Brixton Metals drills nearly 1,600 meters of copper mineralization at Camp Creek

After a longish wait, copper and gold explorer Brixton Metals (WKN A114WV / TSXV BBB) now presents the first drill results of 2023 from the Camp Creek copper porphyry target, part of Brixton’s huge Thorn project in British Columbia. And the company has made a find with this drill hole, which was planned in collaboration with partner and major shareholder BHP. And with drill hole THN23-261, Brixton proved the longest section of copper mineralization discovered to date on Camp Creek!

Longest intersection of mineralization drilled to date on Camp Creek

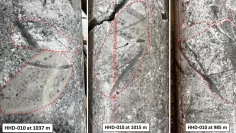

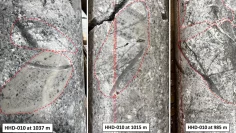

In fact, as the company has now announced, THN23-261 returned a mineralized interval of a massive 1,562.35 metres at 0.34% copper equivalent (CuEq = 0.19% copper, 0.05 g/t gold, 2.81 g/t silver, 180 ppm molybdenum)! On top of that, it includes a high-grade interval of 855 meters that comes in at 0.52% CuEq (0.29% Cu, 0.06 g/t Au, 2.44 g/t Ag, 314 ppm Mo). Not to mention an interval 109.87 meters long that averaged as much as 0.86% CuEq (0.51% Cu, 0.08 g/t Au, 3.70 g/t Ag, 498 ppm Mo). So, it is no exaggeration to say that the extent of Camp Creek’s porphyry mineralization has been “significantly” extended….

No wonder, then, Christina Anstey, Brixton’s VP of Exploration is getting excited. And not just given the extent of porphyry copper mineralization at Camp Creek, but also the realization that this drill hole has encountered 580 meters of mineralized porphyry and that the copper mineralization is open in several directions at once.

Successful extension of known copper mineralization

Brixton’s intention with THN23-261 was to investigate the potential extension of the known porphyry mineralization discovered with drill holes from 2021 and 2022, which also had very long mineralization intervals of up to 821.25 metres. And drill hole THN23-261 represents a significant extension of mineralization in light of the results now presented – extending the mineralization 468 meters to the east from drill hole THN21-184 and 245 meters to the southeast from THN22-221.

Further long copper ore intervals drilled

While the results of the additional reported drill holes THN23-258 and THN23-260 were less spectacular, and THN23-259 had to be abandoned due to difficult ground conditions – the intended target will be investigated with a later drill hole – copper mineralization was nevertheless encountered over long intervals.

For example, hole 258 returned 0.20% CuEq over 1,109.40 meters, including 330 meters of 0.31% CuEq and 32 meters of 0.54% CuEq, while hole 260 returned 753.50 meters of 0.12% CuEq, which included an intercept of 10.50 meters of 0.35% CuEq.

Conclusion: In our opinion, the THN23-261 drill hole in particular, with its almost 1,600 meters of continuous copper mineralization, is a considerable success for Brixton Metals. Brixton’s largest shareholder BHP, the world’s largest mining group, owns 19.9% of the company. The average metal content of producing copper mines around the world continues to decline, making bulk effects increasingly important. We are looking forward to the next results from Camp Creek and Thorn as a whole.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Artic Fox Lithium Corp. and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of Artic Fox Lithium Corp. at any time, which could influence the price of the shares. In addition, a consulting or other service contract exists between Artic Fox Lithium Corp. and GOLDINVEST Consulting GmbH, with which a further conflict of interest is given, since Artic Fox Lithium Corp. remunerates GOLDINVEST Consulting GmbH for the reporting.