Extremely promising results at the new Pukelman target

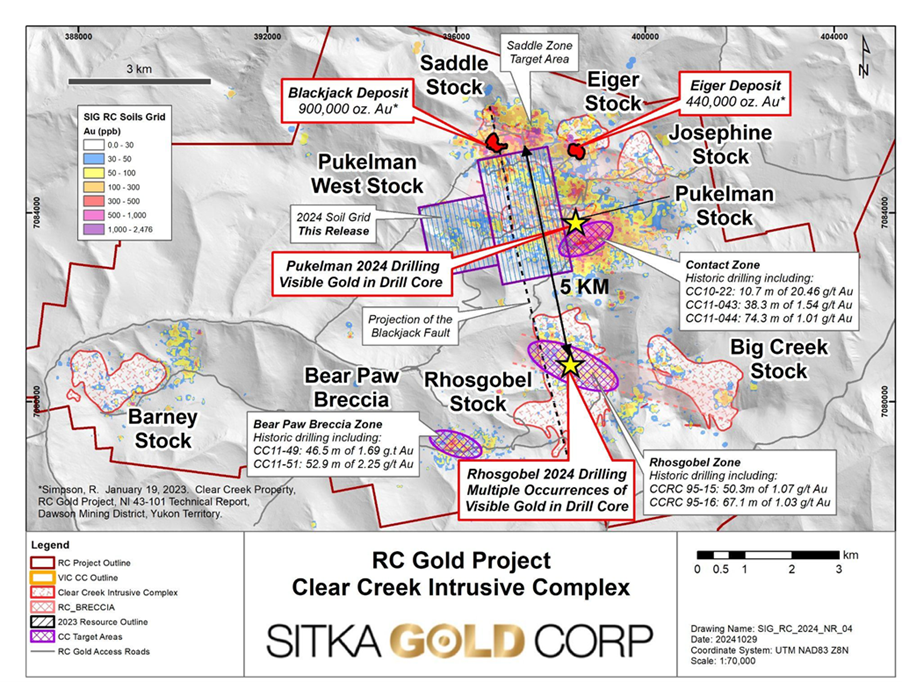

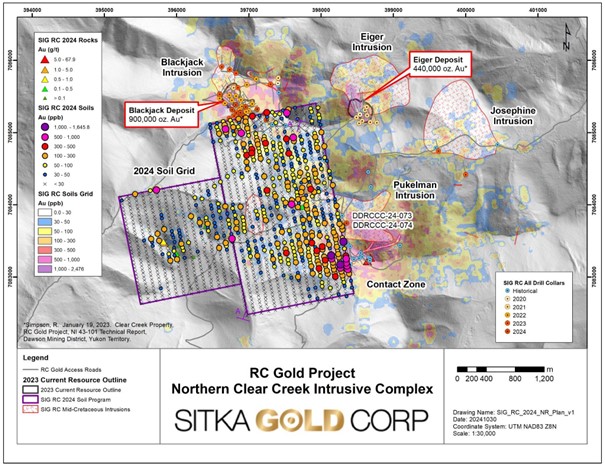

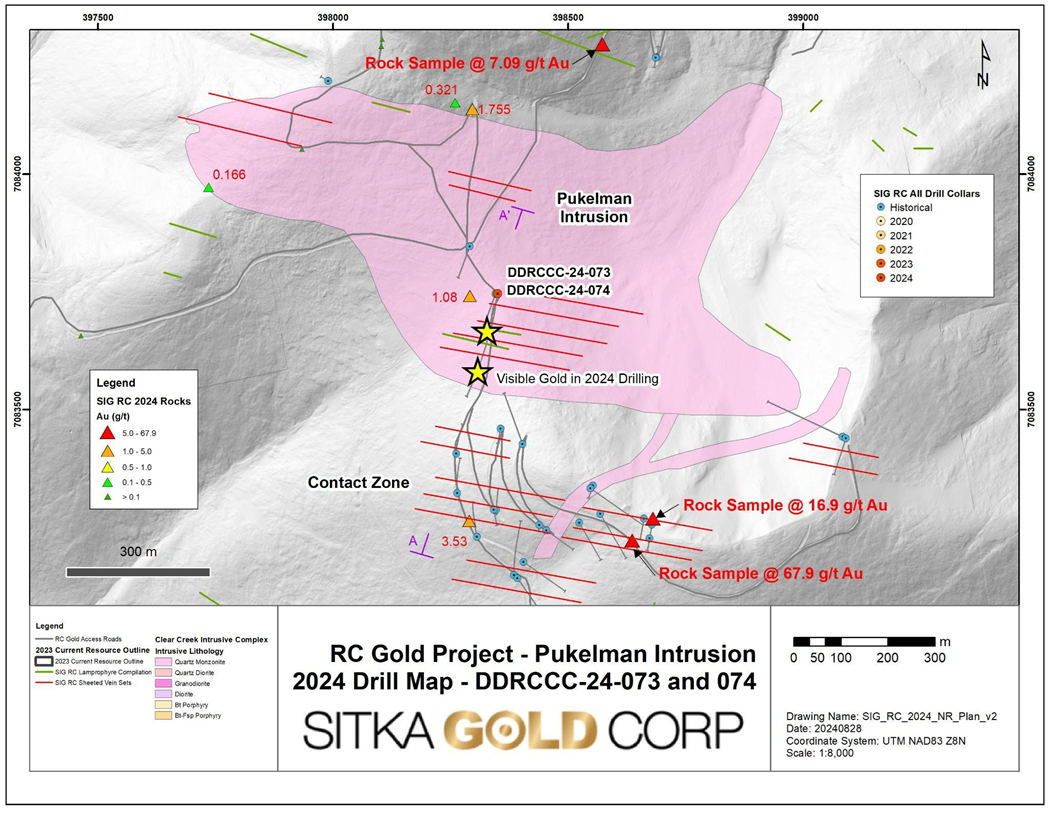

Sitka Gold Corp. (TSXV:SIG; FSE:1RF; OTCQB:SITKF) seems to have had a golden touch when it acquired the Clear Creek property in June of this year. On this 8 by 15 kilometer extension to its 431-square-kilometer RC gold project in the Yukon, the company has yet again achieved extremely promising results at the new Pukelman target at the first attempt. Visible gold and abundant sheeted quartz veining were observed in the first two diamond drill holes completed at the Pukelman intrusion. Laboratory results are still pending. In addition, Sitka has identified an east-southeast trending zone of foliated quartz veining and brecciation with visible gold in the Contact Zone, located immediately south of the Pukelman intrusive, near the Pukelman intrusive target. Surface rock samples there have returned up to 67.9 g/t Au. The Pukelman target lies along a five kilometer long corridor about halfway between the Blackjack resource to the north and the recently drilled Rhosgobel target to the south. In the area between the Blackjack and Eiger deposits, 1,354 soil samples have been taken by geologists this season. The Pukelman intrusion has significantly extended the gold-in-soil anomaly. Peak values of up to 1645.8 ppb Au (1.65 g/t Au) were found there.

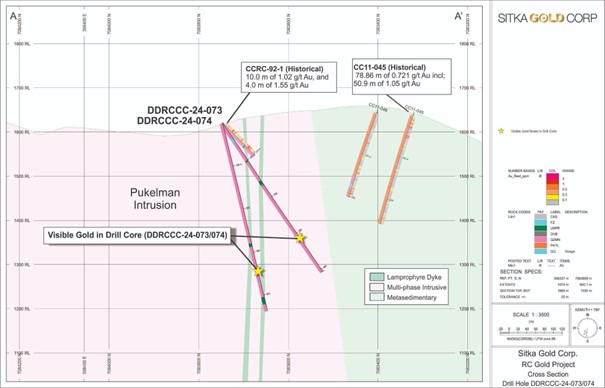

The two drill holes DDRCCC-24-073 and DDRCCC-24-074 on Pukelman were drilled from the same location to test a stratiform quartz vein mineralization in the Pukelman intrusion where historic drill hole CCRC-92-1 returned 10.0 meters of 1.02 g/t Au and 4.0 meters of 1.55 g/t Au. The drilling was approximately 500 meters north of the Contact Zone, where 2,368 meters of historic shallow reverse circulation and diamond drilling intersected broad zones of gold mineralization, including 74.3 meters of 1.0 g/t Au, as well as intervals of higher grade mineralization such as 10.7 meters of 20.46 g/t Au and 1.52 meters of 137.5 g/t Au.

Cor Coe, CEO and Director of Sitka Gold, commented, “Sitka’s initial drilling on the Pukelman target has returned extremely encouraging results, with visible gold observed in both drill core and a surface rock sample returning 67.9 g/t gold, highlighting the potential for this area to host strong gold mineralization. Since acquiring the Clear Creek property in June of this year, the company has made impressive progress, with the first diamond drilling at the Rhosgobel Intrusion revealing numerous visible gold occurrences and two diamond drill holes recently completed at the Pukelman Intrusion, where visible gold was also observed in the drill core. Additional exploration work included an extensive soil geochemical survey that returned up to 1,645.8 ppb gold between the Blackjack deposit and the Pukelman stock, as well as mapping and prospecting with rock sampling that returned strong gold mineralization. These results highlight the potential for discovery of another intrusive-related gold deposit at RC Gold.

Conclusion: Sitka Gold has only drilled 76 diamond drill holes totaling approximately 28,535 meters to date on its Yukon RC project. Of these, 20 holes totaling 9,263 meters were completed in 2024. The objective was to expand the maiden resource around Blackjack, but also test new targets such as Rhosgobel and Pukelman where there was limited historical information from RC drilling. The success rate and high efficiency of the drilling have become a hallmark of Sitka Gold. The highlight of drilling in 2024 to date was 678.1m @ 1.04 g/t gold from 4.4m, including 409.5m @ 1.36 g/t gold from 273.0m in drill hole DDRCCC -24-068. Assay results are still pending from a total of eight drill holes at Blackjack, Rhosgobel (5 km south of the Blackjack deposit) and Pukelman (2 km southeast of the Blackjack deposit), which target known intrusion-related gold mineralization.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.