{kanada_flagge} Juggernaut Exploration Ltd (TSXV: JUGR; OTCQB: JUGRF; FSE: 4JE) is kicking off the exploration season with 1,500 m of drilling at the high-grade Metallica Zone on the Empire property at the southern end of the Golden Triangle in British Columbia, 70 km from Terrace. The extensive mineralized outcrops on the project were recently exposed by glacial retreat. Surface sampling from these outcrops last year returned some of the highest silver values ever measured from outcrops in Canadian history. Juggernaut geologists suggest that the massive sulphide veins indicate a connected porphyry feeder system. Drilling is only occurring on a small portion of the Empire property, which is 12,480 hectares in size.

Conclusion: Juggernaut and Goliath Resources (TSXV: GOT) have the same founders and the same founding idea. Both companies are taking advantage of glacial retreat and moving into alpine areas that were previously inaccessible. With the first mover advantage, both companies have secured large prospective filets in the Golden Triangle of British Columbia. While Goliath is already in its third year of full throttle drilling and steadily increasing the footprint of Surebet and neighboring zones (current market cap around $75 million CAD), Juggernaut is still on the cusp of drilling discovery. Accordingly, the stock market value currently stands at CAD 14 million with lots of upside in case of success.

Juggernaut Exploration Ltd (TSXV: JUGR; OTCQB: JUGRF; FSE: 4JE) is kicking off the exploration season with 1,500 m of drilling at the high-grade Metallica Zone on the Empire property at the southern end of the Golden Triangle in British Columbia, 70 km from Terrace. The extensive mineralized outcrops on the project were recently exposed by glacial retreat. Surface sampling from these outcrops last year returned some of the highest silver values ever measured from outcrops in Canadian history. Juggernaut geologists suggest that the massive sulphide veins indicate a connected porphyry feeder system. Drilling is only occurring on a small portion of the Empire property, which is 12,480 hectares in size.

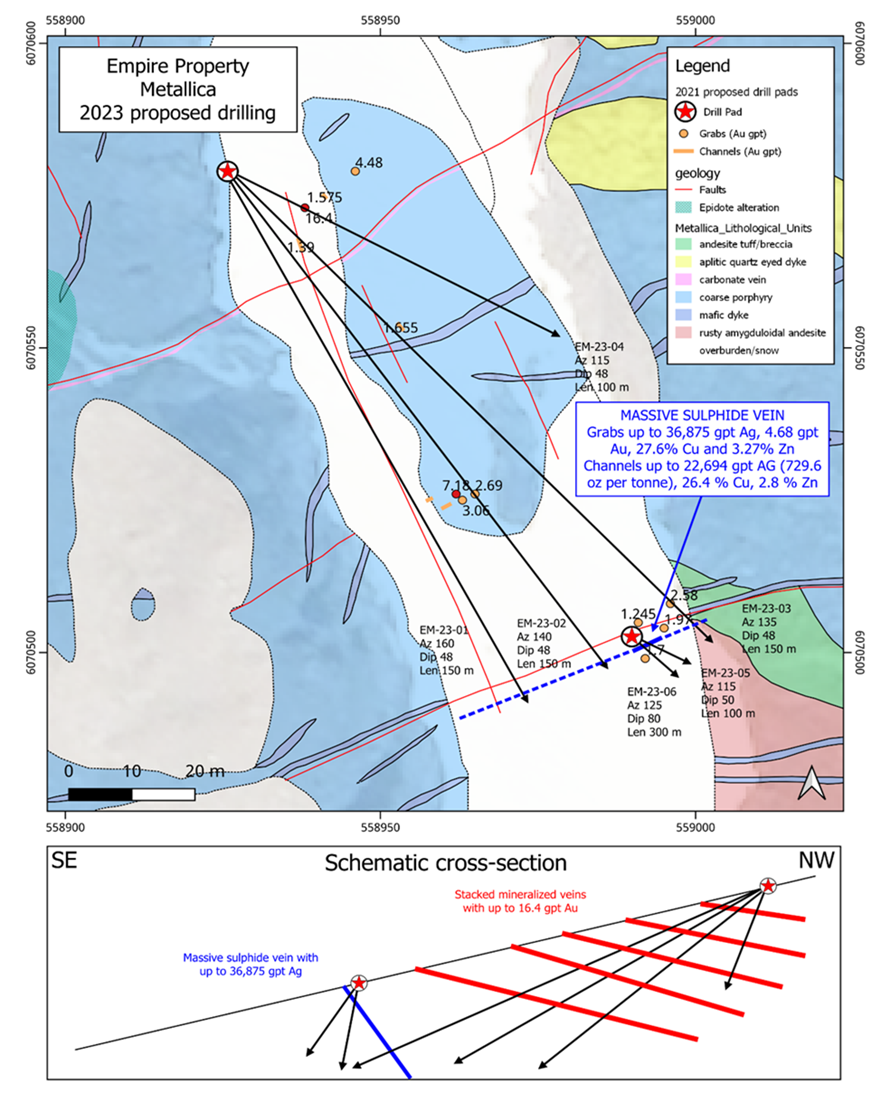

Trenching has identified surface mineralization over an area of approximately 250 metres by 225 metres that remains open. Grab samples from a massive sulphide vein up to 30 cm wide assayed up to 36,875 gpt Ag (1180 ounces per tonne silver), 4.68 gpt Au, 27.6% Cu and 3.27% Zn. Channel samples from the massive sulphide vein returned 22,694 gpt Ag (729.6 ounces per tonne), 26.4% Cu and 2.8% Zn. The vein extends east-west for 40 meters and indicates a large porphyry feeder system at depth that remains open and amenable to drilling. Five separate, gently dipping veins returned values ranging from 1.00 to 16.4 gpt Au and up to 2470 gpt Ag, 15.45% Cu and 1.58% Zn. These veins are up to 30 cm wide, contain quartz + Fe carbonate ± covellite ± sphalerite, and are arranged in a traceable series for 50 meters along strike. The nearby potassic alteration and porphyry textures seen at surface are believed to be related to a subtle magnetic high, indicating a porphyry core feeder at depth.

Figure 1: The 1,500 m drilling at the Metallica Zone is planned from two drill stations. The upper of the two is planned to test a series of high-grade veins and also intersect the high-grade massive sulphide vein (blue) at least at one location. This target will be tested again separately from a nearby drill station.

The Metallica Zone is part of the Inca Trend, a high-grade polymetallic mineralized trend that extends 1.6 kilometers by 1.2 kilometers in an area where recent glacial erosion has exposed several extensive new zones of mineralized outcrop that were previously unknown.

Five separate, gently dipping veins returned values ranging from 1 to 16.4 gpt Au and up to 2470 gpt Ag, 15.45% Cu and 1.58% Zn. These veins are up to 30 cm wide, contain quartz + Fe carbonate ± covellite ± sphalerite and are arranged in a traceable series for 50 meters along strike and remain open.

Dan Stuart, President and CEO of Juggernaut Exploration, commented, “We are excited to begin initial drilling of the high-grade Metallica Zone at Empire.”

Stuart further announced that maiden drilling will also commence shortly on the Bingo project. This project is located in close proximity to Goliath Resources’ Sure Bet discovery.

Conclusion: Juggernaut and Goliath Resources (TSXV: GOT) have the same founders and the same founding idea. Both companies are taking advantage of glacial retreat and moving into alpine areas that were previously inaccessible. With the first mover advantage, both companies have secured large prospective filets in the Golden Triangle of British Columbia. While Goliath is already in its third year of full throttle drilling and steadily increasing the footprint of Surebet and neighboring zones (current market cap around $75 million CAD), Juggernaut is still on the cusp of drilling discovery. Accordingly, the stock market value currently stands at CAD 14 million with lots of upside in case of success.

Subscribe now to the Goldinvest.de newsletter

Follow Goldinvest.com on LinkedIn

Risk note: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice, but rather represent advertising / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH hold shares of Juggernaut Exploration and therefore a conflict of interest exists. Furthermore, we cannot exclude that other stock exchange letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Juggernaut Exploration and GOLDINVEST Consulting GmbH, which means that there is also a conflict of interest.