{kanada_flagge}Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) has achieved a good hit rate on its first drill holes at the Cesar project in northeastern Colombia. Malachite and chalcocite zones were intersected in 12 of the first 14 holes, with significant copper-silver mineralization encountered in 6 holes, including bonanza grades of 18.5% copper and 292 g/t silver over 0.8 m, and an interval 10.6 m of 3.4% copper and 48 g/t silver in hole URU-12!

{kanada_flagge}Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) has achieved a good hit rate on its first drill holes at the Cesar project in northeastern Colombia. Malachite and chalcocite zones were intersected in 12 of the first 14 holes, with significant copper-silver mineralization encountered in 6 holes, including bonanza grades of 18.5% copper and 292 g/t silver over 0.8 m, and an interval 10.6 m of 3.4% copper and 48 g/t silver in hole URU-12!

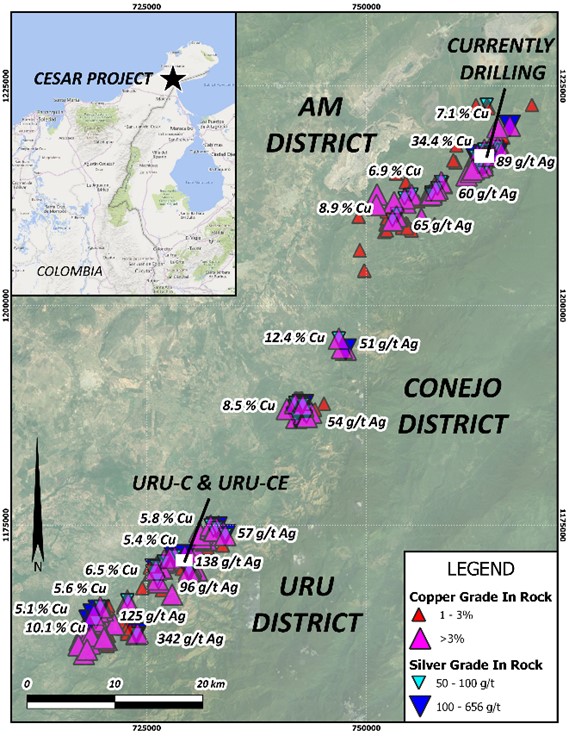

Within the 20 km long and 2 km wide copper-silver bearing URU district, only two targets Uru- Central (URU-C) and URU-Central East (URU-CE) have been drill tested (see Figure 1). The drill holes on the URU-C and URU-CE targets were 750 meters apart. They confirmed the continuity of copper-silver mineralization at depth.

All holes encountered significant alteration associated with a district-scale hydrothermal system. All structures identified to date appear to be associated with mineralization events. Most notable is the presence of widespread copper oxide in the form of malachite and primary chalcocite.

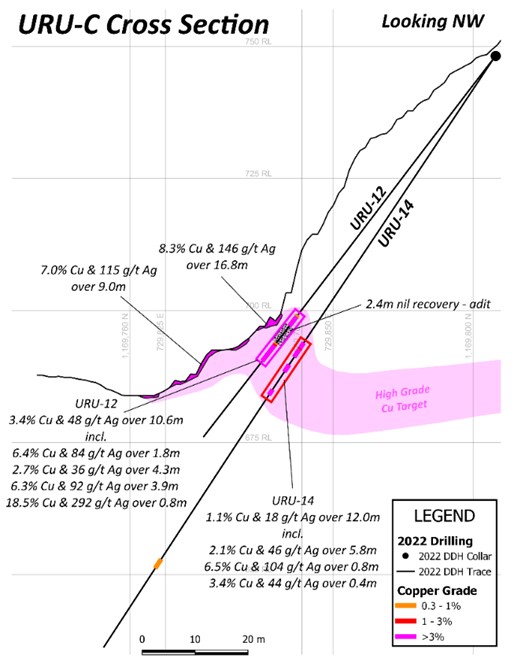

At URU-C, a discovery of 9.0 m at 7.0% Cu + 115 g/t Ag at depth was confirmed by hole URU-12, which intersected 10.6 m at 3.4% Cu and 48 g/t Ag, including a 2.4 m non-core intercept calculated as zero grade as the hole intersected a high-grade underground adit. This hole also contained 0.8 m of 18.5% Cu and 292 g/t Ag. Further drilling is planned to confirm the continuation of high-grade mineralization down-dip.

At URU-CE, the discovery of 19.0 m at 1.3% Cu was confirmed by hole URU-9, which intersected a broad zone of copper oxide that returned 33.0 m at 0.3% Cu from 4.0 m, including 16.5 m at 0.5% Cu. The wide associated alteration zone indicates the potential for a large tonnage system. The planned drilling will also target higher grade zones at surface discovered by rock channel sampling along strike 235 m to the south.

Brett Matich, CEO of Max commented, “We are pleased to have confirmed two discoveries with the initial drill program that continue at depth, emphasizing that the results are from a 750 meter portion of the 90 km long copper-silver zone. Max’s twenty-one mining concessions cover a total area of 188 km².2

The Company’s exploration team has now commenced its fully funded 2023 exploration and drilling program.

Figure 1. drill locations of Cesar’s 90-km belt. The URU district is 20 kilometers long.

Figure 2: Cross-section of URU-C hole.

Plans for 2023 exploration

Max has now commenced its 2023 exploration and drilling campaign. Additional geophysical techniques, including ground Magneto-Telluric (MT) surveys, are being deployed to provide a broader basket of tools to explore the AM, Conejo and URU districts, which together cover a 60 km strike length of copper-silver mineralization.

SUMMARY: Max’s twenty-one mining concessions cover a total area of 188 km². The Uru project alone has a strike length of 20 kilometers. With these numbers in mind, it is clear that the Maiden drilling program of just 14 holes is only the prelude to many thousands of meters of drilling to follow. Fortunately for Max, the company is well funded with approximately $17 million CAD to continue focused exploration free from the stress of an upcoming capital raise. Max Resource has already significantly improved its understanding of Uru. Upcoming drilling should continue to identify high-grade copper mineralization through better orientation and targeting. The focus is on understanding the structures before Max moves to define a resource. In the longer term, the Cesar project has the potential to put Colombia on the world map as a new destination for copper production.

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not replace in any way an individual expert investment advice, but rather represent promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold or hold shares of Max Resource and therefore a conflict of interest may exist. Furthermore, we cannot exclude that other stock exchange letters, media or research companies discuss the values discussed by us in the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between GOLDINVEST Consulting GmbH and Max Resource, which means that there is also a conflict of interest, especially since Max Resource has commissioned GOLDINVEST Consulting GmbH to report on the company.