{kanada_flagge}A planned IPO in the high-grade Minto copper district in the Yukon is a breath of fresh air and is likely to unleash significant positive side effects for its earlier-stage neighbor Granite Creek (TSXV: GCX; FRA: GRK). The owners of the Minto copper mine, who restarted production in 2019 after acquiring the project from Capstone, want to take advantage of the current strong environment in the copper market to emerge as a Tier 1 mining company on the TSX Venture Exchange under the name Minto Metals Corp.

The announcement was made yesterday by UK-based Pembridge Resources, which acquired 100 percent of the project in June 2019 for CAD 20 million. Stifel GMP and Raymond James Ltd have been appointed as lead brokers to raise the required CAD45 million from investors. The price range envisaged for the transaction implies a pre-money valuation for the project of between i the CAD 157 million and CAD 170 million.

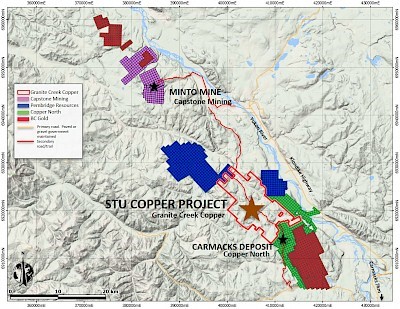

With drill results from its current 10,000 meter program pending, a resource update and new economic study on the near horizon, nothing better could have happened to its small neighbor Granite Creek than Minto’s IPO. Now many large investors will be taking a close look at the Minto mine and its surroundings. They will take note that the Minto Mine is located in an 80 km long, highly underexplored copper belt with numerous targets near the mine and in the region that offer significant potential for extending the life of the mine. And it will not escape their attention that Granite Creek owns 176 square kilometers of the Minto copper belt, which at one point even directly adjoins Pembridge-held properties.

Minto Metals will no doubt also be taking a close look at what is on that ground and Granite Creek is on the verge of not only vastly increasing its tonnage, but is conducting in-depth studies on processing options that will surely include the potential of running through the Minto facilities. In fact, under the “Investment Highlights” section of the news release the last bullet could easily be interpreted as a subtle nod to this possibility when they note that Minto Metals “Owns the only processing infrastructure in the region, providing opportunities for further production growth initiatives”.

The Minto resource, while high grade, is not particularly large at 11Mt @ 1.46% copper (about 357 million pounds). As a result, current resources only allow for an initial eight-year mine life. In short, investors know that Minto will need more resources in the future. There are two ways to achieve this goal: through its own exploration or by acquiring resources in the neighborhood. Which option is more attractive to a future publicly traded company like Minto Metals will be up to future management to decide. But it’s hard to imagine Minto and its investors being unimpressed if Granite Creek actually doubles its resource again during this year’s exploration season as hoped.

Currently, Granite Creek reports a resource of 23.7 million tonnes @ 0.85% copper in the Measured & Indicated category. This equates to 446 million pounds of copper, with 325 million pounds in oxide ore and 141 million pounds in deeper sulphide ore. It would seem logical to look at this as an option, perhaps in conjunction with their own exploration efforts. Or could we see some other arrangement under which GCX does ongoing exploration in the region on Minto’s behalf. Possibilities aplenty once the IPO completes and Minto is listed and flush with working capital.

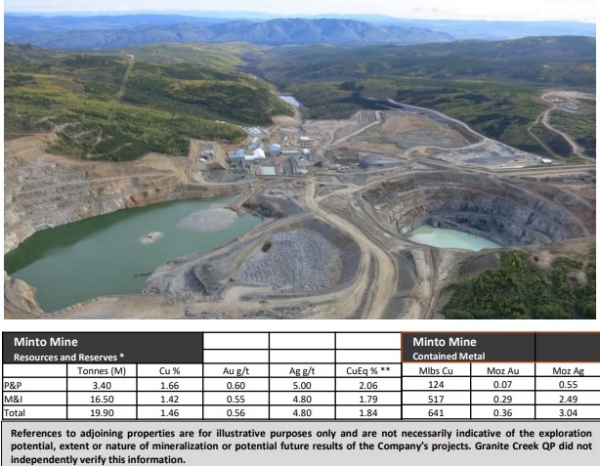

Figure 1: Aerial view of the currently idle Minto Mine in the Yukon, including infrastructure.

Figure 2: The Minto Mine was owned by Capstone Mining until 2019. Capstone had ceased operations in 2018 because, at the price of copper at the time, the risk of exploring for an extension of the operating life seemed too risky. The mine is located only about 20 kilometers away from the area where Granite Creek plans to drill this season. Pembridge Resources, the owner of Minto, is even directly adjacent to Granite Creek’s property.

Bottom line: Granite Creek couldn’t ask for better PR than its neighbor’s IPO. While Granite has yet to announce results in this year’s exploration campaign, drilling started in early May and, at the time of writing, has exceeding 6000 meters. Initial assays should be forthcoming in the next weeks and continuous throughout the summer with a second phase program a distinct possibility in the fall. Many more investor eyes will be following GCX news than ever before as it looks like a very obvious take-out target now. The Minto copper belt is crying out for consolidation. What if Granite Creek could boast twice as many resources as its producing neighbor by the end of the year? The synergies would be obvious. Granite could answer for future Minto shareholders the question of how to extend the life of the mine and where future production growth should come from. Both would certainly be welcomed by the market. For us, at any rate, Granite Creek is therefore a acquisition candidate in perspective. But the new Minto management will have to decide on this in due course. First of all, Minto has to successfully complete its IPO. We will stay tuned to the story.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Granite Creek Copper and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Granite Creek Copper and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Granite Creek Copper. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Granite Creek Copper. This is another clear conflict of interest.