conflict of interest.