{kanada_flagge}Tembo Gold (TSXV: TEM; FRA: T23A) and Barrick Gold (TSX: ABX) today released details of a spectacular transaction: for USD $6 million, Barrick will acquire from Tembo a total of six licenses directly adjacent to Barrick’s world-class Bulyanhulu mine in Tanzania. On top of that, Barrick also becomes a shareholder of Tembo, as upon signing the purchase agreement, Barrick’s subsidiary Bulyanhulu Gold Mine Limited agreed to subscribe for common shares of Tembo in a private placement at a price of CAD0.27 per common share. Barrick will acquire 5,518,764 shares of Tembo, becoming a 5.5 percent shareholder.

Barrick also commits to invest at least USD $9 million in the newly acquired license area over the course of four years following the closing of the transaction. In the event of success, Tembo would benefit massively again and receive up to USD $45 million in profit sharing. These are “contingent payments” to be calculated on the basis of inferred, indicated and measured gold mineral resources if found in the land areas covered by the licenses.

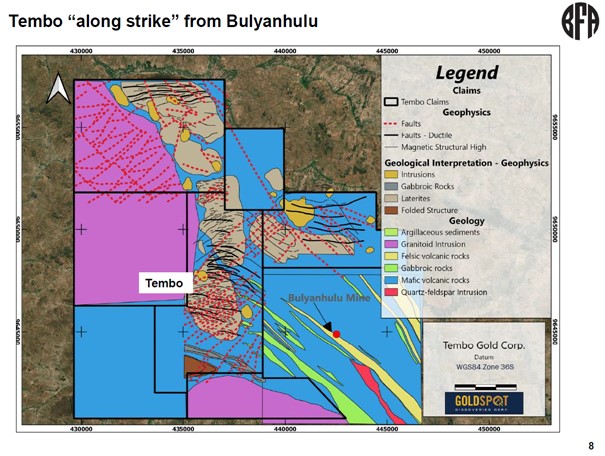

Figure 1: Goldspot’s data analysts suggest that the Tembo licenses may be “on strike” with Barrick’s Bulyanhulu mine. If nothing else, this evaluation is likely to have convinced Barrick.

Even after the deal with Barrick, Tembo retains the vast majority of its eponymous exploration properties in Tanzania. The six licenses sold are in areas where Tembo has not previously concentrated its exploration activities. Accordingly, Tembo retains its core licenses on which the last two drilling campaigns were carried out. On these core licenses, as Goldspot’s analysis has shown, there are still a significant number of untested new high priority targets. In addition, the core licenses include the three main targets where the majority of the drill holes have been completed.

David Scott, President & CEO, stated, “This agreement is an important milestone for Tembo. We have long considered our license area to be one of the most prospective areas in the Lake Victoria goldfield. Barrick’s commitment is a significant endorsement of the potential for gold discovery in the area. The proceeds from the sale will allow us to move forward in earnest with our exploration strategy. We expect and hope that a significant new discovery will be made that will benefit the companies as well as the surrounding communities and the country of Tanzania.”

The formal closing of the transaction and private placement are subject to TSX Venture Exchange approval and other required regulatory approvals in Tanzania, as well as other customary closing conditions for transactions of this nature. However, both parties anticipate that the closing of the Transaction and the Private Placement will occur in the first quarter of 2022.

Conclusion: German stock market speculator André Kostolany once referred to stock market gains as pain money. This wisdom proves exemplary in the case of Tembo Gold. For more than a decade, the team around CEO David Scott held together the concessions in Tanzania, although the matter often enough seemed hopeless due to the political conditions in Tanzania. Insiders in particular have kept the company alive over the past few years and massively increased its position. Now it is paying off that Tembo has held on to its “asset.” The neighbor Barrick has publicly stated several times its intention to make Tanzania a focus of future investments. To implement this growth strategy, Barrick apparently needed the Tembo licenses, which are directly adjacent to the world-class Bulyanhulu mine. For Tembo shareholders, it’s a well-deserved “ten year over night success” as well as the go-ahead for some serious exploration of their own early next year. The bull elephant in the company’s logo has proven to be a true alpha dog. Tembo’s journey has just begun anew. Goldinvest first highlighted Tembo in May of this year. At that time, the stock stood at CAD 0.16.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH may hold shares of Tembo Gold and therefore a conflict of interest may exist. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time, which could affect the price of Tembo Gold Corp. shares. In addition, there is a consulting or other service contract between Tembo Gold Corp. and GOLDINVEST Consulting GmbH, with which a further conflict of interest exists, since Tembo Gold Corp. remunerates GOLDINVEST Consulting GmbH for reporting on Tembo Gold Corp.