{kanada_flagge}Concurrent with its recent acquisition of the Jackpot Lake lithium brine project just 35 km northeast of Las Vegas, Nevada, Usha Resources Ltd. (TSXV USHA WKN A3DK8K) has completed an oversubscribed financing of CAD2,895,401. The placement was made in four tranches since the beginning of April, each at a price of CAD 0.30 per share unit. With a well-funded treasury, Usha now plans to aggressively advance exploration on the Lithium Brine Project and, in the best case scenario, deliver an initial 43-101 standard resource estimate later this year.

A smaller portion of the fresh capital will go toward an initial drill program at the Lost Basin gold-copper project in Mohave County, Arizona. Usha also plans to spin off its Nicobat nickel project (Ontario) into its wholly owned subsidiary Formation Metals Corporation (“FMC”). As a result, Usha shareholders are to receive a 20% “stock dividend” in the form of one (1) FMC share for every five (5) USHA shares owned on the record date for the stock distribution.

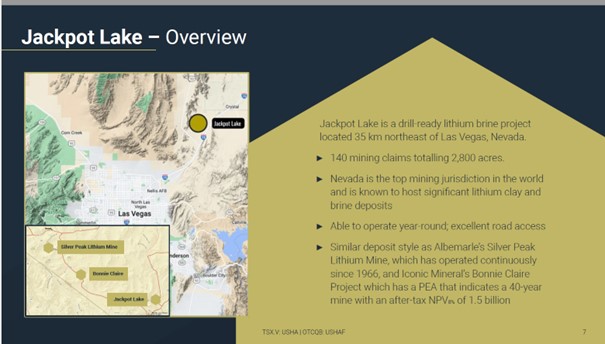

Figure 1: Jackpot Lake is located 35 kilometers northeast of Las Vegas and is well served by roads and other infrastructure

Deepak Varshney, CEO of Usha Resources, stated, “Given the current market conditions, the completion of this oversubscribed placement is a testament to the strong demand and growing confidence in our team, our lithium, gold-copper and nickel projects, and our vision for the future that we intend to pursue with the Company. We are very pleased to welcome many new subscribers to this financing, including our newest institutional investor, and thank our existing shareholders who participated for their continued support.”

Each share unit issued consists of one common share and one-half of one transferable share purchase warrant, with each whole warrant exercisable at $0.45 CAD per share for a period of two years from the closing date.

Bottom line: the market has barely realized how transformative the acquisition of the “Jackpot Lake” lithium salar is actually for Usha Resources. The extremely negative market sentiment at the moment may play a role in this. Just a few months ago, Usha would have been flooded with fresh money at the mere mention of the buzzword lithium. But as it is, the company has had to seek out new shareholders and convince them with a solid plan, which is no disadvantage for the future. In principle, there are two questions that investors need to ask themselves: First, how likely is it that Usha Resources will be able to identify an initial lithium resource in the coming months and, second, what would a lithium brine resource be worth in today’s Nevada market? Of course, it also depends on the size and quality of the resource, but usually just becoming a resource-status lithium explorer provides a significant jump in valuation. After financing, Usha has about 35.1 million shares outstanding. At the current price of CAD 0.35, this translates into a market value of about CAD 12 million. It is up to the market to decide whether and for how long this valuation is appropriate.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Usha Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, there is a contractual relationship between Usha Resources and GOLDINVEST Consulting GmbH, which includes that GOLDINVEST Consulting GmbH reports about Usha Resources. This is another clear conflict of interest.