Drilling to be much more focussed

In this year’s drilling season, Core Assets Corp. (CSE:CC; FSE:5RJ; OTC.QB:CCOOF) aims to prove just how significant its Silver Lime non-ferrous project in the Atlin Mining District of northwest British Columbia really is. The focus is on the target structures or “spokes” that the company has now identified as pathways for repeated polymetallic mineralisation events.

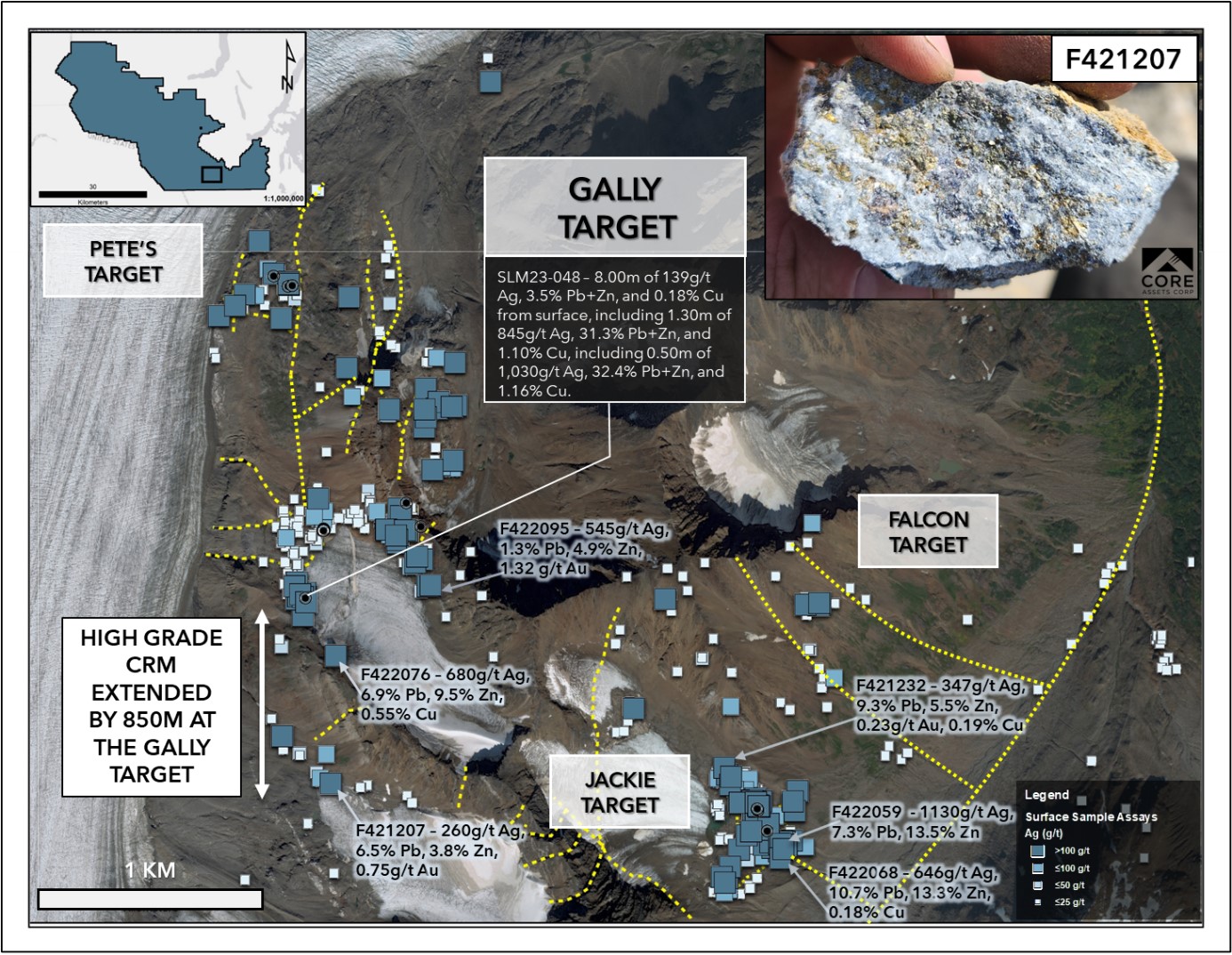

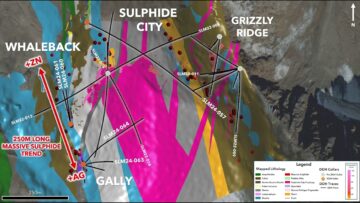

The company will shortly present its exploration results for the past year 2023 and announce its plans for 2024 in detail. In 2023, 89 surface rock samples were collected within the 9.5 km x 10 km mineralised footprint at the Silver Lime project (see Figure 1). Among other things, Core Assets has succeeded in extending the so-called Gally Trend to a strike length of 2.5 km with massive sulphide at surface, with grades of up to 680 g/t Ag and >36.4% Pb+Zn & 0.55% Cu. To date, a total of 9,809 metres of scout diamond drilling has been completed at the Silver Lime CRD porphyry project. This first-pass drilling has successfully confirmed the presence of high-grade Ag-Pb-Zn-Cu carbonate replacement mineralisation (CRD) at depth, as well as widespread porphyry Mo mineralisation and associated mineralised skarns.

Nick Rodway, President & CEO of Core Assets, commented: “The team continues to discover significant, high-grade mineralisation at surface at Silver Lime, expanding the project’s surface footprint and metal showings.”

At the Gally target area, located immediately southwest of the Sulphide City porphyry, high-grade Ag-Pb-Zn mineralisation has been extended 850m along trend to the south (Figure 1), increasing the Pete’s-Sulphide City-Gally trend to a length of 2.5km. Samples of marble-bearing massive sulphide-carbonate replacement and sulphide-bearing veins in shale were collected along this trend extension in 2023 and returned grades up to 680 g/t Ag, >20% Pb, 14% Zn, 0.55% Cu, 0.75 g/t Au, 0.14% Bi and 155 ppm Te.

The Company’s longest and best drill intersections to date were achieved at the Pete’s and Gally targets in 2023 SLM23-028 intersected 6.40 metres grading 159 g/t Ag, 8.7% Pb, 7.7% Zn and 0.23% Cu from 27.43 metres depth, including 0.57 metres grading 301 g/t Ag, 11.5% Pb, 10.7% Zn and 0. 31% Cu, while SLM23-048 returned 8 metres of 139 g/t Ag, 3.5% Pb+Zn and 0.18% Cu, including 0.50 metres of 1,030 g/t Ag, 32.4% Pb+Zn, 1.16% Cu, 0.19% Bi and 270 ppm Te from surface.

Conclusion: As the successful results of the extensive surface sampling from last season show, Core Assets now holds the most important key to mineralisation at its polymetallic Silver Lime project. Exploration is efficiently following the “spoke structures” that appear to have served as pathways for repeated mineralisation events. The drilling planned for this year’s season is therefore likely to be much more focussed than previous First Pass drilling, which has also been very successful. The table is well set with prospective targets: The 10 km by 9.5 km Silver Lime project consists of a total of seven highly prospective target areas covering the full spectrum of mineralisation from porphyry Mo-Cu to Fe-Zn-Cu-Ag massive sulphide skarn (Sulphide City) and Ag-Pb-Zn-Cu-Au carbonate replacement mineralisation (Gally, Pete’s, Grizzly, Jackie) to sediment-hosted Ag-Au bearing quartz veins and Au-bearing base metal sulphide veins.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, they are in no way a substitute for individual expert investment advice; rather, they are advertising/journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the case of penny stocks, involves high risks that can lead to the total loss of the capital invested. GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete. Please also note our terms of use.

In accordance with §34b WpHG i (Germany) and §48f paragraph 5 BörseG (Austria) we would like to point out that clients, partners, authors and employees of GOLDINVEST Consulting GmbH hold shares in Core Assets and therefore a conflict of interest exists. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. This may result in the symmetrical generation of information and opinions during this period. Furthermore, there is a consultancy or other service agreement between Core Assets and GOLDINVEST Consulting GmbH, which gives rise to a conflict of interest.