Everyone wants environmentally friendly mining and the cleanup of contaminated sites. But when in doubt, small start-ups have to find the money themselves. This can be seen in the case of Cerro de Pasco Resources Inc. (CSE: CDPR; FRA: N8HP), which has set out with the vision of completely acquiring the Peruvian scandal project of the same name and rehabilitating it from the ground up, while continuing its commercial operations.

Most recently, negotiations with owner Glencore had stalled. Nevertheless, Cerro has now managed to raise a further CAD 3 million in fresh capital from investors and even oversubscribed the placement in the end. The price in this round was CAD 0.35 per unit. As a little treat, investors also received a full two-year warrant at CAD 0.50 on top.

One should not take this ability to continue financing at a constant price level for granted, because Cerro de Pasco is not an explorer like all the others. Already the stock market value of far more than 100 million CAD betrays the high ambition and, conversely, says something about the confidence and expectations of the investors.

No bed of roses for shareholders to date

For shareholders, the past two years have not been a bed of roses. Cerro shares have been trading in a corridor between CAD0.27 and CAD0.40 virtually since 2019 – with no tangible progress in negotiations with owners Volcan/Glencore. Negotiations have been underway for more than a year to acquire the mine outright and move it forward. Towards the end of last year, an agreement seemed to be within reach. The draft contract was on the table. But then came the announcement in November 2020 that the partners had not been able to agree on the details of the contract in the time allotted, immediately followed by the assurance that negotiations with Glencore were continuing. Since that time, the responsible personnel at Glencore has changed and the deal still hangs in the balance. In any case, the Glencore side did not exactly signal that it was in a hurry to reach an agreement, while it watched impassively as the junior partner regularly threatened to run out of financial steam. Some consider this to be a typical Glencore negotiating strategy. The fact that the cleanup of the contaminated sites is being delayed seems to play a subordinate role – despite the great public interest in the politically charged symbolic project. NGOs like to use Cerro de Pasco as a striking example of the irresponsibility of large corporations, as most recently in the referendum on the supply chain law in Switzerland, where the mine literally had to serve as a backdrop for election posters.

In the past 12 months alone, Cerro has had three rounds of financing, each in several tranches, so that the company has actually felt like it was constantly in financing mode. In total, Cerro has raised around CAD 6 million in this period. It is solely thanks to the energy performance of CEO Guy Goulet that investors have stayed with the company.

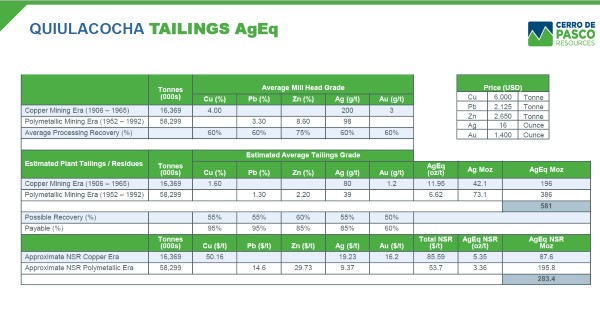

The net proceeds of the latest capital increase will be used primarily for the exploration and development of the Quiulacocha overburden project at the Cerro de Pasco project. There, Cerro intends to define a comprehensive resource for the first time with 40 drill holes, each 40 meters deep. The tailings pond, which covers more than one square kilometer, contains 100 years’ worth of mining waste. On the one hand, this is a huge legacy, but it could also be the key to an economic revival of the project. This is because modern methods can be used to process old slag residues and recover the residual metal they contain. We are staying tuned to Cerro de Pasco and hope that the company will soon be able to cut the knot in negotiations.

Figure 1: The potential of Quiulacocha is enormous. The tailings pond is estimated to hold 75 million tons of mining waste, some of which is 100 years old. Back then, metallurgy was not as advanced as it is today. Therefore, the material was ground less finely and much of the metal it contained was considered not recoverable at all. Cerro assumes that about 16,000 tons of copper-bearing ore with “residual grades” of 1.6 percent copper are preserved from the era of copper mining between 1906 and 1965 alone. Since this material is already pre-ground, mining it could be extremely attractive economically. The greater portion of the mining waste is from Cerro de Pasco’s forty-year polymetallic era. Cerro can reconstruct from historical records that up to 58,299 tonnes were deposited, containing 6.62 ounces of silver in silver equivalent terms. The total resource under review is estimated to be in excess of 500 million silver equivalent ounces. About half of this could be economically recoverable.

Conclusion: The Quiulacocha tailings basin could hold the key to a renaissance of mining at Cerro de Pasco under modern auspices. Cerro de Pasco has yet to prove its potential in upcoming drilling, but the historical record already provides a fairly detailed picture. The amount of metal contained in the huge tailings pond could easily rival new projects, especially in terms of copper grades. However, the market, and probably Glencore, wants to see confirmation of the deposits in black and white first.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Cerro de Pasco Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Cerro de Pasco Resources and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since Cerro de Pasco Resources remunerates GOLDINVEST Consulting GmbH for reporting on Cerro de Pasco Resources.