Great potential for intrusion-related and orogenic gold deposits

Brixton Metals’ (TSXV BBB / WKN A114WV) focus is clearly on the giant Thorn project, which the company believes has the potential to host at least one world-class deposit. However, at its Atlin Goldfields gold project, Brixton was active in 2022 and drilled a test hole which, as reported today, returned gold mineralization over a length of almost 160 meters.

Specifically, Brixton drilled 159.80 meters of 0.33 g/t gold from a depth of only 55.00 meters at the project located near Atlin, British Columbia. However, this included several mineralized intercepts with higher grades, including:

– 35.00 meters of 0.77 g/t gold,

– 19 meters of 1.34 g/t gold and

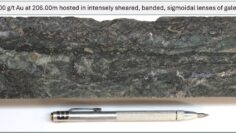

– 0.45 meters of 38.1 g/t gold.

(There was visible gold in the sample).

Great potential for intrusion-related and orogenic gold deposits

The drill hole tested the so-called Yellowjacket target and Brixton’s Vice President Exploration Christina Anstey is pleased to have identified visible, high-grade gold within a thicker halo with lower grades. She went on to explain that Atlin Goldfields has great potential for intrusion-related and orogenic gold deposits.

Drill hole YJ-23-003 was 349.91 meters long and intersected the so-called Pine Creek fault system. This was used to test suspected sub-parallel gold-bearing quartz vein sequences based on historical drilling results. In the past, however, exploration drilling was limited to a depth of 50 meters, so that only very limited drilling penetrated to a depth of 150 meters below the surface of Yellowjacket. A second objective of last year’s drilling was to demonstrate the potential of the Pine Creek Fault system for mineralization at greater depths than previously tested.

And that potential certainly appears to be there, given the latest drill results. According to Brixton Metals, gold mineralization at the Yellowjacket target appears to be controlled by the Pine Creek fault system, a northeast trending, steeply dipping, 60 to 80 metre wide structure. According to the company, the Pine Creek Fault hosts sub-parallel, moderately southeast dipping, millimetre to centimetre sized quartz veins containing gold mineralization. The gold-bearing quartz veins preferentially occur within listwanitic rocks and other minor fault contacts with ultramafic rocks within the Pine Creek system. Gold mineralization occurs in the form of native gold associated with pyrite, chromite and mariposite.

Interestingly, placer gold has been mined in most of the creeks and rivers in the Atlin Goldfields project for over 125 years. Although several hard rock exploration companies have worked the area, the source of the abundant placer gold in the area has not yet been identified. The Atlin Goldfields Camp holds the Canadian record for the largest gold nugget, which weighed 2.6 kilograms or 85 ounces and was discovered at Spruce Creek.

In addition to Yellowjacket, Atlin Goldfields has numerous other under-explored orogenic and intrusive-related gold targets. Despite these exciting prospects, however, Brixton has an extremely promising project in Thorn that demands a great deal of attention. Accordingly, as recently announced, Brixton is actively seeking partners who can advance the project to assist in the discovery of the source of the abundant placer gold.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, they are in no way a substitute for individual expert investment advice; rather, they are advertising/journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the case of penny stocks, involves high risks that can lead to the total loss of the capital invested. GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete. Please also note our terms of use.

According to §34b WpHG i (Germany) and according to paragraph 48f section 5 BörseG (Austria) we would like to point out that clients, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Brixton Metals and therefore a possible conflict of interest exists. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. This may result in the symmetrical generation of information and opinions during this period. Furthermore, there is a consultancy or other service agreement between Brixton Metals and GOLDINVEST Consulting GmbH, which may give rise to a conflict of interest.