Metallic Minerals (TSX.V: MMG; FRA: 9MM1) is different from other exploration companies in that CEO Greg Johnson’s vision since inception has been to look for opportunities to bring cash flow into the company as early as possible. Johnson, a geologist and entrepreneur, had good experience with this during his time as a co-founder of NovaGold Resources (NYSE and TSX: NG) where their early acquisition of a gravel and alluvial gold business initially gave them significant extra income with which they were able to cover much of their corporate expenses and weather the depths of a bear market.

This operating income also provided NovaGold as a small cap explorer with the ability to go after the world class Donlin Gold project in Alaska, which they grew to over a $3 billion market cap company by defining 40-million-ounces of gold that is now partnered with Barrick.

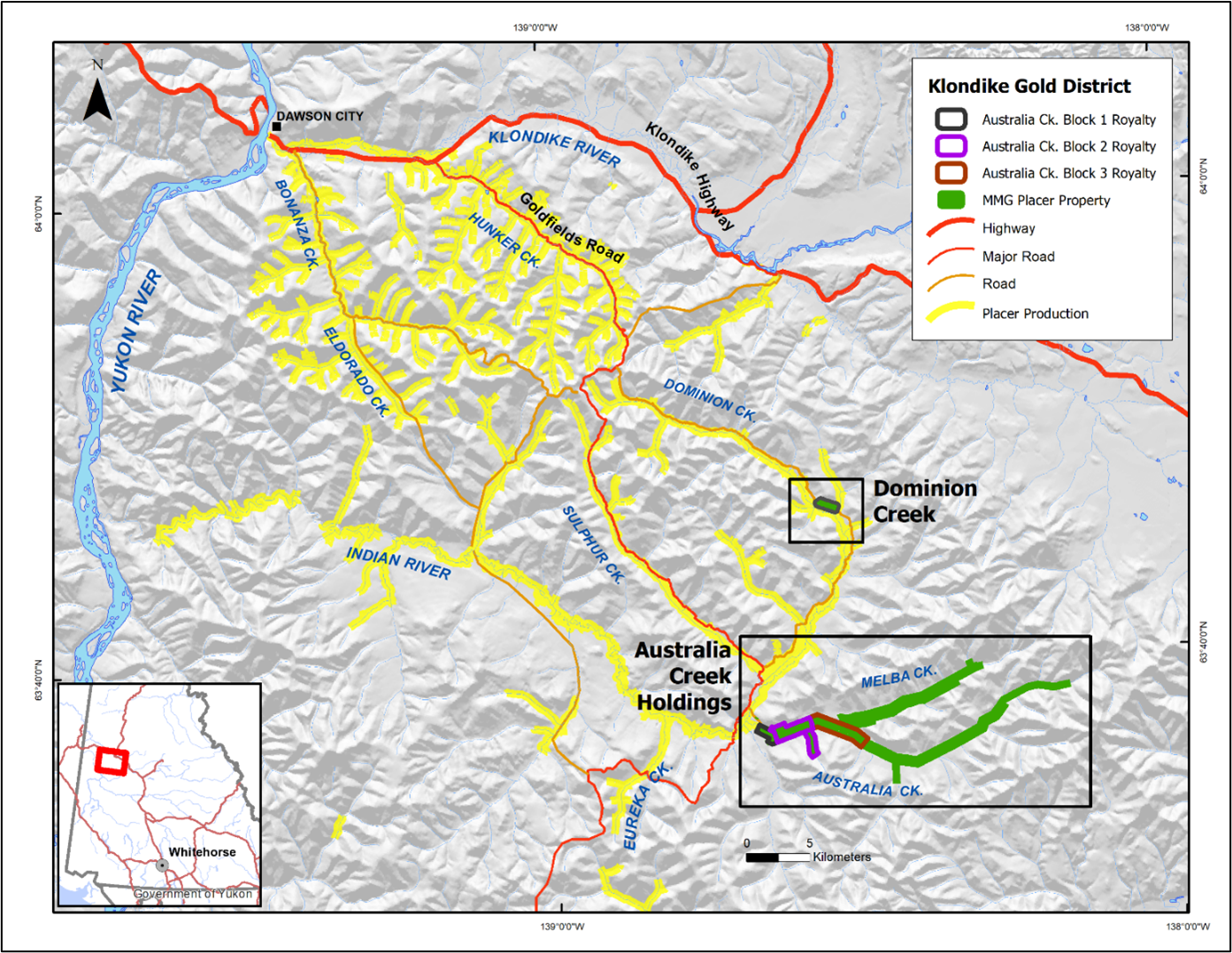

Bringing a similar concept to Metallic, the Company is expecting cash flow and gold production to start building from their alluvial gold operations in the prolific and famous Klondike gold district near Dawson City in Canada’s Yukon Territory. This famous gold district has produced over 20 million ounces of alluvial gold since its historic discovery in 1898. Alluvial or placer deposits are deposits of gold and silver hosted in shallow gravel that can be mined and processed using simple water and gravity separation.

Metallic’s holdings are very large lease areas of unmined Klondike style alluvial gold and they lie directly up valley from some of the largest open pit placer mines in the Yukon. These operating mines currently produce 50% of all the gold in the Yukon. Drill campaigns this spring on Metallic’s holdings have confirmed the presence of alluvial gold in the same geologic setting as the large mines down valley.

Bulk sampling is already underway at one of the projects, so Johnson believes there is a good chance that royalty income will be generated for the first time as early as this year. Metallic Minerals will receive a royalty of 10-15% from all gold production.

Metallic has active leases on four alluvial claim blocks at Australia and Dominion Creeks with three operators. All four properties are currently being developed and preparations for commercial gold production are underway. In particular, bulk sample testing is an important step in the development process designed to confirm the gold grade indicated in the drilling. Bulk sample processing is expected to begin in August and continue into the fall, with additional site preparation and drilling expected to begin in September.

Figure 1 – Metallic Minerals’ portfolio of alluvial gold royalty claims in the Klondike gold district.

The company controls a further 30 kilometers of claims up valley with room for growth to an additional 10 or 15 operations in the Australia and Melba Creek valleys.

Though the company’s primary focus is its potential for a world-class silver discovery at its projects in the Keno Hill and La Plata mining districts, we believe the early introduction of cash flow and gold production makes it stand apart from its peers and may well lead to the kind of massive value creation that was seen with NovaGold.

Conclusion: The corporate purpose of exploration companies is to invest large amounts of money into relatively high-risk exploration with the target to develop a new economic metal deposit that can be mined. This is effectively the Research & Development side of the mining industry and it is expensive. Its similar to the type of high-risk, high-cost research done by a biotech company. There are only a handful of explorers that counter the inevitable of dilution in continued capital rounds with their own cash flow. Metallic is such an exception. We will see how royalty income develops in the coming years. Ideally, they could cover Metallic’s overhead costs and then even more money would flow into focused exploration giving the shareholders greater leverage to discovery and value creation.

{letter}

Risikohinweis: Die GOLDINVEST Consulting GmbH bietet Redakteuren, Agenturen und Unternehmen die Möglichkeit, Kommentare, Analysen und Nachrichten auf http://www.goldinvest.de zu veröffentlichen. Diese Inhalte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung, es handelt sich vielmehr um werbliche / journalistische Veröffentlichungen. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Der Erwerb von Wertpapieren birgt hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die GOLDINVEST Consulting GmbH und ihre Autoren schließen jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich aus. Bitte beachten Sie auch unsere Nutzungshinweise.

Gemäß §34b WpHG und gemäß Paragraph 48f Absatz 5 BörseG (Österreich) möchten wir darauf hinweisen, dass Auftraggeber, Partner, Autoren und Mitarbeiter der GOLDINVEST Consulting GmbH Aktien der Nova Minerals halten oder halten können und somit ein möglicher Interessenskonflikt besteht. Wir können außerdem nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen. Ferner besteht zwischen einer dritten Partei, die im Lager der Nova Minerals steht, und der GOLDINVEST Consulting GmbH ein Beratungs- oder sonstiger Dienstleistungsvertrag, womit ein Interessenkonflikt gegeben ist, da diese dritte Partei die GOLDINVEST Consulting GmbH entgeltlich für die Berichterstattung zu Nova Minerals entlohnt. Diese Dritte Partei kann ebenfalls Aktien der Nova Minerals halten, verkaufen oder kaufen und würde so von einem Kursanstieg der Aktien von Nova Minerals profitieren. Dies ist ein weiterer, eindeutiger Interessenkonflikt.