{kanada_flagge}The Newfoundland gold rush is by no means over. Just recently, Etruscus Resources Corp. (CSE: ETR; OTC: ETRUF; FRA: ERR) announced the first promising results from its 2021 field exploration program in the Lewis permit area adjacent to New Found Gold Corp.’s Queensway gold project in the Gander gold belt of central Newfoundland. It appears that Etruscus has identified several high-grade gold targets. At peak, samples returned 24.2 g/t gold per ton.

The Lewis property, acquired by Etruscus in June 2021, was selected based on Noranda Resources’ historical discovery of gold mineralization and its prime location in an unfolding exploration district adjacent to New Found Gold’s project. Noranda’s historical work had demonstrated anomalous gold grades in almost all drill holes. Historical reports on this work highlighted Noranda’s intention to return to the permit area and expand this initial drill program.

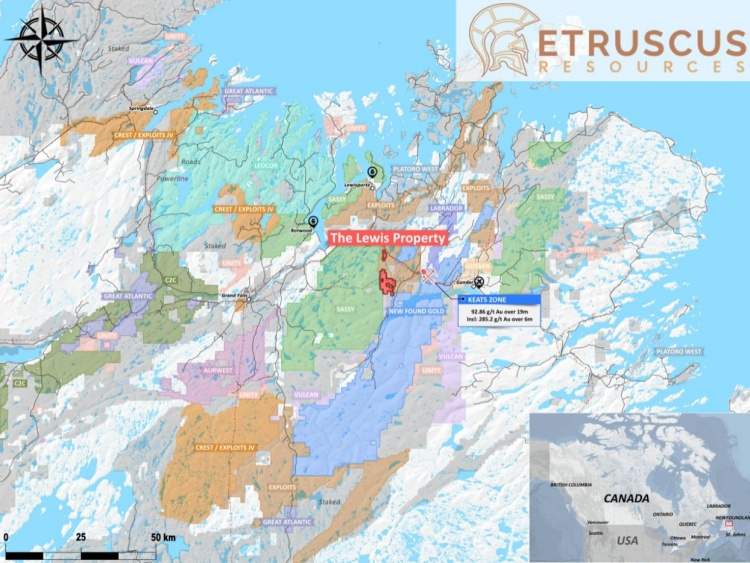

Figure 1: The Etruscus properties are directly adjacent to New Found Gold.

The exploration program was designed to identify new targets but to support the prioritization of targets already highlighted by the previous operator, Noranda Resources. A total of 1,922 soil samples, 60 rock samples were collected and over 100 geological mapping points were recorded. As a result of the Company’s exploration activities, several new high-grade gold targets have been identified. These targets will be further evaluated this spring using an Induced Polarization (IP) geophysical survey and magnetics survey to delineate drill targets for the upcoming 2022 drill program (click here to view map of concession area).

20 of the 60 rock samples collected from the concession area returned assay results greater than 1 g/t Au; 5 of these returned assay results greater than 10 g/t Au, with the most outstanding assay results being 24.2 g/t Au. – The Company has now identified a 1.3 km extension of the 2 km NW Corsair trend mapped in the past. This trend has anomalous Au, Sb and As grades and can now be traced for approximately 3.3 km across the property.

Etruscus has discovered several anomalous areas of elevated gold and associated pathfinder features along the north-northwest striking Mount Peyton lineament. A historic trench that has never been drill tested returned 3 (out of 6) rock samples, all of which returned values greater than 20 g/t Au.

Fiore Aliperti, President and CEO of Etruscus, commented, “The compilation of historical data along with the results of our 2021 field program has allowed our geological team to identify drill targets that have not yet been tested, even at this early stage of the exploration process. We are looking forward to returning to the permit area in the coming weeks.”

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the contentwise warranty for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Granite Creek Copper and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Granite Creek Copper and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Granite Creek Copper. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Granite Creek Copper. This is another clear conflict of interest.