{kanada_flagge}Sitka Gold (TSXV:SIG;FRA:1RF): Sometimes all it takes is one drill hole to make a company’s fortune. We believe Sitka has just released this “company maker” drill hole (also painfully delayed due to the lab).

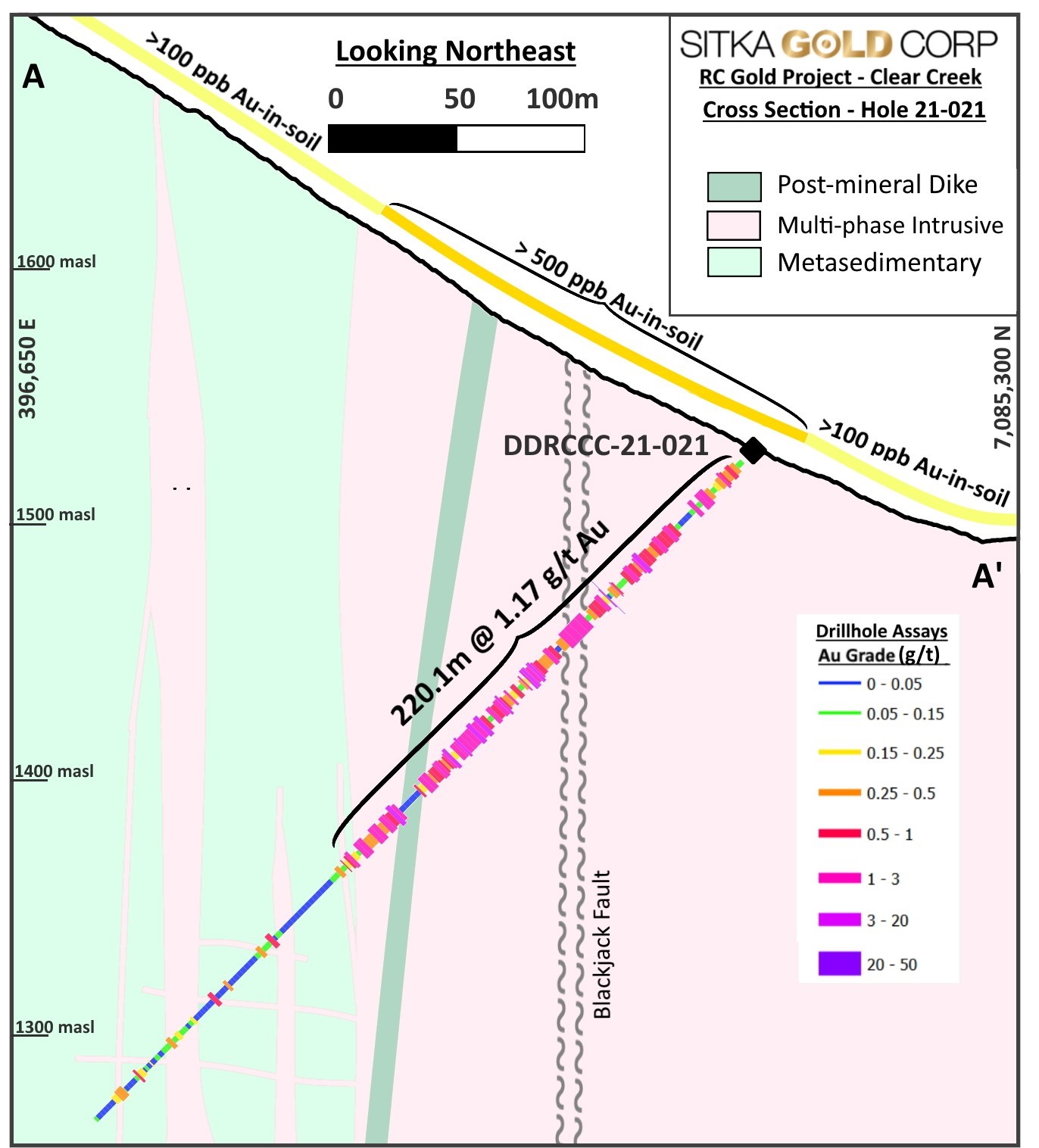

We’re talking about drill hole 21 at the RC Gold project in the Yukon, which averaged 1.17 g/t gold over 220 meters virtually off surface. (Small detail on the side: CEO Cor Coe is sure that the first six meters of drill hole 21 are gold-bearing as well. But because the drill had to be encased in friable rock near surface, no assay values are available).

After the recent funding, there is much to suggest that Sitka does not want to wait until summer to follow up. It is possible to drill in the winter. We believe the market is just waiting for this announcement to take off. Shareholders love nothing more than action. We’re keeping our fingers crossed for Sitka: if neighboring drill holes deliver similarly strong results, Sitka could become a 1A takeover candidate in no time.

Other companies in the broader neighborhood are valued much higher, such as Banyan Gold, which still brings it to CAD 70 million market value at around 900,000 ounces of resource (at an average of 0.54 g/t gold). Sitka, at CAD 0.145, has a market capitalization of just CAD 16 million – although it does not yet have a resource. On top of that, Sitka has a trump up its sleeve with the Alpha Gold Project in Nevada, not to mention Burro Creek in Arizona.

Figure 1: It almost doesn’t get any prettier than this. The topography on the flank of a hill, the continuous mineralization for 220 meters away from surface, and the coincidence with a fault zone that has been christened the “Blackjack Fault” to match the hole numbering.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.