Up to 50,000 oz could be recovered

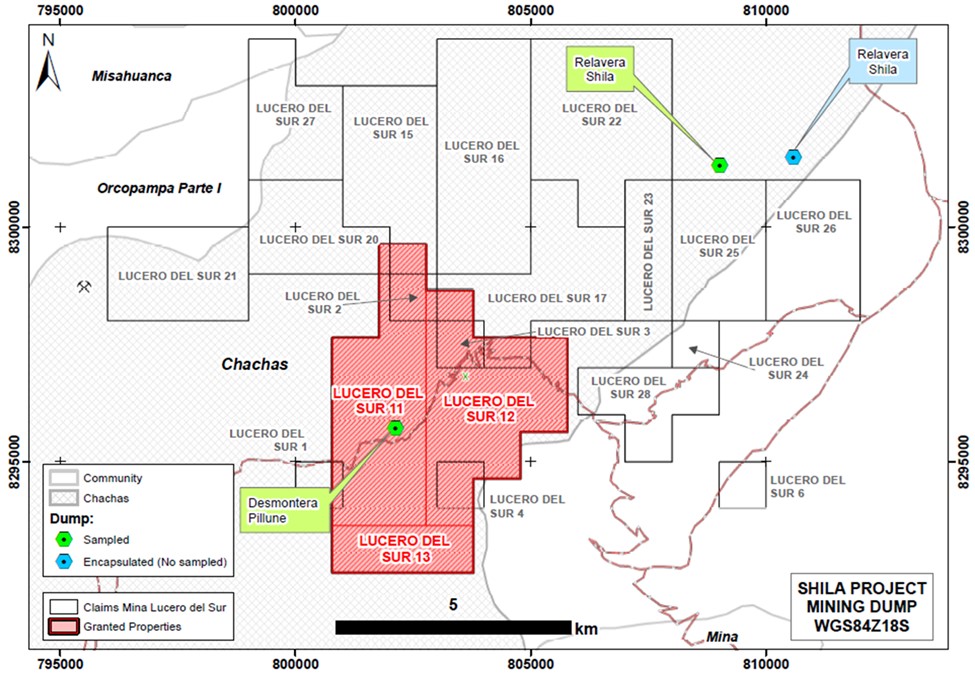

Element79 Gold (WKN A3EX7N / CSE ELEM) has secured the right to purchase and process 1.3 million tons of gold-bearing tailings from the private Peruvian company S.M.R.L. PALAZA 16 (“Palaza”) in Arequipa, Peru, by letter of intent. The tailings originate from previous mining activities at the Shila (now Lucero) and Paola mines.

The reprocessing of the tailings is part of the strategic plan to reopen the Lucero mine. Element79 described the LOI as a “significant milestone”. The strategic partnership with Palaza, a company with strong local roots, is intended to strengthen regional and community ties. The private seller Palaza estimates that approximately 50,000 ounces of gold equivalent can be recovered over the life of the project. As part of its due diligence, Element79 intends to verify this figure in independent 43-101 and PEA studies. In the best-case scenario, construction of a processing plant could begin after the end of the rainy season, presumably at the end of Q1 or the beginning of Q2 2025.

Element79 is paying $25,000 USD immediately for the option and plans to complete due diligence, including sampling, in the next 75 days. The purchase is to be completed subject to satisfactory results and the payment of a further USD 50,000. The partners have agreed a variable base price for the overburden of USD 10 per tonne plus VAT (18 %) at an assumed gold price of USD 2,200. In addition to the purchase price, Element79 Gold will pay Palaza a 1% royalty on all processed waste. Palaza has authorized Element79 Gold to construct a 350 tonne per day processing plant on its property, as well as a tailings dump for up to 2.5 million metric tons. This plant will not only process the acquired tailings but will also serve as a base for receiving other mineral ores from Lucero and regional small-scale miners (ASMs), with the aim of maximizing operational efficiency and output.

James Tworek, CEO and Director of Element79 Gold Corp commented, “We are very excited about this strategic partnership with Palaza, which underscores our ongoing commitment to strengthening our presence and operational capacity through innovative and sustainable mining practices. The Palaza team has been operating in the region for decades, has solid local relationships, and has valuable experience exploring and operating the Shila mine in the past. The end result of this agreement not only enhances Element79’s accessible resource base, but also positions us for long-term growth and profitability while helping to rehabilitate the tailings piles to achieve a stable closure and provide a solution to many of the local logistical barriers to increasing production from the Lucero mine and other mines in the region. We are confident that reprocessing these tailings will provide significant economic benefits for both parties and the communities involved and will strengthen our presence in the Peruvian mining sector.”

Figure 1: Element79’s main mineral rights at the former Lucero mine, including the tailings deposits.

Strategic partnership offers commercial benefits for both sides

Both partners expect the processing of the tailings to generate significant potential revenues in the future. Internal estimates based on old lab tests from 2011 and 2012 indicate that the gold equivalent grade in the tailings was approximately 1.5 g/t at that time. The gold solubility/yield from the tailings is estimated at 85% and the silver yield at 75%. Palaza estimates that approximately 50,000 gold-equivalent ounces can be recovered during the life of the project. With an estimated potential gross gold equivalent of US$100 million (at a gold price of US$2,000) with 80% recoverable resources (US$80 million), less US$16 million in input costs (overburden) and a scalable $6-$20 million in sustaining capital costs, the project could generate $44-$58 million in gross revenue over a 15-year project life (or $2.9-$5.3 million in gross revenue per year).

Element79 offers access to new technologies

Element79 Gold has evaluated various options to enhance safety and minimize the environmental impact of the proposed tailings management facility. As part of the due diligence process, the grinding and processing methods with and without chemicals, ore processing, efficiency and soil impermeability to prevent soil leaching are being tested. Element79 Gold is committed to ensuring that all activities meet strict environmental and community standards.

Conclusion: The agreement between Element79 and the private Peruvian company Palaza offers significant economic benefits for both parties. Added to this are the social and environmental benefits for the region and the local community. The project has been a long-standing priority for the local population, as it would complete the final clean-up of four piles of dry-stacked tailings that have been inactive for approximately 19 years without remediation, covered with ‘biomembranes’ and limestone. There is a very good chance that Element79 will be able to raise institutional funds for the development of the mill/processing plant for overburden based on the upcoming 43-101 reports and the PEA, especially since the plant could in turn be the first step in resuming commercial production at the Lucero mine. In this bull market for gold, fast cash flow is certainly the best argument for reopening an old mine.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Portofino Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Under certain circumstances, this may influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company about which reports are published on the GOLDINVEST Consulting GmbH website, in the social media, on partner sites or in emails, which also constitutes a conflict of interest. The above information on existing conflicts of interest applies to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Portofino Resources. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. Therefore, there may be a symmetrical generation of information and opinions during this period. No guarantee can be given for the accuracy of the prices quoted in the publication.