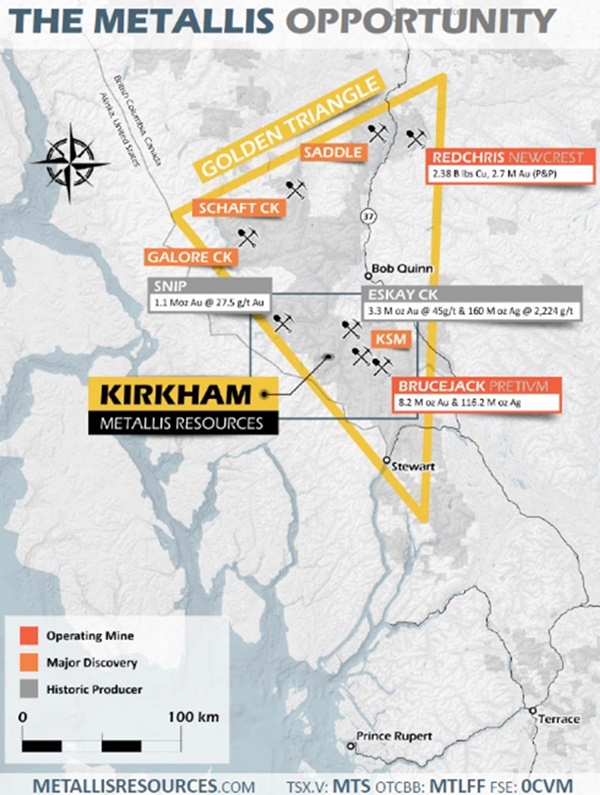

{kanada_flagge}It’s been just two weeks since Newmont Corp. (TSX:NGT) announced its full acquisition of GT Gold (TSXV:GTT) for CAD456 million. The amicable transaction once again shines a spotlight on the Golden Triangle in northwestern British Columbia: this is the district where those big discoveries that ultimately make a difference to the big mining companies are apparently possible. Representative examples are the producing mines Red Chris (acquired by Newcrest in August 2019) and Brucejack (owned by Pretium) or the large-scale projects KSM of Seabridge (TSX: SEA) and Galore Creek (owned by Newmont/Teck), which are currently under development.

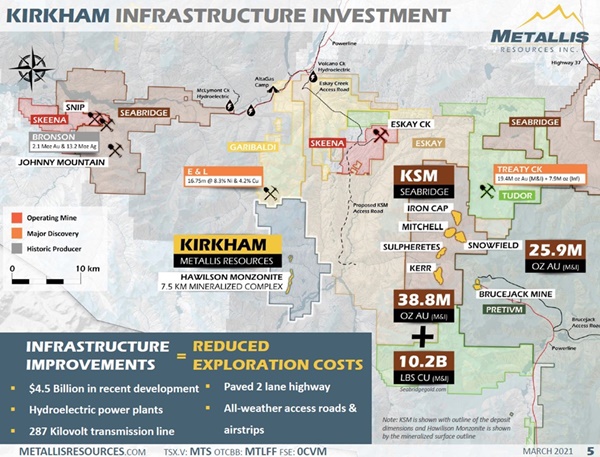

According to recent estimates, total gold resources in the Golden Triangle now stand at 219 million ounces of gold with another 87 billion pounds of copper. In the middle of it all is Metallis Resources’ (TSXV: MTS; FRA: A1W2NG) large-scale Cliff copper-gold porphyry system located on their 100% owned Kirkham Property. Metallis’ neighbors are some of the most well-known Companys in the GT and geologically the Cliff Porphyry System sits on the same “Red Line” rift fault as Seabridge’s (TSX: SEA) KSM project, Tudor’s (TSX: TUD) Treaty Creek and Pretium’s Brucejack gold mine just a few miles to the east.

Newmont’s latest coup ensures that all companies with prime real estate within the “Golden Triangle” are currently attracting the greatest attention from investors, all the more so if – like Metallis Resources you have a similar deposit type of similar age as other major discoveries in the area. To some extent, the investors are the same anyway. The inevitable Eric Sprott is a shareholder in both GT Gold and Metallis. Thanks to ironclad spending discipline over the last 7 years, Metallis has managed to issue only 44,060,433 shares so far in the Kirkham development with no roll backs to date. At the current share price of CAD 0.40, this results in a market value of just CAD 17 million! In terms of valuation, Metallis is a veritable chick compared to its neighbors. However, recent news could quickly change the picture, especially if investors draw parallels with GT Gold.

Figure 1: Metallis Kirkham project in the Golden Triangle is surrounded by big names.

Figure 2: Close-up of Kirkham. Seabridge’s KSM project is 22km directly to the east. Skeena and Eskay Mining are in the immediate vicinity.

Discovery of gold-bearing zone in four-kilometer-long Cliff porphyry

Metallis has significantly expanded the previously known gold-bearing zone within the four-kilometer Cliff Porphyry system. Recent drilling suggests a near surface 200 to 300 metre wide mineralized corridor of finely disseminated gold that is already 2 kilometers long today and could grow even further along the Cliff Porphyry system. The gold-rich corridor extends at least 600 meters deep.

Results also indicate, similar to the other major discoveries in the area, that gold grades increase with depth. The fact that the Cliff Porphyry contains high grade gold is otherwise unusual for a porphyry system. Not so, however, with similar systems in the Golden Triangle. The discovery of significant high-grade gold at depth in two drill holes more than one kilometer apart opens the possibility of further extending the gold zone and testing the deeper core of the Cliff Porphyry system.

Fiore Aliperti, President and CEO of Metallis, stated, “We have now established in two separate discovery holes that gold grades increase with depth. Significantly, holes 34 and 37 are approximately 1.2 km apart, which has extended the gold-bearing mineralized corridor to a strike length of at least 2 km.”

He added, “We have decisively improved our chance of defining large tonnage gold mineralization.” Aliperti compares Kirkham to world-class Golden Triangle deposits such as Saddle North, KSM and Red Chris.

Cliff porphyry offers opportunity for large tonnage gold project

Metallis plans an aggressive work program in 2021 focused on further expanding the gold-rich corridor and exploring even deeper copper-rich core zones of the Cliff Porphyry system.

Figure 3: Plan view map of mineralized corridor coincident with IP resistivity anomalies.

Figure 4: Northeast view of surface geology and orientation of mineralized corridor at Miles.

The Kirkham property is 106 square kilometers in size and is 100% owned by Metallis. It is located 65 km north of Stewart, B.C., in the heart of the prolific Eskay Camp in the Golden Triangle. The property is prospective for several mineral occurrences and is located along a strategic geological boundary – the “Red-Line”, which lies on the western edge of the Eskay rift system in the Golden Triangle of northwestern British Columbia.

Conclusion:

Metallis Resources owns a filet piece in the heart of the Golden Triangle with its 106-square-kilometer Kirkham Project. Recent drill results indicate that a large tonnage gold deposit may be developed along the Cliff Porphyry. Already, the gold-bearing corridor can be traced over a width of 200 to 300 meters and over a length of 2 kilometers and still remains open in all directions. Further drilling may show that gold mineralization extends even further along the porpyhry. This makes Metallis’ project an attractive target for industrial gold mining with comparatively low grades but large tonnage. It will take more drilling to bring this concept to the resource stage. Remains the fact the company shrewdly purchased the 2% NSR back in 2018 so there is no NSR on the porphyry which can only help the economics.

{letter}

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold shares of Metallis Resources and therefore a conflict of interest could exist. We also cannot exclude that other stock letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service relationship between GOLDINVEST Consulting GmbH and a third party that is in the camp of the issuer (Metallis Resources), which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Metallis Resources. This third party may also hold, sell or buy shares of the issuer and would thus profit from a price increase of the shares of Metallis Resources. This is another conflict of interest.