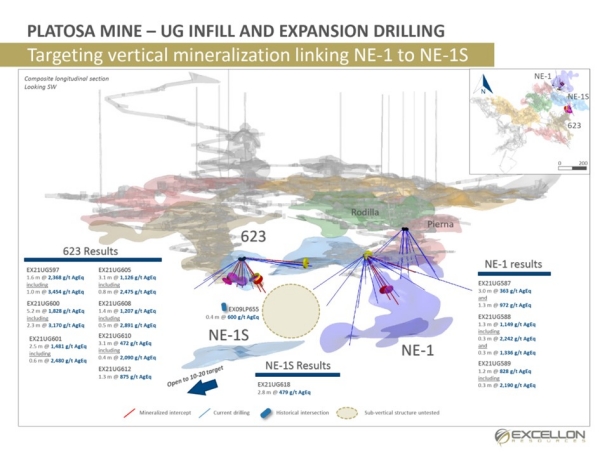

{kanada_flagge}Excellon Resources Inc. (TSX:EXN; NYSE:EXN; FRA:E4X2) reports continued success with underground drilling at its Platosa Mine in Durango, Mexico. Ongoing underground drilling is primarily aimed at defining and extending known Manto structures 623, NE-1 and NE-1S, whose mineralization lies outside the current mine plan.

Drilling campaign highlights included 1,828 g/t silver equivalent (“AgEq”) over 5.2 metres (1,051 g/t Ag, 12.1% Pb, 13.1% Zn and 0.2 g/t Au) in EX21UG600; including 2. 368 g/t AgEq over 1.6 meters (1,647 g/t Ag, 12.3% Pb, 11.6% Zn and 0.1 g/t Au) in EX21UG597; and 1,481 g/t AgEq over 2.5 meters (784 g/t Ag, 7.7% Pb, 13.9% Zn and 0.3 g/t Au) in EX21UG601. The calculation of AgEq values in the drill results assumes $24.00 Ag, $0.90 Pb, $1.20 Zn and $1,800 Au at 100% metallurgical recovery.

Ben Pullinger, Senior Vice President Geology & Corporate Development explained, “Drilling at Platosa continues to define high grade mineralization upstream of production. In addition, drilling in areas previously defined by historical surface drilling is improving our confidence in the grade and orientation of the mineralization and extending the mineralized envelope around 623 and NE-1.”

Drilling at Platosa will continue to target areas ahead of production and test the extent of mineralization in the vicinity of the mine facilities.

Figure 1: Schematic overview of underground drill compartments in Manto structures 623; NE-1S and NE-1. In the center, an ochre circle marks an untested large structure below 623.

CONCLUSION: Excellon is delivering excellent results with nice regularity from its extension drilling at Platosa. Underground diamond drilling is confirming high-grade mineralization in expected locations, increasing confidence in the grade and orientation of the mineralization ahead of production. Importantly, the high-grade mineralization now encountered is not included in either the mining plan or the resource. In this respect, the strong results are primarily indicative of the robustness and longevity of the Platosa Mine.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish commentaries, analyses and news on http://www.goldinvest.de. This content serves exclusively to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly, and is not to be understood as an assurance of any price development. Furthermore, it does not in any way replace individual expert investment advice and does not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offerings, as our information only relates to the company and not to the reader’s investment decision.

The purchase of securities involves high risks which can lead to the complete loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the guarantee of the topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares in Excellon Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Furthermore, a contractual relationship exists between Excellon Resources and GOLDINVEST Consulting GmbH which involves GOLDINVEST Consulting GmbH reporting on Excellon Resources. This is another clear conflict of interest.