Project could generate an annual profit of CAD 140 million, conservatively

Cerro de Pasco Resources (CSE: CDPR; OTCQB: GPPRF; FRA: N8HP) is finally able to demonstrate the true potential of its polymetallic Quiulacocha tailings project in central Peru: more silver than expected and extremely high-grade gallium with an average grade of 34.61 g/t to date. The company has just published a further 177 samples from nine drill holes, which suggest that the metal content is consistent at depth and laterally beyond 400 and 600 meters of the drill area examined so far.

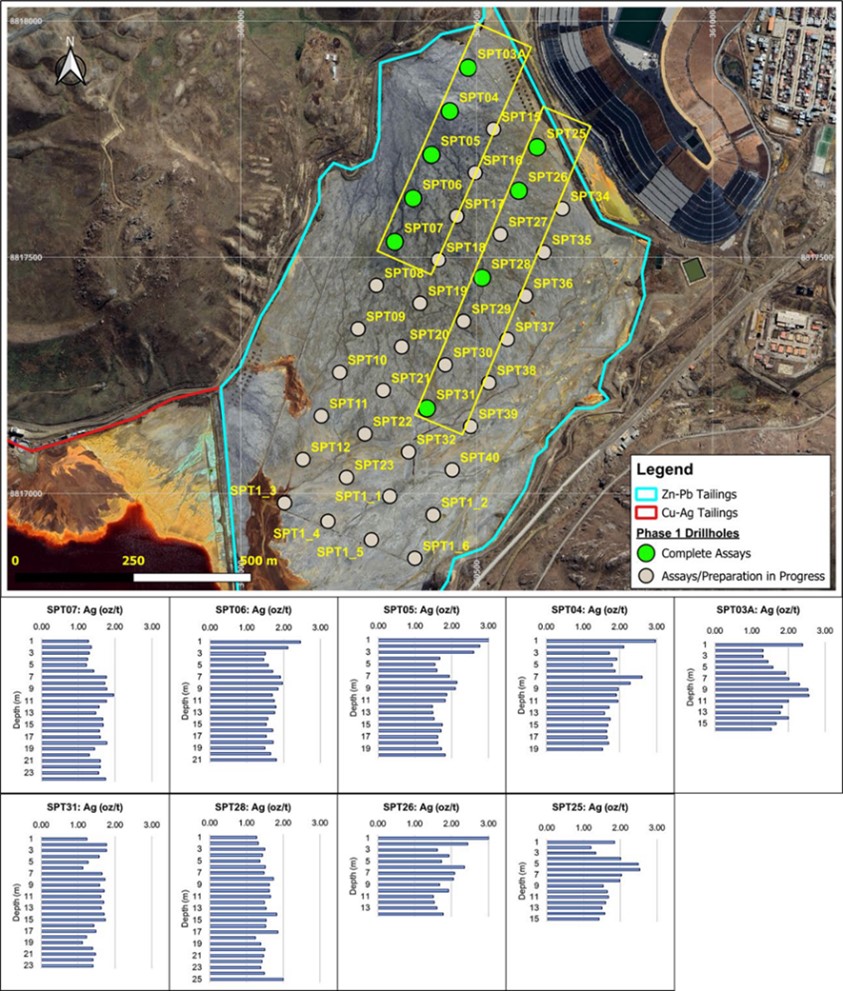

The results are part of a 40-hole drill program at the Quiulacocha Tailings Project, which was completed on October 23 of this year. More than 1,000 samples were taken, of which 177 have been analyzed to date, including hole SPT04, which was released on October 15. The 177 samples analyzed to date have an average silver grade of 1.72 ounces per tonne (t) silver (53.64 g/t Ag), which is 37% higher than the average of the near-surface drill hole samples reported by Brophy in 2012 in the northern and central sections of the Quiulacocha Tailings Project. In addition to silver, zinc and lead were found to have average grades of 1.56% Zn and 0.77% Pb.

Gallium, an important mineral used in high performance microchips for advanced military technologies, is present in these 177 samples with an average grade of 34.61 g/t and reaching a maximum of 144 g/t, increasing towards the center of the Quiulacocha tailings project. Iron values also indicate consistent pyrite presence throughout the deposit. Pyrite (estimated to comprise 50% of the waste) could be a valuable by-product for the project. The potential for pyrite recovery, including likely grade, by-products, and impurities, will be evaluated as part of the upcoming metallurgical test program.

Figure 1: 40-hole Quiulacocha drill program with drill holes with assays completed. Bar graph shows silver grade over 400 meters of Quiulacocha declines, among other information.

Guy Goulet, CEO of CDPR, commented, “These results are extremely encouraging and exceed our initial projections, particularly in terms of the continuity and grade of silver. In addition to zinc, lead, silver, copper and gold, the detection of elements such as gallium and indium – which are critical to advanced 5G technologies, robotics and nuclear medicine – offers the potential for valuable by-products in the planned concentrates. Representative composite samples will now undergo metallurgical testing to support further studies. These results will be incorporated into our planning for an expanded drill campaign to commence in Q2 2025, focused on the remaining tailings piles.”

Conclusion: Assay results from 177 samples from nine drill holes from the northern and central areas of the polymetallic tailings (Ag-Zn-Pb;) represent only about 15% of the current drill program. In other words, 85% of the results are still pending. Cerro de Pasco expects to publish the remaining samples step by step from the beginning of next year. The results should always be evaluated in the context of the historical partial exploration in this part of the Quiulacocha Tailings. To date, the results indicate silver grades that are 37% higher than expected. In addition to the metal grades, the outstanding results of the metallurgical tests are, of course, crucial for the economic viability of the project. In its preliminary calculations, Cerro de Pasco has publicly based its calculations exclusively on the historically measured metal grades and a metal recovery rate of 41%. According to Cerro de Pasco, these figures alone would enable the project to generate an annual profit of CAD 140 million in a 10,000 tons per day / 3.6 million tons per annum production scenario. It is therefore worth paying close attention to the metal contents and perhaps even more so to the upcoming metallurgy.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely to inform readers and does not constitute any kind of call to action; it should not be understood, either explicitly or implicitly, as an assurance of possible price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the shares discussed, nor an invitation to buy or sell securities. These are expressly not financial analyses, but rather advertising/journalistic texts. Readers who make investment decisions or carry out transactions based on the information offered here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company, but not to the reader’s investment decision.

The purchase of securities involves high risks that could lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. However, any liability for financial losses or the content-related guarantee for timeliness, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria), we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Cerro de Pasco Resources and thus a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, a contractual relationship exists between Cerro de Pasco Resources and GOLDINVEST Consulting GmbH, which includes GOLDINVEST Consulting GmbH reporting on Cerro de Pasco Resources. This is another clear conflict of interest.