{kanada_flagge}High grade copper values such as Max Resource Corp. (TSX.V: MAX; OTC: MXROF; FRA: M1D2) is presenting today from its Uru project in Colombia have not been seen in a long time, even though it is only rock channel samples to date:

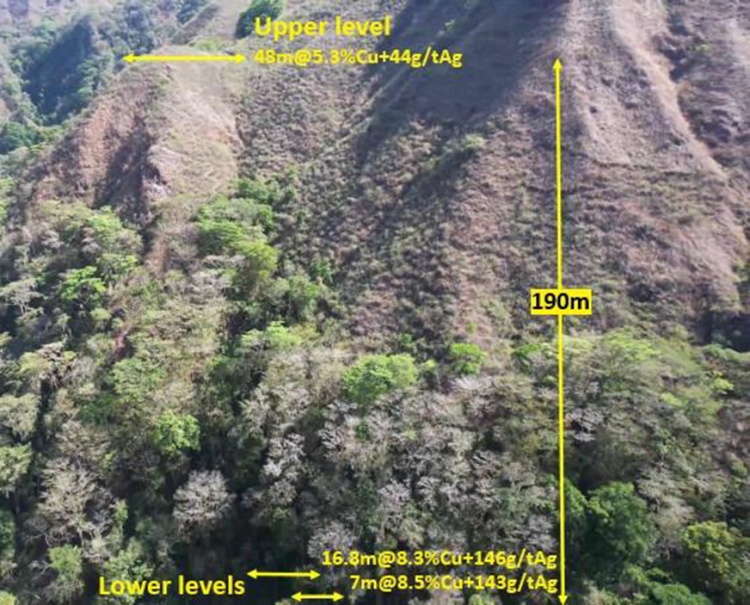

Samples were taken at three levels along an easily identifiable, near-vertical structural fault with a strike length of 290 meters to date and a vertical extent of at least 190 meters. At the base (in the valley), 16.8 m @ 8.3% copper + 146 g/t silver and 7.0 m @ 8.5% copper + 143 g/t silver were measured. In the upper part of the structure, due to limited outcrop on a ridge, a total of only 24 chip samples over 48 meters could be collected. However, even these samples returned an average value of 5.3% copper and 44 g/t silver. Unlike the samples taken further down, the true thickness of the mineralization in the upper part of the structure has not yet been determined. All readings are from the Uru copper-silver project in northeastern Colombia, which is part of the 90-kilometer Cesar project. Max Resource is currently preparing initial drill holes at Uru.

Max Resource geologists suspect that the vertical extent of the mineralization will continue. Meanwhile, 120 meters above the uppermost sampled level, several historic adits have been discovered that are now interpreted as Spanish silver mines due to the high silver grades in the fresh ore. The structure is also open along strike in a north-north-east direction. Accordingly, ongoing fieldwork on the priority drill target Uru is focused on determining both the further extension up strike and the further vertical extension to the top. To this end, Max plans to conduct an induction polarization survey to follow the structure at locations with little surface outcrop.

The vast majority of the samples are primary chalcocite (80% copper by weight). Notably, silver grades were much higher in the fresh samples where the chalcocite had only partially oxidized to malachite.

Brett Matich, CEO of Max emphasized that the current assay results cover only a small portion of the large Uru concession. Along a 15 km structural corridor, Max Resource plans to test at least four secondary targets through rock channel sampling and induction measurements, including Southern URU, which (as reported in press releases on 1. February) has also already returned high copper values: 4.3% copper over 10.0m (876065) 4.0% copper over 10.0m (878781) 3.7% copper over 5.0m (876486) 3.1% copper over 3.0m (876488) 3.0% copper over 10. 0m (876379) 3.0% copper above 10.0m (876363) 3.0% copper above 10.0m (878685) 2.9% copper above 10.0m (876460) 2.7% copper above 25.0m (876288)

Figure 1: The high-grade discovery at URU can be traced over a vertical length of 190 meters to date. ld Spanish silver mines along the ridge indicate that the mineralized structure continues for at least 120 meters above.

Figure 2: Mineralization begins just below the ground cover. At the lower level (in the valley), 16.8 meters of 8.3% copper + 146 g/t silver, open ended were measured.

A video of the discovery can be viewed here: https://bit.ly/3jf1fu4

Figure 3: The uppermost sampling to date was on a ridge line more than 190 meters above the measurements in the valley.

Conclusion: It is true that Max Resource – stock market value currently CAD 70 million – has not yet drilled a single hole. But that has not stopped Endeavour Silver from entering into a strategic partnership with Max. At the same time, representatives of the majors are already making pilgrimages to the project. Copper values such as those currently presented by Max Resource from its Uru project in Colombia are otherwise only known from the Congo. You have to get the scale right: The single discovery at Uru may be impressive in its own right, but in a larger context, the point is that Max Resource could completely redefine Colombia as a copper destination. Add in the fact that Max has gained near-exclusive access to the entire 90-kilometer-long Cesar Basin, and you get a sense of the geostrategic significance of this discovery. Of course, Max Resource is only at the very beginning, but this start is extraordinary in every respect. Just consider the advantages of a high-grade structurally-bound copper mineralization over a naturally low-grade porphyry deposit. High grades (most of which are chalcocite) mean that an equivalent amount of copper is present in a much smaller volume. This already saves many meters of drilling during exploration, but helps even more during mining and processing. There would be a lot less dead rock to treat: 16.8m @ 8.3% copper is just not the same as 168m @ 0.83% copper in a porphyry in that respect. In the case of a vertical structure, gravity would also be a supporting factor. Mining-wise, it’s a no-brainer.

The majors, many of whom have been on site themselves as I said, are of course aware of these advantages. If Max Resource can fully visualize the potential of Uru and other targets along the Cesar Basin, the company could potentially become a prime target for acquisition even before a resource is delineated. But first, of course, must come drill results. We are excited and will stay tuned to the story.

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not replace in any way an individual expert investment advice, but rather represent promotional / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold or hold shares of Max Resource and therefore a conflict of interest may exist. Furthermore, we cannot exclude that other stock exchange letters, media or research companies discuss the values discussed by us in the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between GOLDINVEST Consulting GmbH and Max Resource, which means that there is also a conflict of interest, especially since Max Resource has commissioned GOLDINVEST Consulting GmbH to report on the company.