{kanada_flagge}The best exploration results are good results that cost nothing. True to that motto, Dynasty Gold Corp. (TSXV: DYG; FRA: D5G1; OTC PINK: DGDCF) has been digging into the depths of the database it co-acquired last October from previous owner Teck Resources Limited (NYSE: TECK) for the Thundercloud project in northwestern Ontario. In the process, it turned up the results of a whopping 15 drill holes drilled on the property between 1986 and 1988 by Noranda Exploration, which were previously thought to have been lost. As a result, this data was not included in the most recent resource estimate released in January of this year.

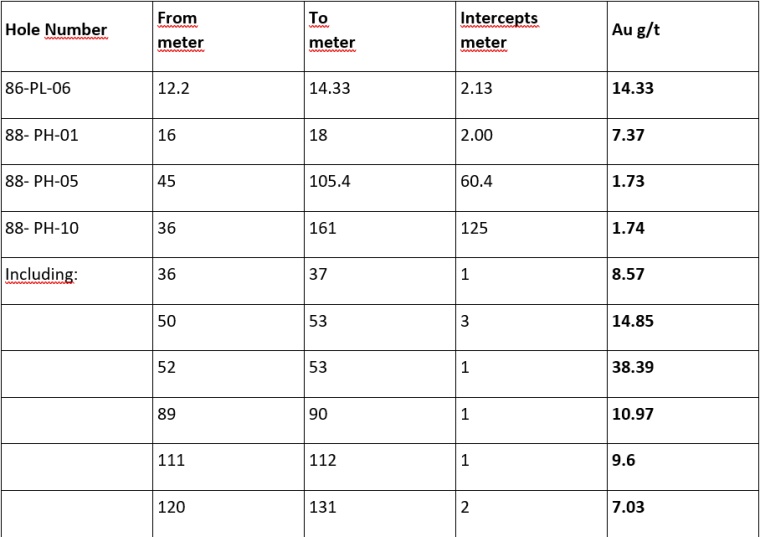

While no conclusions can be drawn as to how the new information will affect the current resource estimate of 182,000 ounces of gold until these holes are accurately located, the results themselves are – by today’s standards – extremely encouraging. The best hole, 88-PH-10, returned 125 meters of mineralization at 1.74 g/t in the interval between 36 and 161 meters. Hole 86-PL-06 returned 2.13 meters of 14.33 g/t gold near surface.

Figure 1: Historical drilling data from 1986 to 1988 at a glance.

Once the ground is cleared of snow, Dynasty plans to begin a drone-based aerial survey. Based on this data, the Company plans to initiate its first drill program to expand the documented resources at the Pelham Zone.

A review of previous geophysical work, including IP and magnetic surveys, conducted by Teck Resources Limited has already been completed. Most of the historical IP and Magnetic Surveys outlined areas of sulphide mineralization in the Pelham portion of the property using grid lines cut in an east-west direction. This line direction was not optimal for highlighting the Pelham Zone gabbros and associated mineralization, which also trend east-west, but has helped in understanding the West Contact Zone area where mineralized structures appear to trend north-south. Because the detailed airborne drone magnetic survey will be flown with lines closer to right angles to the gabbro bodies and mineralization in the Pelham area, it is expected to provide new data to help interpret the structure of the Pelham mineralization.

The expanded magnetic survey will cover most of the property where the previous geophysics was conducted with flight lines spaced 100 meters apart. By reducing the line spacing to 50 meters (including the Pelham area), more detailed structural information can be obtained. The closer spaced survey work will include portions of the West Contact area where 2007 surface and trench sampling returned gold values up to 8.02 g/t over 39 meters, including 89 g/t over 3 meters.

Bottom line: things exist that really don’t exist. At least, they shouldn’t: There are simply 15 drill holes disappearing from the statistics – even more so those with excellent results. Dynasty Gold can rejoice, because the company has apparently acquired Thundercloud from Teck at a sell-out price: just $100,000 CAD has been paid by Dynasty for the project. In the project’s history to date, more than CAD $10 million has been spent on drilling and other surface exploration work. However, the majority of the 12,000 meters of drilling has been focused on a very small area of the property.

The Thundercloud property is located in the Manitou-Stormy Lakes greenstone belt in Ontario, 47 kilometers southwest of Dryden. The geological setting is similar to the Abitibi Belt in eastern Ontario, but is much less explored. The belt contains numerous gold deposits, with several high-grade mines discovered in the area, including the Big Master Mine (1902-1943) and the Laurentian Mine (1906-1909). In recent years, nearly 30 million ounces of gold have been mined and discovered, such as New Gold’s Rainy River Mine (6.4 million ounces of gold and 18.7 million ounces of silver) and Agnico Eagle’s Hammond Reef deposit (5.8 million ounces of gold).

Dynasty shareholders can look forward to an exciting season.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH could hold shares of Dynasty Gold and therefore a conflict of interest could exist. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. This could possibly influence the share price of Dynasty Gold. GOLDINVEST Consulting GmbH currently has a commissioned relationship with the company, which is to be reported on in the context of the internet offer of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Dynasty Gold. We also cannot exclude that other stock letters, media or research firms discuss Dynasty Gold during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.