Both averages continue to rise

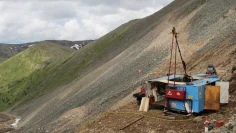

The share price of the Canadian gold explorer Sitka Gold (WKN A2JG70 / CSE SIG) made its way upwards, as announced in the last chart check on November 15, but narrowly missed the theoretical target (0.25-0.30 Canadian dollars) at CAD 0.235 – the upper trend channel line proved to be somewhat stronger than the price target derived from the flag formation. At the turn of the year, the consolidation phase began, which took the price back to the 100-day line and slightly above the lower trend channel line.

Both average lines continue to rise, which is just as positive as the fact that the 100-day line is still above the 200-day line.

The MACD indicator generated a technical sell signal at the start of the year in correlation with the price consolidation (the blue line intersects the red line downwards) and is currently at a one-year low. The same scenario applies to the stochastic indicator – although this indicator has already issued another buy signal (blue line intersects red line upwards). The trend confirmator has crossed the neutral 100 downwards in the course of the consolidation and is currently quoted in negative territory at 90. This is the value that was reached several times in the last 11 months when the lower trend channel line was touched and then led to a renewed price rise. Similarly, after the overbought/oversold indicator peaked in November (above 2.0), it is now close to the annual lows – it currently stands at 0 and should be viewed as neutral.

Source: Comdirect

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Portofino Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Under certain circumstances, this may influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company about which reports are published on the GOLDINVEST Consulting GmbH website, in the social media, on partner sites or in emails, which also constitutes a conflict of interest. The above information on existing conflicts of interest applies to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Portofino Resources. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. Therefore, there may be a symmetrical generation of information and opinions during this period. No guarantee can be given for the accuracy of the prices quoted in the publication.

Latest News

Latest Videos

MD INTERVIEW: Parkway Corporate (ASX:PWN) MD Speaks with GoldInvest about recent corporate developments (30 Sep 2021).

Group managing director, Bahay Ozcakmak sat down with Sven Olsson of to discuss all things $ESG & $water.

$pwn

https://www.youtube.com/watch?v=h3DtJKjGNs4

Parkway Corporate - Die Zukunft der Wasseraufbereitung

Parkway Corporate (WKN A1JH27 / ASX PWN) hat sich unter der Führung des jungen MD Bahay Oczakmak in weniger als...

Goldinvest.de

Earlier this month, Parkway Corporate (ASX:PWN), released a new corporate presentation.

$PWN #ESG #investing #sustainability #water #innovation #technology

The corporate presentation can be viewed here:

https://cdn.shopify.com/s/files/1/0529/9529/3345/files/2021_09_03_PWN_Presentation_82.pdf?v=1630891279

June 2020 Quarterly Report can be found here: https://www.asx.com.au/asxpdf/20200709/pdf/44kcy4sy0mpryd.pdf

$PWN - JUNE 2020 QUARTERLY REPORT

The quarter was marked by significant progress on both the Technology and Projects front, as Parkway Minerals continues to undergo an exciting transformation into a leading brine processing technology company.

June 2020 Quarterly Report can be found here: https://www.asx.com.au/asxpdf/20200709/pdf/44kcy4sy0mpryd.pdf

🌿 June 2020 Quarterly Report | Parkway Minerals (ASX:PWN) | Strong progress during quarter 🌿 - https://mailchi.mp/parkwayminerals.com.au/parkway-minerals-asx-pwn-updated-investor-presentation-outlining-business-model-3909134

PWN - March 2019 Quarterly Report - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1567837

PWN - Exploration Target for Dambadgee Prospect, Dandaragan Trough - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1536229

Significant Resource Upgrade for Davenport Resources - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1510121