Aggressive expansion drilling shows potential

Even before the current gold price rally, Canada’s Sitka Gold (WKN A2JG70 / TSXV SIG) was one of the few gold explorers to record a steady increase in its share price over the last year and recently even a 52-week high. The company’s RC Gold project in the Yukon, which still has immense potential even after an initial resource estimate, is the main driver, here. And it is precisely from this project that Sitka has once again reported excellent drill results!

Since RC Gold, unlike many other exploration projects in the Yukon, can be reached all year round, CEO Cor Coe’s company already has a program underway there in 2024, which has now brought Sitka its first drill success south of the Blackjack deposit gold resource.

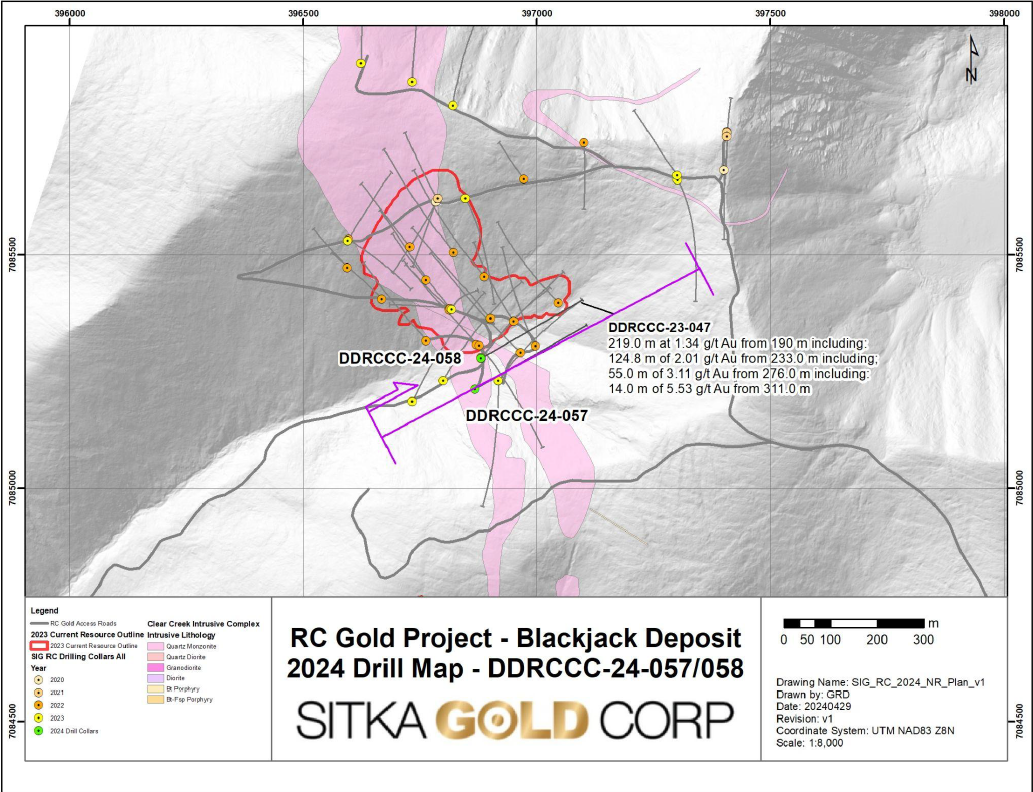

Drill hole 57 intersected 191.0 meters averaging 1.16 g/t gold, which included an interval of 11 meters at 5.80 g/t gold and an interval of 89 meters at 2.03 g/t gold! Gold mineralization of 21.20 g/t gold was also observed over an interval of 2.0 metres.

With this, Sitka has achieved a first target of this year’s drilling and confirmed that strong gold mineralization continues 175 metres below and 45 metres southeast of hole 47. This hole, reported in September 2023, is the most successful to date at RC Gold and returned 219.0 meters of 1.34 g/t gold, including 124.8 meters of 2.01 g/t gold and 55.0 meters of 3.11 g/t gold.

Aggressive expansion drilling shows potential

Sitka CEO Cor Coe explains that the latest hole, which he says is an “aggressive” step-out hole, demonstrates the area’s potential for further, higher-grade gold mineralization in larger volumes, while also showing that pervasive gold mineralization occurs not only in the intrusive rock system, but also in the metasediments. This, says Coe, will ultimately contribute to a very large gold endowment within the grouping of intrusive rocks and surrounding metasediments that form the Clear Creek Intrusive Complex.

The company, and no doubt its shareholders, are now eagerly awaiting the results of drill hole 58, which was collared at a location around 70 meters north of borehole 57 and reached a length of 535.9 meters. The drill cores were logged, sampled and have already been submitted to the laboratory.

Summary: Hole 57 is the first hole of a 15,000 meter drill program at RC Gold. With this program, Sitka intends to further define and expand targets within the gold-rich Clear Creek intrusive complex, which hosts the Blackjack and Eiger deposits, both of which remain open in all directions. In addition, other highly prospective drill-ready targets in the project area will be investigated. Given the results presented today, we believe it is fair to say that Sitka’s drill program is off to a promising start! If the results continue, we believe the positive share price performance should do the same. (Of course, like all exploration companies, Sitka remains a risky speculation).

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.