In recent weeks, the silver price has also risen significantly in the wake of the impressive gold rally. Despite this increase, however, the momentum has not been sufficient to reach the 12-year high of $34.89 achieved on October 22, 2024.

At least the round mark of $34 was briefly exceeded on Tuesday. However, a weekly closing price will not be achieved. Instead, precious metal prices are falling significantly just before the weekend.

While the gold price has been rushing from one all-time high to the next since the beginning of the year, the silver price continues to follow only in its slipstream. Conversely, this also means that the rally in precious metal prices could continue in the coming weeks despite the overbought situation and the current pullback.

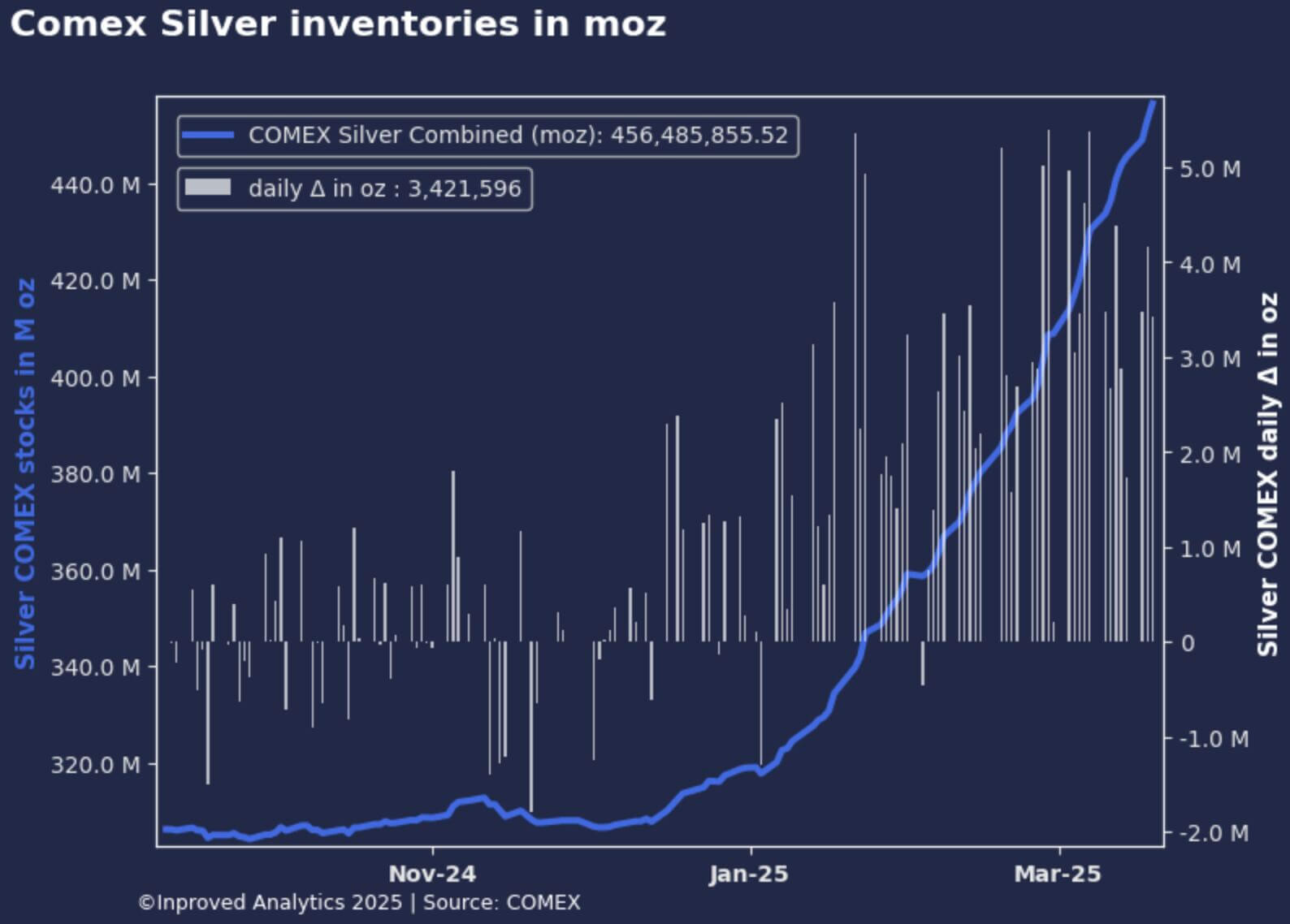

Regardless of the continued favorable fundamental situation, a similar bottleneck seems to be developing in the silver market as in the gold market since December. The COMEX silver vaults are recording stronger inflows. Since the beginning of the month, 1,484 tons of physical silver have already been delivered!

Silver Coins

As a result, the silver inventories recorded by COMEX have grown to the highest level since data collection began in 1992 and have increased by 40% this quarter so far.

This unprecedented increase reflects the ongoing market shift and arbitrage opportunities arising from price differences between the gold and silver markets in London and New York.

While inventories at COMEX are rising, silver stocks in London have fallen to a record low. This divergence confirms the complex dynamics currently affecting global precious metal markets, including the impact of geopolitical factors and changing trade policies.

We suspect that the silver price is facing a similarly steep rise as observed in the gold price since the end of January.

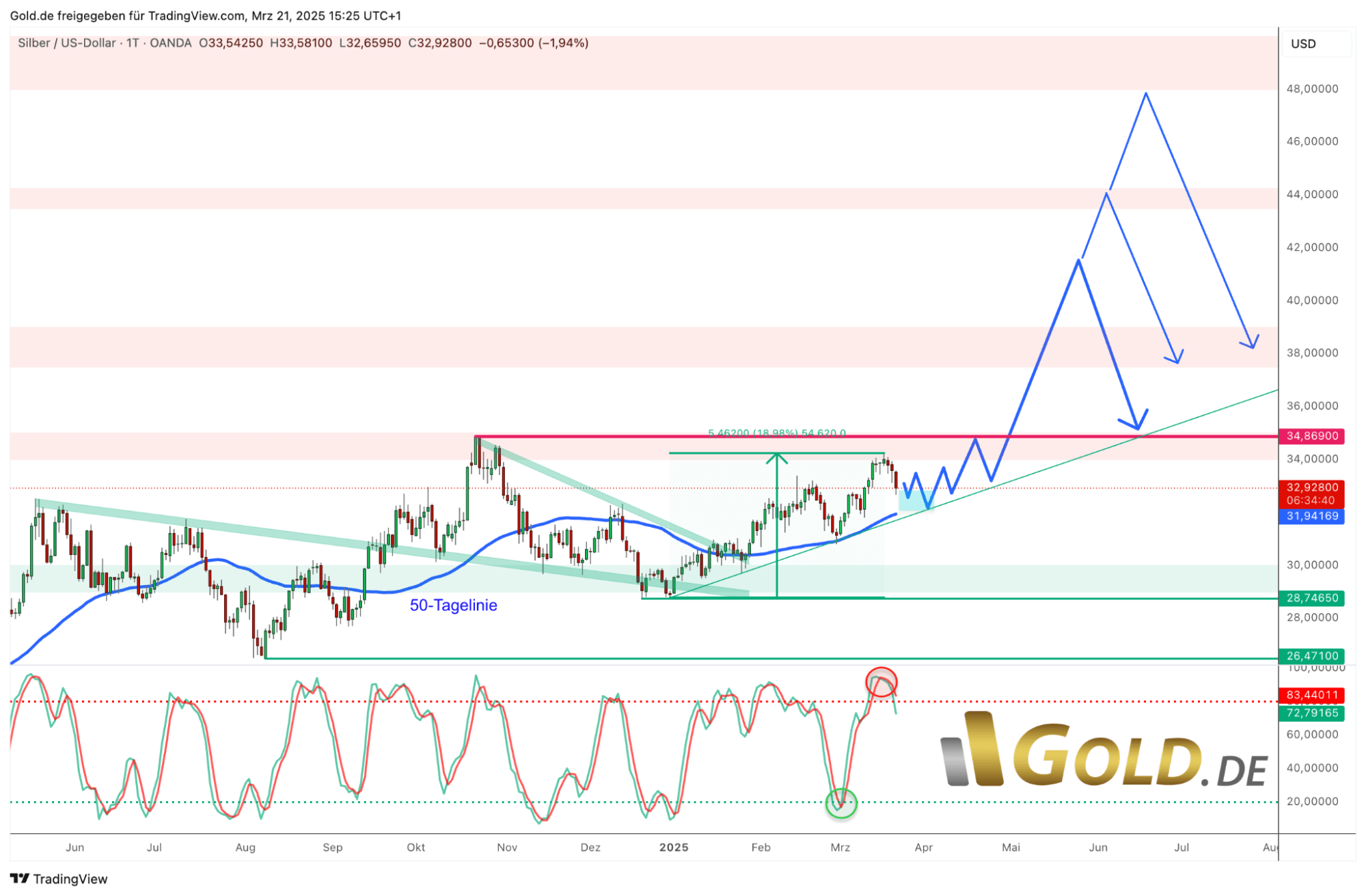

Silver in US Dollars – Daily Chart

Driven by the strong gold price, the silver price has increased by about 19% at its peak since the beginning of the year. However, this rise was much tougher than in the gold market.

There were repeated pullbacks and sideways consolidations. Ultimately, however, silver quotations have managed to maintain themselves above the rising 50-day moving average ($31.94) since the end of January.

With this moving average behind them, the silver bulls fought their way up to $34.20. Accordingly, the next short-term target is the 12-year high of $34.89 from October 22.

The price increase has brought the silver market closer to this 12-year high, but has also cost considerable strength. A new sell signal in the daily stochastic since Tuesday, as well as the overbought condition of the gold market, indicate a short-term intermediate correction.

Moreover, next week will see the expiration of COMEX option contracts. Additionally, about 240,000 April gold contracts still need to be either sold, rolled into the next contract, or registered for delivery.

Historically, issuers often use such phases to steer precious metal prices in a direction advantageous to them.

Given the steep price increase, banks could benefit from lower prices, making a more significant pullback or a “cold shower” for precious metal prices in the next one to two weeks not surprising.

Nevertheless, the silver price should be more or less in the starting blocks just in time for spring to begin its typical sprint on the home stretch.

Since silver has so far only moved upwards in the slipstream of gold, the initiated pullback should therefore be limited both in terms of time and price and will be more of a cold shower than a real correction.

Subsequently, the silver bulls should take command.

In summary, the silver price is still lagging behind gold. The Gold/Silver Ratio is trading at 91.4, once again making it clear how extremely undervalued silver still is.

We suspect that the cold shower that has started will wake up the silver bulls and the breakout rally above $35 will begin shortly. Then we will see if the strength of the silver bulls only reaches about $38, or if we are in for a spectacular catch-up rally towards $40 and perhaps even $50 and an all-time high for silver.

Original article available at: https://www.gold.de/artikel/silber-kalte-dusche-als-weckruf-fuer-die-silberbullen/