{australien_flagge}Sand does not exist “like sand by the sea.” When factors such as transportation and sustainability are factored in, the number of economic deposits shrinks very quickly. Even more so when it comes to high-purity quartz sands that are suitable for the production of glass or even as a precursor for PV modules. A quartz sand resource with an exceptional purity of 99.66% has now been proven by the young Australian quartz sand explorer Allup Silica (ASX: APS; FRA: U77) at its Sparkler A project in Western Australia.

{australien_flagge}Sand does not exist “like sand by the sea.” When factors such as transportation and sustainability are factored in, the number of economic deposits shrinks very quickly. Even more so when it comes to high-purity quartz sands that are suitable for the production of glass or even as a precursor for PV modules. A quartz sand resource with an exceptional purity of 99.66% has now been proven by the young Australian quartz sand explorer Allup Silica (ASX: APS; FRA: U77) at its Sparkler A project in Western Australia.

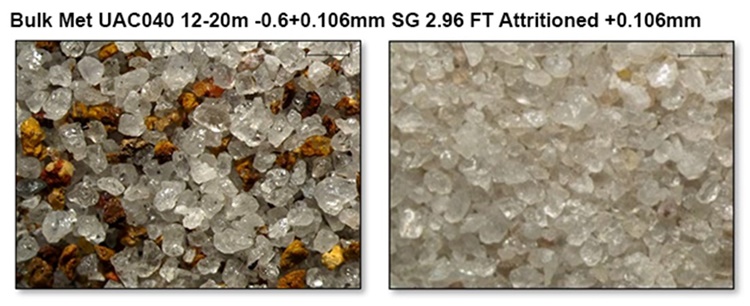

According to an independent study, in the fine sand fraction (0.106mm – 0.6mm), the project contains 37 million inferred tonnes at 99.66% SiO2 with lowest impurities of 0.02% (200ppm) Fe2O3. In the coarse sand fraction (+0.6mm), another 25 million inferred tonnes are proven at 99.67% SiO2 and 0.03% (300ppm) Fe2O3. The total resource is reported as 70 million inferred tonnes at 96.84% SiO2 and 0.34% (3400ppm) Fe2O3. The new resource estimate is based on recent metallurgical results from Sparkler A released on May 16, 2022. Test work has shown that the finished product with a target sand fraction of 0.106mm-0.6mm is suitable for the production of high quality glass. Metallurgical test work on four samples showed that magnetic separation achieved purities of 99.465% to 99.774% SiO2 and 80ppm to 290ppm Fe2O3.

The Sparkler Silica Sands exploration project sites are located approximately 300km south of Perth in the southwestern region of Western Australia. The Sparkler project comprises three granted exploration licenses. The region has a well-established infrastructure that has been built to benefit local industry, agriculture and the community.

Figure 1: Sparkler A is located entirely on private land. The license covers cleared pasture or plantation forest land.

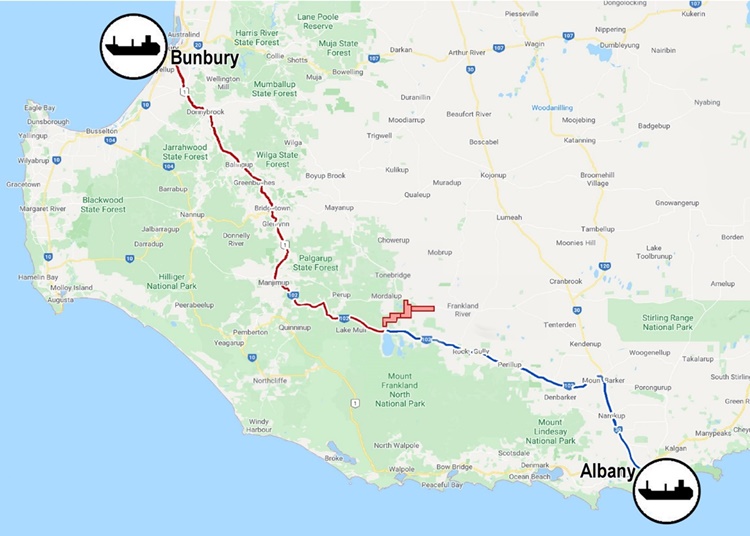

Figure 2: The nearest ports are Bunbury Port, approximately 200 km west, and Albany Port, approximately 150 km southeast of the project site.

For test purposes, a composite sample from four drill holes (UAC020, UAC021, UAC033 and UAC040) was submitted for metallurgical work carried out by Nagrom Laboratories in Perth. Initial test work included size analysis followed by wet screening. Additional test work was carried out on the 0.106 mm – 0.6 mm sand fraction. These consisted of abrasion analysis, heavy liquid separation (HLS), and magnetic separation.

Figure 3: Microscopic images show a clean product after the final magnetic separation tests.

Summary: Allup Silica has only been public since March of this year. The sand start-up raised A$5 million at its IPO price of A$0.20. Currently, the stock is trading at half of the IPO price (AUD 0.10) – in line with the negative market sentiment. This corresponds to a market value of just AUD 8.1 million (most of which is in the form of cash). At the moment, only a few pieces are circulating in the market. Therefore, the stock price is primarily the result of the illiquid market rather than a vote judgment on a fair valuation. The current price level is just about the price paid by venture capitalists pre-IPO at much higher risk! All other investors are first thick in the minus. This is currently also an opportunity. Although the prices of other quartz sand shares in Australia have also corrected, no company in the sector is currently valued as favorably as Allup Silica. There is a nice investor saying about “buying strawheads in winter”. The market is undoubtedly in a winter phase. This is precisely why we see Allup as a forward-looking investment on the coming sand shortage.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Allup Silica and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss Allup Silica during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Allup Silica and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists, especially since Allup Silica remunerates GOLDINVEST Consulting GmbH for its reporting.