A.I.S. Resources Limited (TSX: AIS, FRA: A8S) is seeking a second high-grade Fosterville-type deposit and is now providing increasing evidence to support its geological hypothesis.

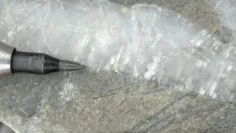

The Company has just completed 31 Reverse Circulation percussion (RC) drill holes, each up to 80 meters deep, along three lines to test a geophysically prominent gravity anomaly that trends north-south through the Fosterville-Toolleen property. As hoped, significant quartz intercepts were found in drilling over gravity anomaly (Figures 1 and 2). Now, over 1,000 bags of rock chips are ready for evaluation, including examination by ISO qualified laboratory for pathfinder elements that include arsenic and lead. Most encouragingly, drilling has already encountered sandstone and shale sediments of the same age as those found at Kirkland Lake’s Fosterville Gold Mine. These sandstone and shale layers (called turbidites) are clearly delineated beneath a gravel layer that also contains gold on the exploration license, but whose rocks are geologically of a later era.

Figure 1. drill hole with gravity survey in background and location of drill holes. The pink hole had the highest gold grade 16ppb of gold. W means the hole hasn’t been assayed yet.

CEO Phil Thomas: “We are only at the beginning of our drilling program”.

Phil Thomas, CEO, commented, “The drill program at our Fosterville-Toolleen gold project is proving to be a great success as we have demonstrated that we are in the right area to discover stress veins and shoots full of quartz with gold mineralization. Gold has been identified in samples in a few of the drill holes and this is just the beginning of our drill program. The use of RC drilling is very economical. Because quartz-gold mineralization occurs in broad quartz veins, we will be able to detect arsenic and other path finder elements in these mineralized systems through fence-line drilling and soil sampling.”

Fig. 2. Bouguer gravity image with gradient edge detection, these fuzzy blue lines are interpreted faults. Mineralization at Fosterville-Toolleen occurs near the gravity feature outlined by the red ellipse.

AIS’ Chief Geologist Denis Walsh, who previously worked for Kirkland Lake on Fosterville, added, “We are off to a great start with large quartz intercepts. Now we will use geochemical halos to guide us into the better mineralized corridors. The evaluation of arsenic and other pathfinder elements will be very important for our exploration.”

“AIS will apply the understanding of the structural setting and geochemical signature from the Fosterville gold deposit, to exploration of Fosterville-Toolleen. The typical high-grade ore zones at Kirkland’s Fosterville Gold Mine are only between 2 and 30 m wide. The high-grade exploration target we are seeking occurs in structures controlled by the interaction of the rock type with folding and faulting the mineralization being concentrated in a comparatively small area.”

Bottom line: It helps, of course, to have good local knowledge with former regional exploration geologist from Fosterville Gold Mine on your team. No one knows better than Denis Walsh how and what to look for to discover a second Fosterville site. AIS Resources has made significant progress with its 31 RC drill holes and continues to narrow down the exploration target. The key finding is that the drilling has intersected rocks of the same type and age that hosts the deposits at Fosterville. This will be followed in the coming weeks by analysis of the 1,000 drill samples for gold traces, as well as pathfinder elements. These are the first drillholes testing for Fosterville style gold mineralization at Fosterville-Toolleen project and will provide valuable information leading into a diamond drill program later in the year. It is foreseeable that AIS Resources will need fresh money for further exploration. But it shouldn’t be too much of a problem to get the right investors on board now, based on the information available. The entry of new investors could also mark the beginning of a re-evaluation, because this much is certain: A drilling success in the style of Fosterville would catapult AIS practically overnight on the radar of all international gold investors. We will stay tuned to the story.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of AIS Resources and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of AIS Resources and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on AIS Resources. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of AIS Resources. This is another clear conflict of interest.