Amount of Contained Metal Increases Significantly!

The wait was worth it! After the stock of copper and gold explorer Abitibi Metals (WKN A3EWQ3 / CSE AMQ) was suspended from trading yesterday, CEO Jon Deluce’s company released its updated resource estimate for the polymetallic B26 project after market close. Based solely on the first drilling phase of 2024 and metal prices adjusted to current market conditions, Abitibi Metals was able to increase the B26 resources by more than 60% in both the indicated and inferred categories!

In total, 13,510 meters of drilling distributed across 44 drill holes were considered in the new resource calculation. The ongoing Phase Two drilling (16,500 meters), with initial results expected to be presented next week according to Abitibi, has not yet been included, and the mineralization of the B26 deposit, which begins at the surface, remains open for expansion at depth and laterally.

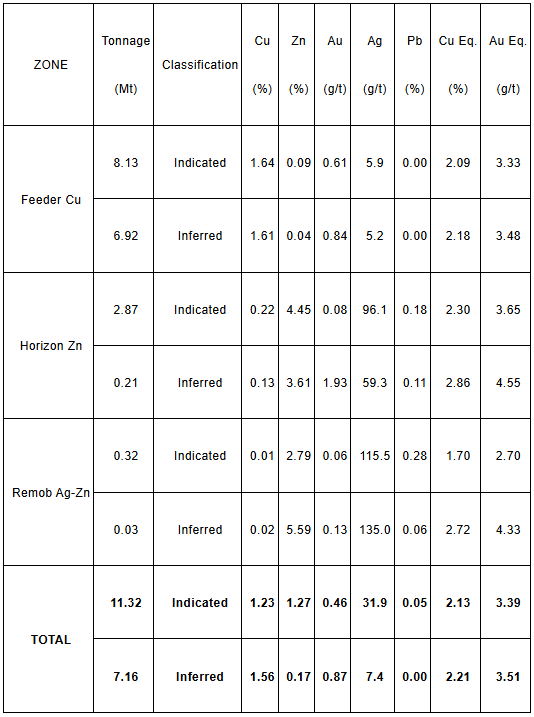

With Phase One drilling, the indicated resource was expanded by 62% from 6.9 million tons to now 11.3 million tons. The average grades are now 1.23% copper, 1.27% zinc, 0.46 g/t gold, and 31.9 g/t silver. According to Abitibi’s calculations, this corresponds to 2.13% copper equivalent.

Thus, the indicated resources now contain 307.9 million pounds of copper, 316.9 million pounds of zinc, 168,200 ounces of gold, and 11.6 million ounces of silver – or 532.3 million pounds of copper equivalent!

In the inferred category, the company can increase resources by 63% from 4.4 to 7.2 million tons, with average metal grades now at 1.56% copper, 0.17% zinc, 0.87 g/t gold, and 7.4 g/t silver, or 2.21% copper equivalent! This puts the amount of contained metal in this resource category at 246.0 million pounds of copper, 27.3 million pounds of zinc, 200,800 ounces of gold, and 1.7 million ounces of silver, equivalent to 348.8 million pounds of copper equivalent.

Amount of Contained Metal Increases Significantly

Overall, this results in a substantial increase in the amount of contained metal compared to the 2018 resource estimate. For copper, it’s an increase of 38%, for zinc 15%, for gold there’s a 29% increase, and for silver there’s an increase of 22%.

Abitibi Metals attributes this significant increase primarily to a refined 3D model of mineralization that also includes updated commodity prices. The calculation method applied, according to the company, corresponds to that used in 2018 for the resource calculation. Furthermore, a more detailed examination of the model allowed for better connection of mineralization sections. And of course, the new drilling completed in 2024, totaling 13,510 meters (44 drill holes), contributed to the expansion of metal occurrences.

Resource Estimate for B26; 2024

Underground Mining Preferred

Based on the information now available, Abitibi Metals has also conducted a detailed analysis of both open-pit and underground mining scenarios. They concluded that a scenario where the deposits are mined exclusively underground offers the most immediate value.

This doesn’t mean that management is ruling out open-pit mining. On the contrary, Abitibi remains convinced that this scenario could also create great value. However, to realize the full potential of surface mining, Abitibi says additional work is needed. This includes further drilling, sampling of historical drill cores where large zones of disseminated mineralization have not yet been examined, and sonic drilling to investigate a possible layer of oxidized overburden containing mineralization directly above the bedrock, similar to what was observed at the Selbaie mine. The company still intends to advance both scenarios to maximize the resource potential of the B26 deposit.

Jonathon Deluce, CEO of Abitibi Metals, is highly pleased with this ‘significant’ resource update, which, as he emphasizes, was achieved after just one year of focused exploration activities. Mr. Deluce stresses that particularly the substantial increase in contained metal underscores the ‘exceptional potential of this asset’ – thus validating the disciplined approach of the Abitibi team in unlocking the value of the property.

The Abitibi Metals CEO further emphasizes that, in his opinion, they are only at the very beginning of delineating a much larger resource on B26, which they are already working on with the ongoing drilling.

Conclusion: In our view, the newly presented resource estimate represents an important first step towards proving a resource of up to 30 million tons on B26, which Mr. Deluce has announced as a possible target in various interviews. With the increase in resources by more than 60% in both the indicated and inferred categories, Abitibi Metals has already significantly increased the value of the project. As the mineralization at B26 remains open both at depth and laterally according to the company, the potential for further resource growth is evident – and the first results of the second drilling phase should follow in just a few days. Adding to this that Abitibi Metals still has 13 million dollars available to complete the second work phase in 2024 and conduct another 20,000 meters of drilling next year, we believe the company is extremely well-positioned for the foreseeable future.