Phase 2 of its 16,500 m drill program starts now

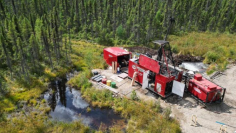

Abitibi Metals Corp. (CSE:AMQ; OTCQB: AMQFF; FSE: FW0) has commenced Phase 2 of its 16,500 m drill program at its B26 high-grade polymetallic deposit in the Abitibi Greenstone Belt of Quebec with the goal of significantly expanding the historic resource. One drill rig is already running and a second drill rig will be added shortly. Drilling will begin with a 1,250 meter drill hole (1274-24-338) to test the western portion of the deposit at a vertical depth of approximately 900. The western extension of the deposit has been tested with limited drilling to date and represents a significant target for expansion of historic resources.

Jonathon Deluce, CEO of Abitibi Metals, stated, “With the findings from our recent gravity survey and Phase 1 drilling, we are well positioned to not only improve the potential for open pit and underground mining, but also to identify new, high priority targets that could significantly increase the value of the B26 property. This phase is critical as we look to expand our historic resource base, particularly in the underexplored western portions and in the middle sections of the deposit.”

The Company is continuing to evaluate the recently completed gravity survey to best define new targets outside of the B26 deposit with similar characteristics. These stand-alone targets will be tested towards the end of the Phase 2 drill program.

Abitibi Metals currently has CAD 16 million in cash and cash equivalents. The Company is more than fully funded to acquire 80% of the high-grade B26 polymetallic deposit from its semi-public partner SOQUEM through its work. The B26 deposit hosts a historical resource estimate of 7.0Mt @ 2.94% Cu Eq (Ind) & 4.4Mt @ 2.97% Cu Eq (Inf). Added to this is the nearby Beschefer Gold Project, where historic drilling has identified four historic intercepts with metal grades in excess of 100 g/t gold, including 55.63 g/t gold over 5.57 meters and 13.07 g/t gold over 8.75 meters.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.