“We are excited to have intersected gold-bearing zones"

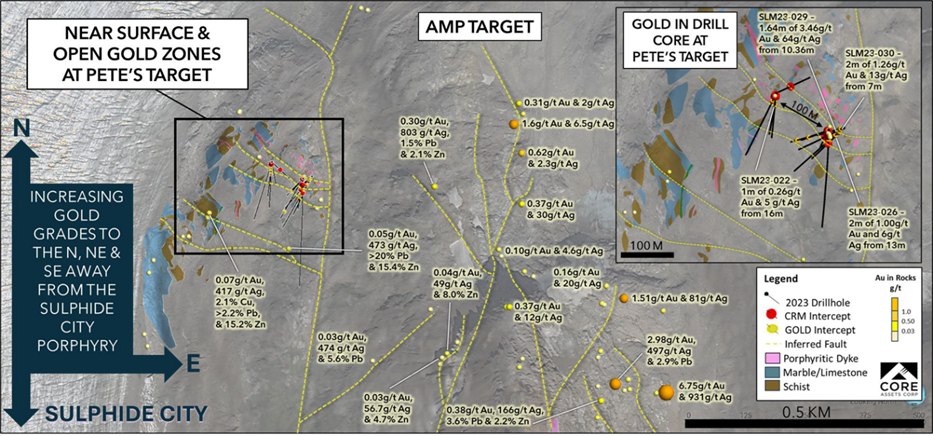

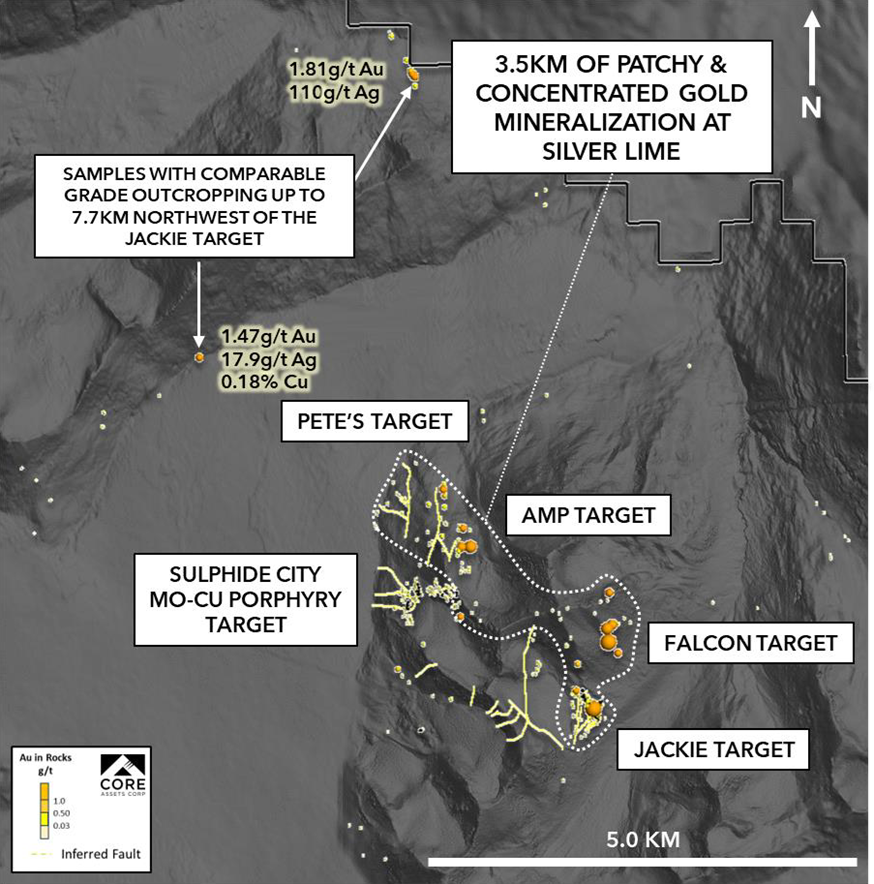

Core Assets Corp. (CSE:CC; FSE:5RJ; OTC. QB:CCOOF) has now also demonstrated systematic disseminated gold mineralisation on the central Blue property at its Silver Lime CRD porphyry project in the Atlin Mining District of northwestern British Columbia. Gold mineralisation at Silver Lime appears to be hosted in late volatile calcite veins derived from steeply dipping faults affecting schist, marble, local porphyry veins and zones of massive sulphide. Geologists suspect that the gold-bearing fluids utilised the same structural pathways downstream in time that concentrated the earlier massive sulphide-bearing ore fluids. This would make these newly discovered steep channels excellent drill targets for both high-grade massive sulphides and late-stage gold mineralisation. Gold could further increase the value of the high-grade skarn and carbonate replacement targets.

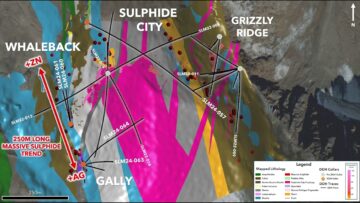

The explored extent of the Silver Lime CRD porphyry project currently measures 10 km by 9.5 km and has an average surface grade of 83 g/t Ag, 0.22% Cu, 1.8% Pb, 3.4% Zn and 0.16 g/t Au (700 samples). High-grade carbonate replacement mineralisation was observed in folded marble bedrock up to 250 metres thick. In 2022, Ag-Zn-Pb-Cu-bearing mineralisation was intersected near the bottom of Sulphide City hole SLM22-006 at a depth of 453 metres.

Nick Rodway, President & CEO of Core Assets, commented: “We are excited to have intersected gold-bearing zones at the Silver Lime Porphyry-CRD project. We continue to discover evidence of a district-scale example of the full spectrum of mineralisation from the Mo+Cu porphyry hub at Sulphide City to Zn-Pb-Ag-Cu massive sulphide to distal/late gold. In 2023, several shallow dipping drill holes intersected these steep gold-bearing conduits. These gold zones remain open for exploration and we look forward to providing further updates as we prepare for our fully funded 2024 exploration programme.”

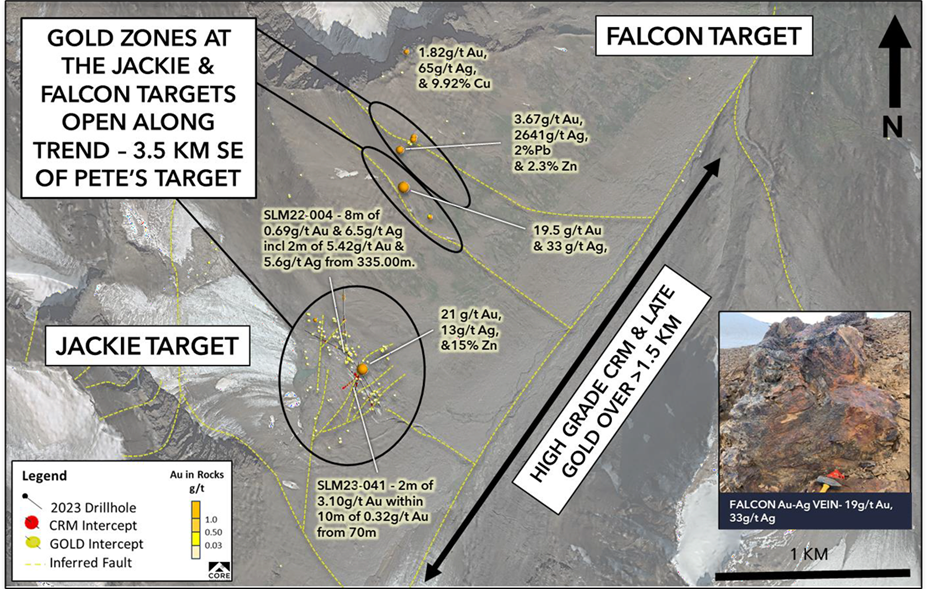

Some high-grade gold deposits at Silver Lime were already known from the past. However, the recent systematic evaluation of more than 40 drill holes in conjunction with surface sampling now provides the explanation for these structurally related occurrences and at the same time an approach for future targeted drilling. The two best gold-bearing surface samples collected to date were discovered at the Falcon and Jackie targets. Historic sample 89868 (Carmac, 1990) at Jackie graded 21 g/t Au, 12 g/t Ag and 15% Zn (+As-Cu-Sb), while sample D935063, collected by Core Assets in 2022 at Falcon, returned 19.5 g/t Au and 33 g/t Ag from coarse quartz-carbonate veins up to 2 metres wide (Figure 2).

Conclusion: The geological structures at Core Assets’ Silver Lime project can be thought of as the pattern created by valuable Japanese kinstugi pottery whose fragments have been reassembled with gold. Geologists hypothesise that the gold-bearing fluids used the same structural pathways downstream in time that concentrated the earlier massive sulphide-bearing ore fluids. This explains the “spoke structures” that Core Assets is now finding on its targets, which provide excellent leads for future drilling. The company has identified seven highly prospective targets to date, covering the full spectrum of mineralisation from porphyry Mo-Cu through Fe-Zn-Cu-Ag massive sulphide skarn (Sulphide City) to Ag-Pb-Zn-Cu-Au carbonate replacement mineralisation (Gally, Pete’s, Grizzly, Jackie). The subsequently added gold should further increase the value of the high-grade mineralisation. With this knowledge, preparations are underway for the upcoming drilling. To date, Core Assets has only completed 5,565 metres of diamond drilling on the project in an initial 2022 drilling programme. Core Assets is therefore only at the beginning of its discoveries at Silver Lime.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, they are in no way a substitute for individual expert investment advice; rather, they are advertising/journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the case of penny stocks, involves high risks that can lead to the total loss of the capital invested. GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete. Please also note our terms of use.

In accordance with §34b WpHG i (Germany) and §48f paragraph 5 BörseG (Austria) we would like to point out that clients, partners, authors and employees of GOLDINVEST Consulting GmbH hold shares in Core Assets and therefore a conflict of interest exists. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. This may result in the symmetrical generation of information and opinions during this period. Furthermore, there is a consultancy or other service agreement between Core Assets and GOLDINVEST Consulting GmbH, which gives rise to a conflict of interest.