Crux Investor’s Copper Bottomed – Copper Market Provides Grounds for Tempered Optimism

Recording date: 30th December

The Battery Show (Copper Bottomed, Episode 10)

Copper prices were range-bound over the year. Unexpectedly strong demand and unexpectedly weak supply kept copper prices close to the US$4/lb level. In real terms, copper prices have actually fallen since 2006. Supply looks tight and demand looks strong for the foreseeable future. Mind the Gap, Go Explorers! Talking of which, there are results out from:

Brixton Metals, Tribeca Resources, Benton Resources, Gladiator Metals, MTB Metals, Barksdale Resources, Serabi Gold, and Nicola Mining. Benton Resources – once again – is the pick of the bunch, although Gladiator Metals catches the eye as well.

Despite lackluster price performance in 2023 after a strong multi-year run, the long-term investment case for copper remains compelling. Decarbonization policies continue to drive electricity infrastructure builds using the metal, underpinning structurally growing demand. Supply meanwhile faces declining ore grades at existing mines and a 15-year plus timeline to bring new projects online. These dynamics point to higher real copper prices over the next decade to incentivize adequate investment in new capacity. Juniors finding early-stage exploration success offer leveraged exposure to this pending supply squeeze.

Select drilling results released in recent months provide grounds for optimism. Brixton Metals’ Thorn project drilling has outlined over 1 kilometer of copper porphyry mineralization open at depth. Management aims to prove a large-scale resource that could support eventual low-cost block cave underground mining, albeit at currently sub-economic grades. 83 meters at 0.4% copper from Tribeca Resources’ La Higuera prospect in Chile confirms impressive prior results, with over 650 meters of untested strike length remaining to the north.

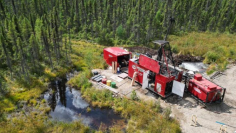

Great Burnt prospect operator Benton Resources continues to deliver broad, high-grade copper intervals near surface such as 24 meters at 3% copper. The extensive system shows excellent continuity with significant expansion potential up and down plunge. Gladiator Metals also hit shallow 26 meter and 13 meter intercepts above 1.5% copper at its Australian Creswick project, defining 1 kilometer of strike amenable to open pit mining. Meanwhile, Barksdale Resources seeks to validate an immense but conceptual copper target in Arizona backed by an industry major.

An emerging two-tier market gives investors selective exposure options. Near-term producers offer leverage to already favorable copper price levels. Juniors demonstrating promising initial exploration results lend exposure to the next leg higher in prices required to spur investment in new mine supply. Assessments should focus on grade quality, thickness consistency, metallurgy and infrastructure access. While further de-risking is essential, early drilling success points to considerable long-term resource upside on selected prospects.

Learn more: https://www.cruxinvestor.com/categories/commodities/copper

Sign up for Crux Investor: https://cruxinvestor.com