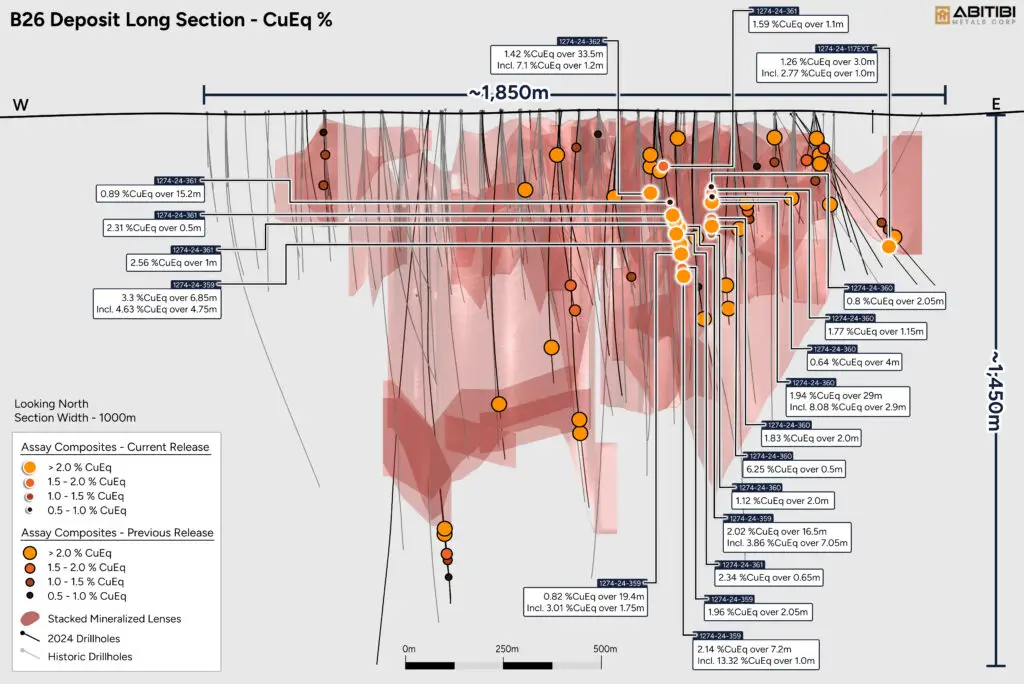

In November 2023, Abitibi Metals (TSX: AMQ, FSE: FW0, WKN: A3EWQ3) entered into an option agreement with SOQUEM Inc. for the B26 Project in the Canadian province of Quebec. The agreement gives Abitibi Metals the opportunity to acquire an 80% interest in the project within seven years. The exploration and drilling work started since then has begun very promisingly and is yielding excellent results. For example, in the last five outstanding drill holes of the completed Phase II program, 1.94% copper equivalent over 29 meters was intersected, among others. At its peak, the mineralization increased to 8.08% copper equivalent over a length of 2.9 meters.

As the other drill holes also intersected considerable mineralization, the work can be considered a success across the board. For instance, drill hole 1274-24-359 intersected a wide mineralized zone with more than 2 percent copper equivalent over a length of 32 meters. The mineralization was encountered in several sections.

At a drilling depth of 326 meters, 2.0% copper equivalent was encountered over a length of 16.5 meters. Slightly below, at a depth of 381.15 meters, a second mineralized section began. It extends over a length of 6.85 meters and contains an average of 3.3% copper equivalent. About 90 drill meters deeper, at 476.4 meters depth, a 7.2-meter long section begins, showing 2.14% copper equivalent.

The previously mentioned drill hole 1274-24-360 with 1.94% copper equivalent over 29 meters starts higher at a depth of only 262 meters. Here, the higher mineralized section begins with 8.08% copper equivalent over 2.9 meters at a depth of 287 meters. Drill hole 1274-24-362 was also very encouraging for Abitibi Metals. It intersected 1.42% copper equivalent over a length of 33.5 meters at a depth of 262 meters. Within this mineralization, a significantly higher mineralized part with 2.32% copper equivalent over a length of 4.0 meters was also encountered.

Phase II drill holes with locations of significant results; Source: Abitibi Metals

In addition to base metals, Abitibi Metals also finds significant gold mineralization

The high gold grades of 8.4 g/t Gold over 1.2 meters and 3.1 g/t Gold over 1.75 meters, encountered in drill holes No. 362 and No. 359, were also encouraging. The latter mentioned drill hole 359 is of particular interest to Abitibi Metals because it was drilled beyond the current block model. Here, high-grade mineralization was detected outside the previously defined block at a drilling depth of 444 to 518.4 meters.

Abitibi Metals can also be very satisfied with the results of drill holes 360 to 362, as further mineralized sections with grades of more than 2 percent copper equivalent were encountered. These results were all the more encouraging as the spacing of the drill holes was chosen to be larger at 50 to 100 meters.

Looking back at the results of the second phase is therefore also a look forward, as the consistency of the mineralization as well as its grade were impressively confirmed by the new drillings. As CEO Jonathon Deluce reported, this occurred primarily in the previously little-explored gaps within the current block model and at its edges.

These results are extremely promising and encouraging for the future. Therefore, a third drilling phase is currently being prepared. It is expected to cover approximately 17,000 meters of drilling, start in March 2025, and focus on further improving the grades and realizing the existing potential for expanding the resource.

In conclusion, it should be noted that the B26 project continues to represent a compelling base metal asset for Abitibi Metals. The previously undrilled gaps within the block model have been successfully closed, and the mineralization has been further extended at the edges. This provides Abitibi Metals with a good foundation to demonstrate that the completion of the option agreement in November 2023 was a very wise and promising step.