Excellent basis for future targeted drilling

Copper explorer Max Resource Corp (TSXV: MAX; OTC Pink: MXROF; FSE: M1D2) has discovered two additional mineralised outcrops along a 15 km corridor of high-grade, sheeted copper-silver mineralisation at the AM-14 target (see Figure 1). Together, these discoveries bring the total number of outcrops at AM-14 to 7.

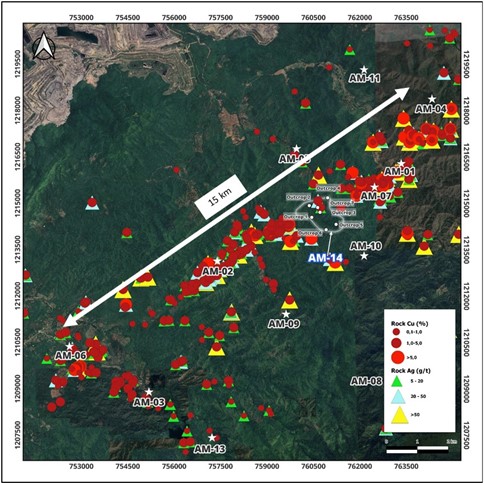

The recent discoveries provide further confirmation that multiple horizons of stratiform mineralisation are present within the sedimentary sequence in the AM District. The discoveries at AM-14 highlight the size of the potential deposits at the Cesar Copper-Silver Project: the 15 km long corridor parallels the regional strike of the sedimentary rocks and has maximum values of 24.8% copper and 230 g/t silver.

Significant horizontal extent of several copper-silver horizons

The newly discovered mineralised layers are up to 2.2 m thick and are exposed for several metres along strike before disappearing under the overburden. Systematic channel sampling of the mineralised outcrop has commenced. Crews will continue detailed mapping in the vicinity of the discoveries to expand the footprint of mineralization.

AM-14 is part of the mining concession area in the AM district of the Cesar copper-silver project in northeastern Colombia. The copper-silver bearing outcrops are exposed up to 285 metres along strike and are up to 4.0 metres thick. There is clear evidence of continuity of mineralised strata between AM-14 and AM-07, a distance of 1.5 km.

Mineralisation in the AM-14 target is hosted in layers of medium to fine grained sandstone rich in organic material. The copper-silver bearing horizons are hosted within a 700 metre thick package of interbedded sedimentary rocks that strike 240⁰ to 260⁰ and dip 30⁰ to 45⁰ to the northwest. Chalcocite, malachite and azurite are the most common copper minerals observed in the outcrops.

Brett Matich, CEO of Max Resource commented: “Our exploration successes confirm the significant horizontal extent of several copper-silver horizons. The focused exploration in each of these three areas along the 120 km of the CESAR basin continues to expand the footprint of copper-silver mineralisation, strongly supporting Max’s geological model for CESAR as an analogue to Kupferschiefer in Poland/Germany and Kamoa-Kakula in the Democratic Republic of Congo.”

Figure 1: Overview of the AM mining license showing the location of the AM-14 discovery. Approximately 1.5 kilometers to the nFigure 1: The image shows a 15 km long corridor of high-grade copper-silver mineralisation at AMorth is the AM-07 discovery, where the same copper-silver bearing horizons were identified. They are distributed over a 700 meter package of interbedded sedimentary rocks that dip 30⁰ to 45⁰ to the northwest.

More than 10,000 line kilometres of high-resolution airborne magnetic and radiometric surveys have now been completed. The survey area covers 114,650 square kilometres of prospective geology. Data analysis and structural interpretation are underway and results are expected in Q2.

Conclusion: Max Resource is finding more and more outcrops with visible copper mineralisation in rapid succession through cost-effective prospecting. The number on the AM mining licence now stands at seven outcropping copper-silver showings. Geologists have concluded that the discoveries are most likely part of a (formerly) continuous sedimentary horizon up to 700 metres thick that hosts multiple structurally-bound, repetitive intervals of copper-silver mineralisation. The copper-bearing corridor on AM can now be traced over a strike length of 15 kilometres, and the dip angle of the sedimentary horizons can also be precisely measured. Together, these data provide an excellent basis for future targeted drilling.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH might hold shares of Max Resource and therefore a conflict of interest might exist. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. This could possibly influence the share price of Max Resource. GOLDINVEST Consulting GmbH is currently seeking a commissioned relationship with the company, which is to be reported on in the context of the internet offering of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email releases, which also represents a conflict of interest. The above notes on existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Max Resource. We also cannot exclude that other stock letters, media or research firms discuss Max Resource during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.