{kanada_flagge}Copper and silver explorer Finlay Minerals Ltd. (TSXV: FYL; FRA: FIG) has just released results from all nine holes the company has drilled over the past year at its Silver Hope property. The project is located adjacent to Newmont’s former Equity Silver Mine about 70 kilometers southeast of the city of Houston in central British Columbia.

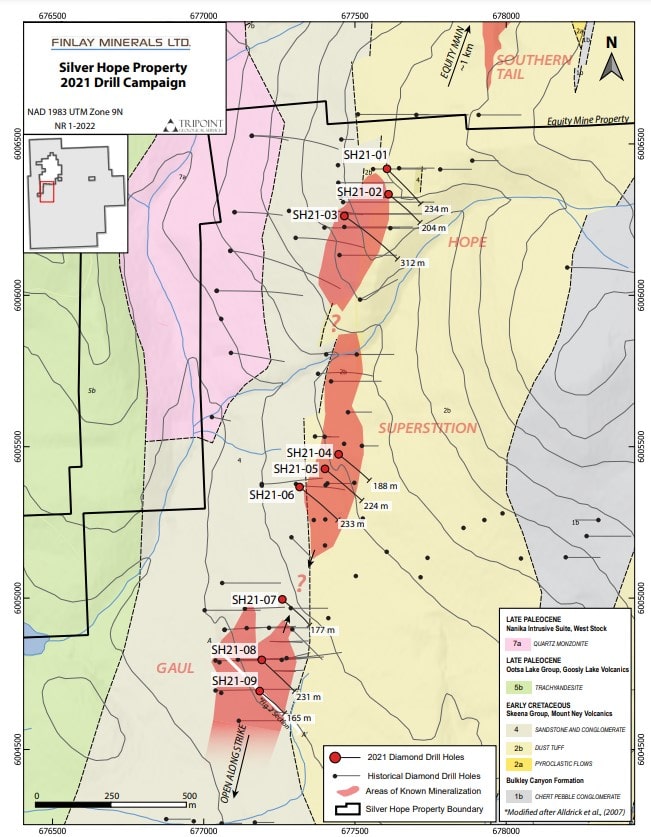

Equity Silver Mine operated from 1980 to 1994. A total of 33.8 million tonnes averaging 0.4% copper (Cu), 64.9 g/t silver (Ag) and 0.46 g/t gold (Au) were mined. Finlay’s drill holes covered a strike length of more than 1,750 meters and tested three distinct mineralized zones along strike (Hope, Superstition and Gaul) offset and truncated by cross structures. (See Figure 1) The total length of the nine drill holes was 1,968 meters. The objective of the drill holes was to outline shallow zones of copper-silver-gold mineralization (Cu-Ag-Au) for open pit mining. All nine drill holes intersected significant mineralization; the three drill holes in the Gaul zone of the Main Trend intersected Cu-Ag-Au mineralization at shallow depths and over significant widths, which correlates well with previous drilling by Finlay. The best hole at Gaul intersected 76.57 m at 0.45% copper, 14.6 g/t silver and 0.14 g/t gold (0.69% CuEq).

Figure 1: Finlay drilled along strike from Newmont’s Silver Equity Mine to the north to find comparable copper-silver mineralization near surface.

In particular, the Gaul Zone hosts significant copper with substantial silver and gold grades that could be mined by open pit. The Gaul Zone remains open along trend to the south, north and at depth, and has been tested over a strike length of 400 m and at a vertical depth of 100 m. Within the Superstition and Hope Zones, drilling in 2021 intersected several narrower mineralized intervals. However, historical drill holes show the potential for thicker mineralized intercepts at depth, suggesting that the northern zones may have formed further up the mineralized system than at Gaul. There remains the potential to demonstrate continuity between the Superstition and Gaul zones.

The best hole at Gaul intersected SH21-09 with a 76.57 m interval (from 80.23 m) grading 0.45% Cu, 14.6 g/t Ag and 0.14 g/t Au (0.68% copper equivalent (CuEq), including 32.07 m (from 123.00 m) grading 0.86% Cu, 26.1 g/t Ag and 0.21 g/t Au (1.21% CuEq). Also on Gaul, drill hole SH21-08 intersected 133.00 m (from 32.00 m) grading 0.30% Cu, 7.6 g/t Ag and 0.03 g/t Au (0.41% CuEq), including 57.23 m (from 107.00 m) grading 0.51% Cu, 13.8 g/t Ag and 0.06 g/t Au (0.71% CuEq). The third drill hole at Gaul, SH21-07, intersected 121.99 m (from 21.10 m) grading 0.23% Cu, 5.1 g/t Ag and 0.03 g/t Au (0.30% CuEq*), including 68.40 m (from 21.10 m) grading 0.29% Cu, 6.6 g/t Ag and 0.03 g/t Au (0.37% CuEq).

Drilling at the Hope Zone (3 holes) intersected several surface high-grade Cu-Ag-Au intervals, including SH21-01, which intersected 0.70 m (from 90.00 m) grading 1.14% Cu, 626.0 g/t Ag and 0.09 g/t Au (6.51% CuEq*).

Drilling in the Superstition zone (3 drill holes) intersected several near-surface high-grade Cu-Ag-Au intervals, including SH21-04, which intersected 0.43 m (of 88.17 m) grading 0.32% Cu, 62.8 g/t Ag and 0.21 g/t Au (1.03% CuEq*).

Further steps: Finlay to test parallel Equity East and Allin structures

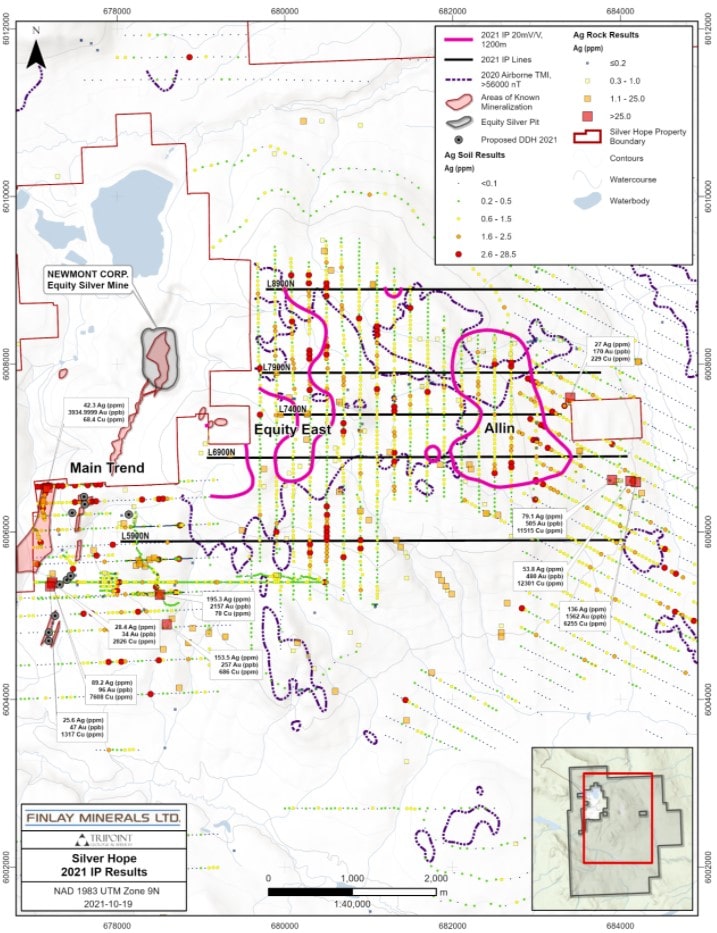

Already in 2020 and 2021, the new Equity East and Allin zones have been defined by geochemistry and geophysics. These are Finlay possible parallel structures to Newmont’s Equity Silver Mine. Finlay plans to drill these zones including the Gaul zone in the current year.

Figure 2: Overall view of the Silver Hope Project. All nine drill holes in the past year were drilled in extension of the strike direction of Newmont’s Equity Silver Mine in what is known as the Main Trend. This year, Finlay plans to test the recently discovered Equity East and Allin structures. They are interpreted as possible parallel structures to the Equity Silver Mine.

Conclusion: Finlay’s success is particularly easy to measure. The benchmark is provided by Newmont’s neighboring former Equity Silver Mine, which operated from 1980 to 1994. Even at copper prices at the time, open-pit mining of 33.8 million tons averaged 0.4% copper (Cu), 64.9 g/t silver (Ag) and 0.46 g/t gold (Au). The drill results now presented are well within this range, even if the gold grades cannot (yet) quite compete with those of Newmont’s project. With a copper price of USD 4.20, this is not even necessary. Now it’s a matter of finding the necessary tonnage on Gaul. The Equity East and Allin parallel structures offer additional potential. Even if no resource is available yet, it can be said that Finlay’s Hope project has a real chance of becoming a mine one day. Especially because the infrastructure is already in place.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH may hold or hold shares of Finlay Minerals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Finlay Minerals. Furthermore, we cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.