{kanada_flagge}Only recently Goldshore Resources (WKN A3CRU9 / TSXV GSHR) completed a 100,000 meter drill program at its Moss Gold project in Ontario, Canada; so some drill results are still pending. Today, however, the company of CEO Brett Richards was already able to present results that could have a big impact!

{kanada_flagge}Only recently Goldshore Resources (WKN A3CRU9 / TSXV GSHR) completed a 100,000 meter drill program at its Moss Gold project in Ontario, Canada; so some drill results are still pending. Today, however, the company of CEO Brett Richards was already able to present results that could have a big impact!

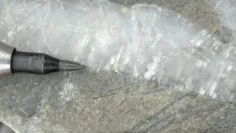

Goldshore reported results from seven drill holes testing the extent of the Southwest Zone towards the Moss Lake Main Zone. They were successful in detecting a new, high-grade gold lens – visible gold included – to the northeast of the previously delineated Southwest Zone resource, extending from surface to a depth of at least 250 meters!

The highlights of these drilling results were:

– 6.96 g/t gold over 15.05 meters from 189.4 meters depth, including 54.4 g/t gold over 1.6 meters from 189.4 meters,

– 2.17 g/t gold over 50.35 meters from 103.55 meters, including 3.47 g/t gold over 26.05 meters from 120.35 meters and

– 1.30 g/t gold over 21.35 meters from 214 meters depth, including 2.60 g/t gold over 7.35 meters from 228.00 meters!

These are very, very strong results anyway, but more importantly they show that the Southwest Zone is a continuation of the Main Zone and not a faulting as previously thought. And as if that were not enough, the results just released also demonstrate that the Southwest Zone continues to depth and is potentially similar in extent to the Main Zone!

Like the pending drill results, today’s results will be incorporated into a new resource estimate that Goldshore plans to present in May. In total, this will include data from 72 additional drill holes, compared to the resource estimate from November 2022. That shouldn’t be the end of the line, however, because as the company points out, the resource area remains open in numerous directions. Incidentally, the previous resource estimate in the inferred category is already 4.17 million ounces of gold at an average of 1.1 g/t gold including a high-grade portion of 2.2 million ounces at 2.0 g/t gold.

Conclusion: These drill results once again confirm Goldshore CEO Richards’ thesis that the Moss Lake project is much larger than previously shown – despite the huge drill program – and even remains open in all directions. At the same time, they improve the company’s understanding of mineralized targets in the southeast Southwest Zone and Main Zone. For now, however, Goldshore’s focus is on finalizing the new resource estimate, which Richards plans to deliver as early as early next month. He also said that a clear, feasible path to a meaningful PEA (preliminary economic analysis) can now be seen.

We are looking forward to the final results of the past drill program and then the new resource estimate and PEA and are curious to see how the market will react to these in light of a gold price of around USD 2,000 per ounce. In any case, Goldshore has already started planning for a infill drill program in preparation for a future pre-feasibility study.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for actuality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and according to Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Goldshore Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Goldshore Resources and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.