{australien_flagge}Following the release of the first eight holes at their Mt Thirsty 50/50 JV in Australia, shares in both JV partners Conico Ltd (ASX: CNJ; FRA: BDD) and Greenstone Resources (ASX: GSR) have crashed. Conico’s shares lost an even 50 percent amid high turnover, while Greenstone was down around 44 percent. While high-grade anomalous mineralization was found in all eight drill holes, contrary to hopes, the drill results failed to match the high PGE values of its northern neighbor Galileo. The best values were returned by MTRC003D with 27.0 meters @ 0.33g/t 3E , 0.12% Ni & 0.05% Cu from 198.0 meters, MTDD001D with 18.0 meters @ 0.29g/t 3E, 0.11% Ni & 0.05% Cu from 182.0 meters and MTRC009D with 10.2 meters @ 0.23g/t 3E, 0.09% Ni & 0.01% Cu from 199.0 meters. The eight drill holes to date cover only about 3% of the altered ultramafic target horizon at Mt Thirsty. Assay results for an additional four holes are pending.

Following the release of the first eight holes at their Mt Thirsty 50/50 JV in Australia, shares in both JV partners Conico Ltd (ASX: CNJ; FRA: BDD) and Greenstone Resources (ASX: GSR) have crashed. Conico’s shares lost an even 50 percent amid high turnover, while Greenstone was down around 44 percent. While high-grade anomalous mineralization was found in all eight drill holes, contrary to hopes, the drill results failed to match the high PGE values of its northern neighbor Galileo. The best values were returned by MTRC003D with 27.0 meters @ 0.33g/t 3E , 0.12% Ni & 0.05% Cu from 198.0 meters, MTDD001D with 18.0 meters @ 0.29g/t 3E, 0.11% Ni & 0.05% Cu from 182.0 meters and MTRC009D with 10.2 meters @ 0.23g/t 3E, 0.09% Ni & 0.01% Cu from 199.0 meters. The eight drill holes to date cover only about 3% of the altered ultramafic target horizon at Mt Thirsty. Assay results for an additional four holes are pending.

At least the depth of the PGE mineralization encountered is consistent with the previously modeled target horizon. Initial geological interpretation of the results suggests that the local distribution of grade and continuity is likely influenced by one or more secondary controls on the mineralization. Nonetheless, the confirmed presence of PGE mineralization within the property, more than 450 meters from the Callisto discovery, suggests that prospects for future PGE discoveries in the area remain. Initial interpretations suggest that secondary controls on mineralization may influence grade continuity. Thickening was observed in the sediments to the south in holes MTRC0011AD (38.0 meters) and MTRC005D (49.0 meters), which have not yet been fully evaluated. Geologists suggest that this thickening may play a key role in mineralization as it is the source of sulphur and fluid, which could facilitate local enrichment of PGE mineralization. Accordingly, the joint venture partners have developed a new geological model for Mt. Thirsty and plan to drill seven additional holes based on this model (See Figure 1). Both MTRC0011AD and MTRC005D have been logged, cut, sampled and submitted to the laboratory. Results are expected in the next 4-6 weeks.

Figure 1: Overview of planned and completed drill holes and prospective ultramafic geological horizons.

Current geological interpretation suggests that the Callisto mineralization lies within a north-south trending zone of demagnetization, resulting in local alteration and remobilization of mineralization. This interpretation is supported by results obtained to date from the northeast corner of the target area and by geophysical interpretations (Figure 1). Importantly, a continuous demagnetized zone has been discovered that extends across the MTJV license (see Figure 1) and has a similar geophysical signature to the Callisto basement lithologies. Since ultramafic formations are strongly magnetic, this suggests a zone of strong alteration and potential mineral remobilization.

Executive Director, Guy Le Page, commented, “The historical focus of Mt Thirsty has been primarily on near surface oxide resources, while more recent PGE exploration has been in largely untested geological horizons. In recent weeks, our geological understanding of the potential drivers of mineralization has evolved rapidly and we continue to dynamically adjust our exploration model to account for this. We are reassured that we have obtained highly anomalous PGE mineralization in all holes completed to date and, more importantly, the two most recent holes, MTRC0011AD and MTRC005D, have intersected significantly thicker sedimentary packages that are believed to be key to the mineralization.”

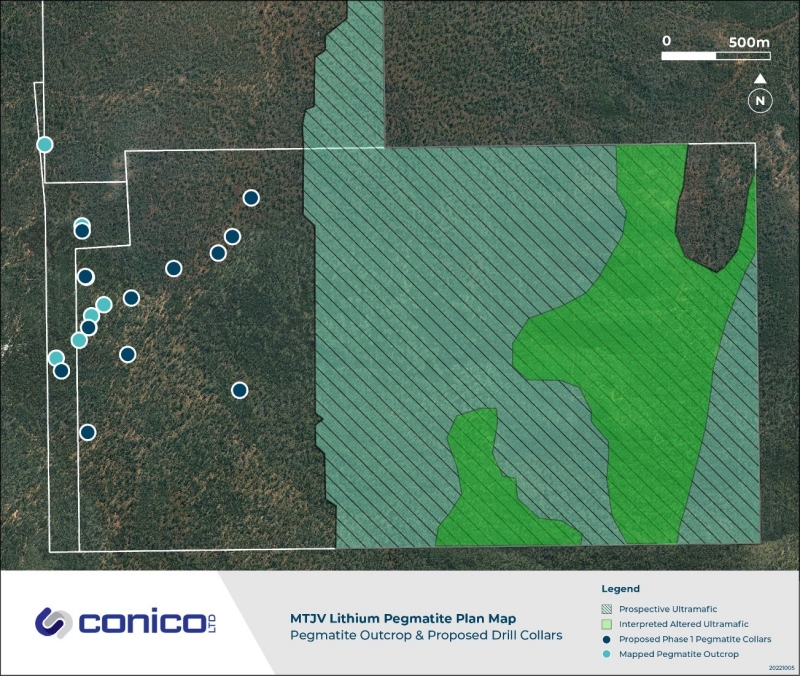

An additional seven holes are planned in the coming weeks as part of the aggressive Phase I drilling campaign. They are designed to test the remainder of the prospective strike horizon at Mt Thirsty. Upon completion of this PGE drilling campaign, the drill rig will then be moved to the western margin of the property to test the recently identified lithium potential. To date, eight pegmatite outcrops have been mapped over a strike length of 1,000 metres.

Figure 2: Plan view of mapped pegmatite outcrops and proposed drill columns.

Conclusion: The stock market likes it simple and fast, black or white. Accordingly, the two JV partners were punished first. Nevertheless, the Mt Thirsty story is not over: the Mt Thirsty complex remains highly prospective for further PGE discoveries. Geologists have learned from the results and refined their geological model. After evaluating all the data, seven new drill holes are now focusing on areas that have a similar signature to Callisto. 90% of the target horizon has not yet been tested, including in particular a large demagnetized zone. However, if upcoming PGE drilling continues to fail to meet expectations, a Plan B is already in place. Geological mapping on the western margin of the Mt Thirsty license has identified eight pegmatite outcrops over a strike length of 1,000 meters (Figure 2). Preparations are already underway for an initial 11-hole program (1,650 meters). Once again, the JV partners are taking their cue from their neighbor. Galileo had in the past taken six grab samples of micaceous pegmatite (lepidolite) 150 meters west of the licenses held by MTJV from a north-south trending pegmatite, grading an average of 2.3% Li2O, 1.87% Rb and 476 ppm Ta205.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Conico Ltd and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Conico Ltd for reporting on the company. This is another clear conflict of interest.