{kanada_flagge} Granite Creek Copper Ltd. (TSX.V: GCX; FRA: A2PFE0) is conducting its most extensive exploration campaign to date, a program which now consists of nearly 13,000 meters of drilling at its Carmacks North copper-gold-silver project in the Yukon. Assay data is expected to result in a major update to its existing 43-101 resource estimate in Q4, as well as an updated economic assessment to follow.

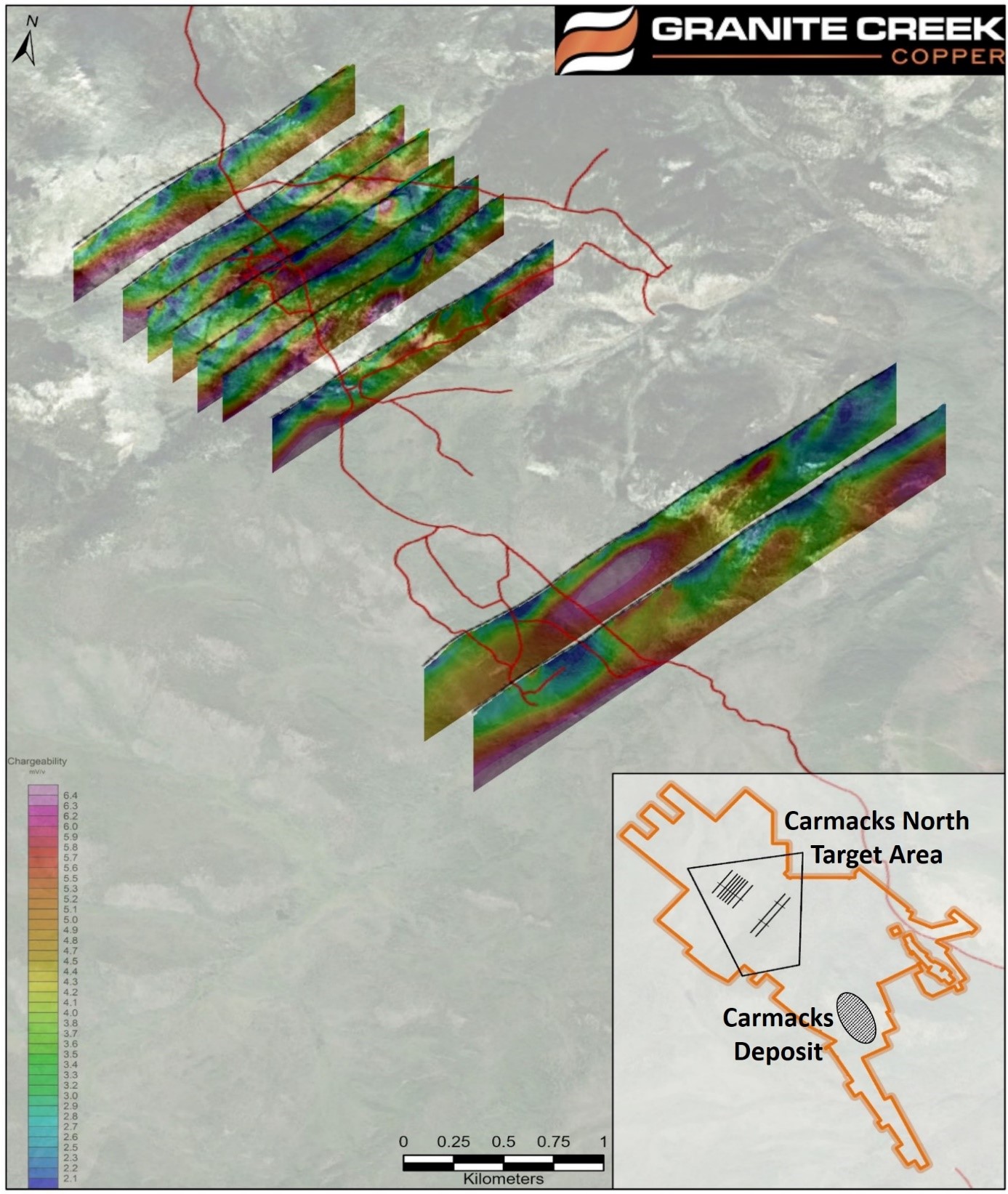

As part of this program, the company has flown 20.8 line-kilometers of induced polarization (IP) surveying and has discovered highly promising new drill targets right off the bat. This type of survey is capable of measuring the chargeability and resistivity of rock up to 1000 meters below surface, which greatly improves the chances of drilling success. Preliminary results from the survey identified several near-surface anomalies that have been selected as prospecting and reverse circulation (“RC”) drilling targets for the second phase of the 2021 season.

Figure 1: Advanced IP surveys produce cross-sectional images that reveal the anomalies in the ground. The deeper the red the higher the chargeability. The whole thing works like cutting into a virtual pie to see where the cherries are.

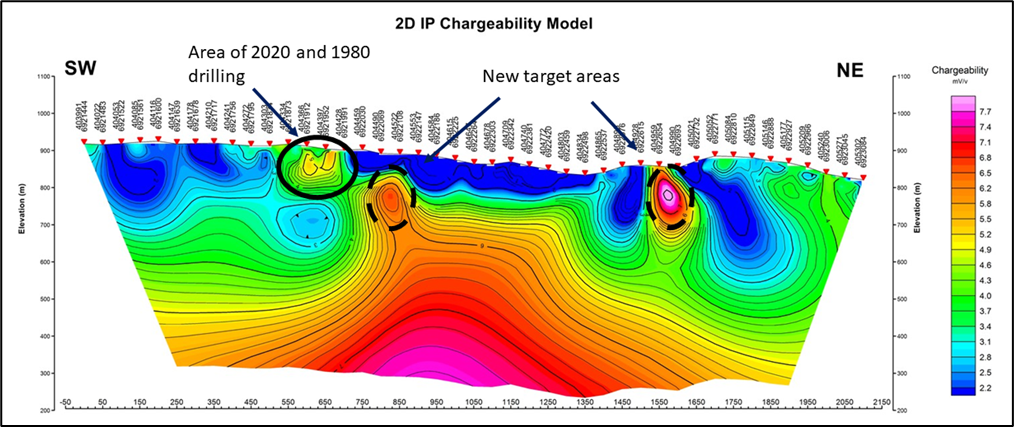

Figure 2: This is the kind of sectional view geologists want. The two-dimensional IP graphic suggests that there are hidden targets with very high chargeability on Carmarck’s North that have not even been considered in previous drilling.

The company says the first phase of the 2021 drilling program has been completed. A total of 32 drill holes with a total length of 6355 meters were drilled, primarily targeting sulphide material at the Carmacks deposit. The first assay results are expected back from the laboratory very shortly. Meanwhile, the second phase of drilling has commenced. It consists of reverse circulation drilling expected to cover approximately 3000 meters and includes holes outside the existing resource area at the Carmacks North target (see figure 1 inset map).

Third phase of drilling added

Given the early start of the 2021 field season and encouraging early signs of success, Granite Creek has made the decision to add a third phase to the previously defined 10,000 meter program. It is anticipated that an additional 2,700 meters of diamond drilling will be completed. The start date for Phase 3 is tentatively targeted for early September, with the possibility of advancing this date to late August. This would likely mean continued substantive drill data newsflow throughout the remainder of 2021 and potentially into Q1 2022.

Tim Johnson, President & CEO of Granite Creek, stated, “We are extremely pleased with the progress we have made to date in advancing the Carmacks project. It is a testament to the strength and commitment of our team that we have been able to maintain a very aggressive pace as we move towards an updated 43-101 resource estimate and subsequent economic evaluation. This drilling campaign was a prime example of the professionalism of our field teams and contractors, and we are very much looking forward to continuing this momentum into Phase 2 and the newly announced Phase 3. In total, we now expect to complete over 13,000 meters of drilling, the data from which will be incorporated into the new resource update scheduled for the fourth quarter.”

Carmacks North Target Area

The Carmacks North target area includes Zones A-D as well as additional targets currently being developed. Prior to Granite Creek’s first drill program, which was completed last fall (see news release dated February 11, 2021), little work had been done in this area since 1980. Known historical high-grade copper intercepts included up to 2.52% Cu, 1.64 g/t Au, 12.84 g/t Ag over 19.81 meters. Granite Creek was able to add successful intercepts of 4.31% Cu, 3.41 g/t Au, 23.78 Ag over 4.36 meters and 0.97% Cu, 0.32 g/t Au, 2.84 g/t Ag over 25 meters to these occurrences.

CONCLUSION: The extensive IP surveys have returned results that exploration geologists could only wish for. The intersection diagrams point to bold red zones adjacent to and below the zones where exploration has historically taken place. Is the best yet to come? The color red represents the high chargeability of the rock, which in turn indicates high copper grades. It is remarkable that the red coloration of the new zones is much more intense than in the targets drilled so far. At the same time, their copper grades were already very high. One can therefore understand why CEO Tim Johnson is pushing for drilling to continue and has attached a third phase of diamond drilling this season. We keep our fingers crossed and look forward to results from the truth meter.

{letter}

Risikohinweis: Die GOLDINVEST Consulting GmbH bietet Redakteuren, Agenturen und Unternehmen die Möglichkeit, Kommentare, Analysen und Nachrichten auf http://www.goldinvest.de zu veröffentlichen. Diese Inhalte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung, es handelt sich vielmehr um werbliche / journalistische Veröffentlichungen. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Der Erwerb von Wertpapieren birgt hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die GOLDINVEST Consulting GmbH und ihre Autoren schließen jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich aus. Bitte beachten Sie auch unsere Nutzungshinweise.

Gemäß §34b WpHG und gemäß Paragraph 48f Absatz 5 BörseG (Österreich) möchten wir darauf hinweisen, dass Auftraggeber, Partner, Autoren und Mitarbeiter der GOLDINVEST Consulting GmbH Aktien der Granite Creek Copper halten oder halten können und somit ein möglicher Interessenskonflikt besteht. Wir können außerdem nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen. Ferner besteht zwischen einer dritten Partei, die im Lager der Granite Creek Copper steht, und der GOLDINVEST Consulting GmbH ein Beratungs- oder sonstiger Dienstleistungsvertrag, womit ein Interessenkonflikt gegeben ist, zumal diese dritte Partei die GOLDINVEST Consulting GmbH für die Berichterstattung zu Granite Creek Copper entgeltlich entlohnt. Diese dritte Partei kann ebenfalls Aktien des Emittenten halten, verkaufen oder kaufen und würde so von einem Kursanstieg der Aktien von Granite Creek Copper profitieren. Dies ist ein weiterer, eindeutiger Interessenkonflikt.