Goal is to define 30 - 50 million tons

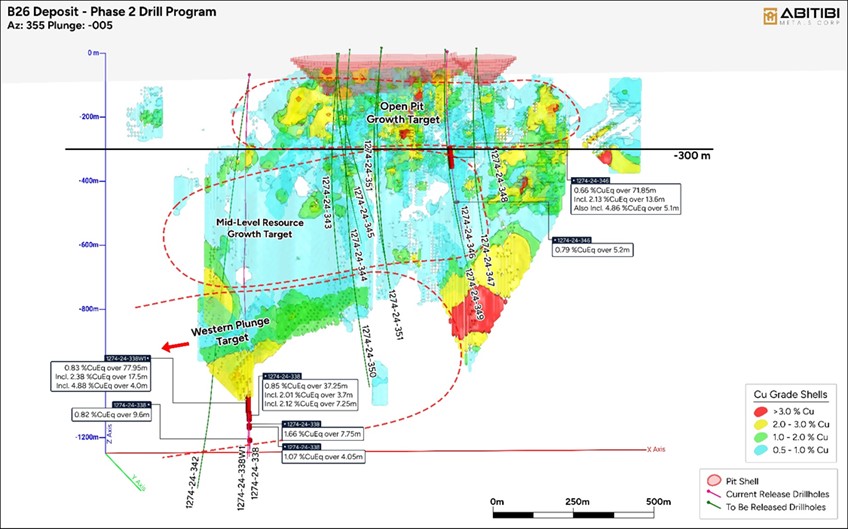

Abitibi Metals Corp. (CSE:AMQ; OTCQB:AMQFF; FSE:FW0) demonstrates with another high-grade drill result from approximately 350 meters depth directly below the proposed open pit that the B 26 polymetallic B 26 polymetallic deposit in the Abitibi mining camp in Quebec has significant growth potential well beyond the recently announced 18.5 million tonne resource estimate with a copper equivalent of 2.17%. Hole 1274-24-346 returned 4.9% CuEq over 5.1 metres within 2.1% CuEq over 13.6 metres, starting from 367 metres depth. Jonathon Deluce, CEO of Abitibi Metals, commented: “These results reinforce our thesis that we can expand the underground resource beyond the current ~850 million pounds of contained copper equivalent. Our goal is to define a deposit in the range of 30 to 50 million tons.”

The new intercept from hole 1274-24-346 is part of a 5,257-metre section of seven drill holes from the Phase II program, which is designed to test along strike of the polymetallic lenses forming the southeastern margin of the B26 system. Assays are pending for six drill holes targeting the section 652750E to 653150E over a strike length of 500 meters and covering vertical depths of 200 meters to 800 meters. The ongoing drilling is designed to expand the known lenses and further define the higher grade mineralization. All drilling is part of a 16,500-meter Phase II drill program currently underway at the project.

Hole 1274-24-346 is designed to infill a 100-meter gap in the drill pattern and intersect the true width of hole 1274-17-252. The Company is also planning a downhole electromagnetic (EM) program to test for depth extensions and potentially larger mineralized sources proximal to the B26 deposit.

Figure 1: Phase II B26 deposit showing location of significant assay results in 1274-24-346

Conclusion: Abitibi Metals is fully funded at $11.5 million to complete the remaining 2024 work program and drill an additional 20,000 metres in 2025 to complete the option to purchase agreed to with the semi-governmental corporation SOQUEM. SOQUEM is a subsidiary of Investissement Québec. Under the option agreement, Abitibi has the right to acquire 80% of the project in return for C$7.5 million in exploration and development expenditures over 7 years. In fact, the earn-in will be completed by the end of next year. The latest resource contains approximately 550 million pounds of copper, 370,000 ounces of gold and significant amounts of zinc and silver. All of the results will be incorporated into a preliminary economic assessment of the deposit planned for next year.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.