5-year earn-out deal for the PIL project

Significant for Finlay, he said, is the 70 percent earn-out just completed for the PIL project in the Toodoggone mining district of northern British Columbia. Finlay has entered into an option agreement with ATAC Resources for the exploration of its PIL project. Finlay is granting ATAC an exclusive option to earn a 70 percent interest in the 13,965-hectare PIL property. Under the terms, ATAC can earn a 70 percent interest in the property by making cash payments totaling CAD $650,000 and issuing the equivalent of CAD $1.25 million in ATAC common shares and undertaking exploration expenditures of CAD $12 million by December 31, 2026. The property is also subject to a 3 percent net smelter return (NSR) license held by Electrum Resource Corp. with the right to buy back 50 percent for $2 million.

Plans for Silver Hope

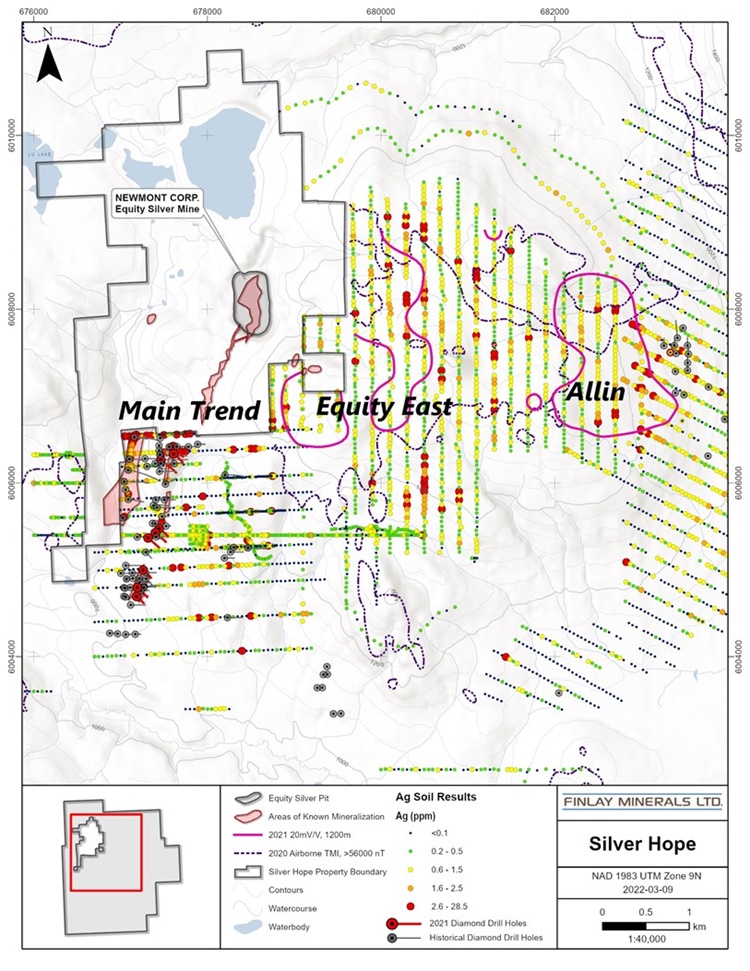

Finlay has planned a drilling program for its 100%-owned Silver Hope project in spring 2022, targeting two prospective areas: the Equity East and Allin Zones (see Figure 1). Finlay is focused on large-scale mineralization at shallow depths, with large tonnage, open pit configurations as well as high-grade mineralization near surface.

The 2021 Silver Hope Main Trend drill program of 1,973 metres (m) in 9 holes was completed with three excellent holes in the Gaul Zone. They confirm near-surface copper, silver and gold mineralization with excellent widths and grades, such as SH21-09 (the southernmost hole at Gaul) with 76.57 meters grading 0.45% copper, 14.6 g/t silver and 0.14 g/t gold (0.69% CuEq).

Drilling is planned at Gaul in the spring of 2022 to extend the target area with large tonnages south of SH21-09 and fill north of it.

Figure 1: Overall view of the Silver Hope project with its three areas of interest: the Main Trend, the Equity East and Allin Zones.

The map below (Figure 2) shows a 3D view of the Main Trend mineralization with the upper and lower mineralized zones. In the Gaul Zone, the larger upper zone is 400 m long (open to the south), has a dip length of 400 m, and an average thickness of 100 m. The zones are ideally configured for open pit mining with large tonnages. The map also shows deeper mineralization in the Superstition and Hope Zones and the West Horizon porphyry copper-molybdenum zone adjacent to the Newmont Corp. property boundary.

Figure 2: 3D view of Main Trend mineralization at Silver Hope showing upper and lower mineralized zones.

Drilling planned for this year at the Equity East and Allin Zones adds to our enthusiasm for further development of the Gaul multi-element zone. A review of recent geophysical and geochemical studies indicated the potential for both Equity Mine style displacement and porphyry copper targets.

Both the Equity East and Allin targets are large geochemical and geophysical anomalies comparable in size to the Equity Silver Mine deposits. Both Equity East and Allin are closely associated with the intrusion of a multiphase intrusive complex into volcanic rocks, with structures interpreted to be like those of the former Equity Silver Mine deposits located along the westward contact of the intrusive complex.

The geological, geochemical and geophysical data provide a compelling scenario of potentially mineralized areas that are largely overburden covered and untested drill targets.

PIL Plans

The PIL and ATTY projects in BC’s northern Toodoggone mining district are both well located and highly prospective porphyry copper-gold and epithermal gold-silver exploration areas. The ATTY project is located immediately north of Centerra Gold’s Kemess Underground and Kemess East deposits, while the PIL project is located between Benchmark Metal’s Lawyers project and Amarc Resources and Freeport McMoRan’s Joy-Pine joint venture project.

The ATAC team has begun planning this year’s ground exploration program at the PIL. Finlay’s management looks forward to working with ATAC’s experienced and professional management and team.

Conclusion: Finlay can fully focus on exploration at Silver Hope by optioning the PIL project to ATAC. Nevertheless, the news flow will double, because the partner ATAC – with its independent funding – is also pushing the PIL project. The current year should therefore be one of Finlay’s busiest. Exploration successes at Equity East and Allin could propel the Silver Hope project into a new dimension of scale. The near-surface mix of copper, silver and gold is the perfect hedge in the face of metal prices that are marking new records across the board.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH may hold or hold shares of Finlay Minerals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Finlay Minerals. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.