Additional targets already being considered

Altiplano Metals (TSXV APN / WKN A2JNFG) is keeping up the pace! The company is currently processing stockpiled copper and gold mineralized material at its El Peñón facility in Chile, which is being supplemented with bulk sample material from the historic Santa Beatriz iron oxide, copper and gold (ISCG) mine. And there, just 13 kilometers from El Peñón, Altiplano is now planning a drill program that will be used to identify additional mineralized material at lower levels in Santa Beatriz to be potentially mined in the future and on a larger scale.

Altiplano Metals expects to drill at least four holes, each with an average depth of 125 meters, targeting the main vein in the Santa Beatriz mine. The company’s main objective is to confirm the continuity of the vein below the deepest level used for mining in the past (level 416).

In addition, Altiplano added, continuity and consistency of metal grades in the mineralization 25 to 40 metres below level 416 will be investigated. There, underground channel samples had returned positive results, including 2.45 meters of 3.65% copper; 0.29 g/t gold and 26.97% iron, including a 1.08 meters sample of 8.08% copper, 0.63 g/t gold and 39.49% iron!

Results enable evaluation of potential underground development

The company will use the results of the planned drilling, along with data from the ongoing bulk sampling program, to evaluate the potential construction of an access road to reach at least three deeper levels at Santa Beatriz. According to Altiplano Metals, this could potentially expand the production of copper, gold and iron mineralized material, making more material available for processing at the El Peñón plant.

In addition, Altiplano is already looking at other IOCG veins on the Santa Beatriz concession that have not yet been undercut and could represent future drilling targets. No wonder, as the mine is located in the Tambillos district, a well-known mining region in Chile’s copper-rich IOCG belt.

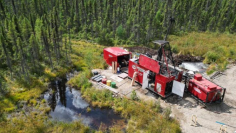

The planned drilling, which will confirm the continuity of mineralization along strike and down dip, is an important technical step at Santa Beatriz to support ongoing underground development. The company will also be able to drill the holes efficiently and cost-effectively using its own drill rig.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute a call to action; neither explicitly nor implicitly are they to be understood as a guarantee of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. It is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so exclusively at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities is associated with high risks, which can lead to a total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. However, liability for financial losses or the guarantee of the topicality, correctness, appropriateness and completeness of the content of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Altiplano Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Altiplano Metals for reporting on the company. This is another clear conflict of interest.