{kanada_flagge}Goldshore Resources (TSXV GSHR / WKN A3CRU9) and CEO Brett Richards have delivered! Back in February Richards had announced in a Goldinvest.de interview a new resource of 6 million ounces of gold as his goal for the Moss Gold Project – consisting of the Moss and East Coldstream deposits – and exactly that’s what the company now reported!

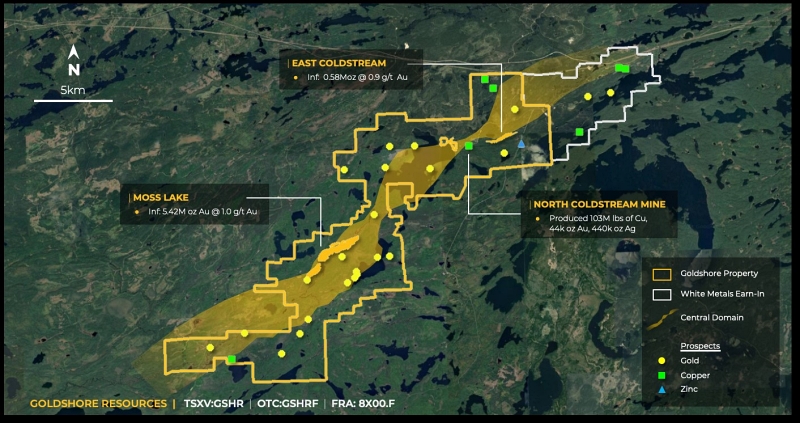

In the process, the resource (open pit and underground) of the Moss deposit increased from 4.17 million ounces of gold contained in 121.7 million tonnes of ore (November 2022) to now 5.42 million ounces averaging 1.03 g/t gold contained in 163.6 million tonnes of ore! This represents a 32% increase in tonnage and a 24% increase in the number of ounces of gold contained.

Location of the Moss and East Coldstream deposits at the Moss Gold Project; Source: Goldshore Resources

In addition, the tonnage of the higher-grade shear zone area increased by 63% compared to the November 2022 resource estimate, and the contained ounces increased by 68%. As a result, this higher-grade portion of the resource alone now contains 3.35 million ounces of the yellow metal at an average of 1.84 g/t gold!

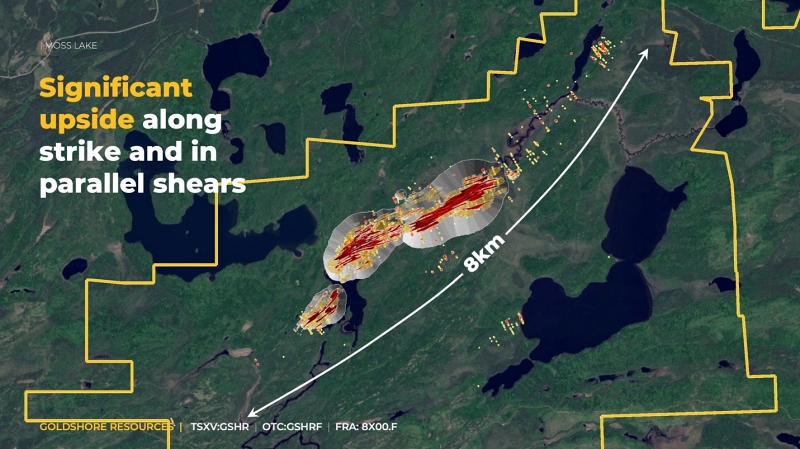

And, as Goldshore rightly points out, there is still clear potential for expansion, as further extensions of the strike – in both directions – totaling 4.5 kilometers in length are known, plus parallel shears where gold mineralization has been encountered. And that, although only a few holes have been drilled in these areas.

Potential along strike and through parallel shear at Moss; Source: Goldshore Resources

In addition, the Company has proven up an initial resource (open pit and underground) of 580,000 ounces of gold at 0.91 g/t gold in 20 million tonnes of ore for the East Coldstream deposit. East Coldstream is located approximately 15 kilometers from the Moss deposit.

Conclusion: With the new resource estimate, which we believe is compelling, Goldshore Resources has begun to show the full extent of the Moss Gold project – and the potential for a high-grade resource that can be mined by open pit. And, as today’s press release states, that’s at a discovery cost of just about $10 Canadian per inferred ounce of gold – acquisition costs and operating expenses included!

All this, however, so far concerns only a small part of the (potential) mineralization on the project area, because Goldshore has 29 (!) further drill targets, among them several gold targets but also four “interesting” industrial and battery metal targets. For now, however, the company is focusing on preparing a Preliminary Economic Assessment for the Moss Gold Project, which is expected to be released later this year. The initial studies for this are already underway and Goldshore Resources will announce a more specific release date once they can better estimate the scope of work needed now that the new resource estimate is available.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for actuality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and according to Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Goldshore Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Goldshore Resources and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.