AngloGold invests up to US$8.9 million (A$13.4 million) over 5 years in the gold project

EcoGraf Limited (ASX: EGR; FSE: FMK; OTCQB: ECGFF) has entered into a binding farm-in agreement with the world’s fourth largest gold miner, AngloGold Ashanti Plc (NYSE: AU; JSE: ANG), for its non-core Golden Eagle Project in Tanzania. The agreement, formally entered into between respective subsidiaries Innogy Limited (Ecograf) and Tanzania-based AngloGold Ashanti Holdings plc, provides for AngloGold to invest up to US$8.9 million (A$13.4 million) over 5 years in the gold project to earn a 70 per cent interest in the project. The partners have agreed that AngloGold will make an upfront payment of US$100,000 to Innogy once the Tanzanian Mining Commission grants mining licences for the Golden Eagle project. In addition, AngloGold has committed to a minimum expenditure of US$ 0.9 million within two years. Only then could AngloGold withdraw from the farm-in agreement. AngloGold is the owner of Tanzania’s largest gold mine, the Geita gold mine with 9.9 million ounces. The Golden Eagle project is part of AngloGold’s new exploration portfolio in Tanzania as the company resumes exploration in the country.

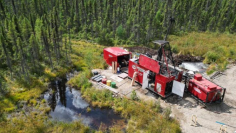

The Golden Eagle Project is located on the eastern margin of the world-class (+70 million ounces of gold) Lake Victoria Goldfields gold deposit in the same structural corridor as the historic Golden Pride gold mine (3.4 million ounces of gold) operated by Resolute Mining Limited. The Golden Eagle project covers a total area of 578 square kilometres. Most notably, it comprises the direct, interpreted northeast continuation of the Banded Iron Formation (BIF) that hosts the high-grade Winston gold deposit, which returned drill intercepts of 16 metres at 55.23 g/t gold from 116 m2. Geologists believe the project has significant potential for the discovery of world-class, multi-million ounce gold deposits.

Previous exploration work has conducted extensive prospecting activities within the Golden Eagle Project licences, which have identified a significant number of gold targets and exploration opportunities. Several highly prospective, untested gold showings, shear zones and faults intersect the BIF units of the Golden Eagle project.

EcoGraf Managing Director, Andrew Spinks, commented: “The Golden Eagle farm-in agreement with AngloGold Ashanti, the fourth largest gold producer in the world, demonstrates the high technical quality of Innogy’s assets and is a further vote of confidence in the mining industry in Tanzania. We look forward to AngloGold Ashanti bringing its gold exploration expertise to Golden Eagle as it seeks another Tier 1 gold deposit to complement its existing operation at Geita in Tanzania. This agreement provides our shareholders with a pathway to realise value from EcoGraf’s non-core minerals. It provides our shareholders with the opportunity to capitalise on the rising gold price while the company focuses on developing its battery anode materials business for the lithium-ion battery market.”

Conclusion: Ecograf has positioned itself as the next integrated graphite company for the global market. The course was set years ago and all properties in Tanzania that are not part of the core business were separated into the subsidiary Innogy Limited. Originally, a separate IPO was even planned for Innogy, but unfortunately the IPO did not materialise. The earn-in agreement with AngloGold is therefore part of a plan B for the benefit of Ecograf shareholders. In addition to the Golden Eagle project, EcoGraf owns a number of other gold, nickel and lithium exploration projects in various regions of Tanzania through its subsidiary Innogy - the Northern, Southern and Western Frontier projects. These Frontier projects also have significant potential for Proterozoic gold mineralisation. EcoGraf says it is already in contact with groups of companies that have expressed interest in these projects. AngloGold's new interest in exploration in Tanzania, Barrick CEO Mark Bristow's commitment to long-term involvement in the country and, most recently, Perseus' (ASX/TSX: PRU) complete acquisition of Australia's Orecorp with its Tanzanian Nyanzaga Gold Project send a clear message: Tanzania will be a force to be reckoned with in the coming gold bull market.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to Paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of EcoGraf and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between EcoGraf and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.