Newly acquired property has four promising intrusion-related targets

With its recent drilling, successful explorer Sitka Gold (WKN A2JG70 / TSXV SIG) had discovered a new structural corridor of high-grade gold mineralization within the Blackjack deposit (900,000 ounces of gold from surface to date averaging 0.83 g/t gold) at its RC Gold project in the Yukon. And this is believed to extend south onto Victoria Gold’s Clear Creek property adjacent to Sitka’s land position. Which is one of the reasons why Sitka has now struck a deal with its much larger neighbor to secure their land!

CEO Corwin Coe’s company now controls the entire so-called Clear Creek Intrusive Complex within the boundaries of which, according to Sitka, the potential for several (!) deposits with several (!) million ounces of gold is becoming increasingly clear.

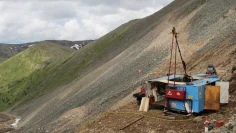

RC property prior to the acquisition of Victoria Gold’s Clear Creek project; Source Sitka Gold

Four additional, already known gold targets

According to Sitka Gold, the newly acquired property already has four promising intrusion-related targets in various stages of exploration, which can be reached via an excellent road network and would therefore entail lower exploration and drilling costs. According to the company, historical drill results there returned up to 20.46 g/t gold over 10.7 meters (Contact), 1.87 g/t gold over 42.6 meters (Bear Paw), 1.03 g/t gold over 67.1 meters (Rhosgobel) and 1.20 g/t gold over 10 meters (Pukelman)!

That the deal came about is – among other things – probably due to the fact that Victoria Gold was impressed by the previous successes Sitka Gold has already achieved at RC Gold. As John McConnell, CEO of Victoria Gold, explains, this new gold district in the Yukon will be consolidated through the merger of the RC Gold project and the Clear Creek property. McConnel assumes that Sitka will be able to extend its series of successes on the new, merged project. Understandable, as Victoria Gold now already holds 8% of Sitka’s outstanding shares!

Victoria Gold becomes a major shareholder

Under the terms of the agreement to purchase Clear Creek, Sitka has already issued 21,843,401 shares to the larger company, representing 8% of Sitka’s outstanding and issued shares. In order to complete the Clear Creek transaction, Sitka must make the following additional payments:

– CAD 2 million until August 30, 2025;

– CAD 3 million until June 24, 2026 and

– CAD 6 million until June 24, 2027.

However, it is up to Sitka Gold to decide whether these payments are made in cash or shares at the price agreed upon. In addition, Sitka is assigning a 5% NSR (Net Smelter Return Royalty) to Victoria, 60% of which can be bought back for a one-off payment of CAD 10 million. A further CAD 10 million will come due if Sitka proves a resource of 2 million ounces or more at Clear Creek in accordance with Canadian standard NI 43-101.

Plan map showing multiple priority target areas on the newly acquired Clear Creek Property and the newly identified Blackjack Mineralized Corridor that extends for over 10 kilometres through the Saddle, Pukelman West and Rhosgobel Intrusive Stocks. Source Sitka Gold

Conclusion: Victoria Gold’s Clear Creek property has a comprehensive database of geological, geochemical and geophysical information. This, combined with the historical drill results and understanding of the controls on mineralization that Sitka has already established, indicates that there is significant potential to discover additional intrusion-related gold deposits. A particularly impressive example of this is the north-south trending structural corridor of high-grade mineralization mentioned earlier. It runs south from the Blackjack deposit through the Pukelman West intrusion and along the western edge of the Rhosgobel intrusion on the new part of the property. Thus, the structural corridor connecting these intrusions appears to extend for over 10 kilometers (!) – and thus already represents a significant exploration target! We think it was a smart move by Sitka CEO Cor Coe’s team to secure this additional, significant potential by acquiring this last “piece of the puzzle”. The task now is to realize this potential as quickly as possible by continuing the systematic exploration and drilling work.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.