{kanada_flagge}More than 11 million shares traded and a share price increase of 111 percent. That was the clear investor response yesterday to Sitka Gold’s (CSE:SIG; FRA:1RF) recent drilling success at its RC project in the Yukon. Many are rating drill hole DDRCCC-21-021 as a “company maker” as the hole showed virtually continuous mineralization from surface and encountered multiple intervals of elevated gold values to a depth of 220.1 meters.

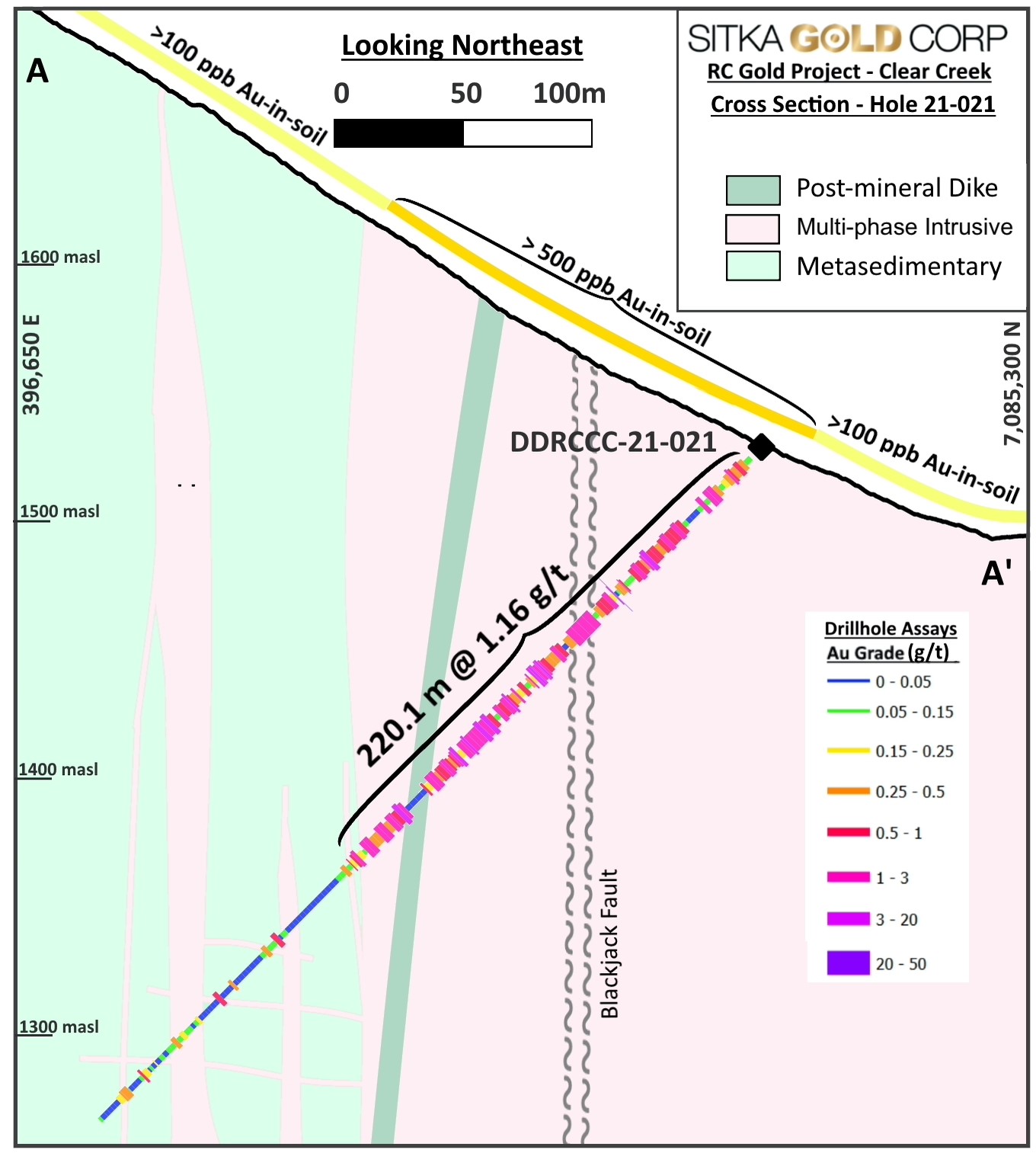

Average gold mineralization over the entire 220.1 metre length was 1.17 g/t gold (from 6.0 to 226.1 metres). Other sub-segments returned 103.2 metres of 1.61 g/t gold from 80.8 metres depth, 50.5 metres of 2.08 g/t gold from 120.0 metres, 20.5 metres of 2.85 g/t gold from 150.0 metres and 6.1 metres of 4.30 g/t gold from 120.0 metres. At depths between 80.8 and 81.5 metres, two particularly high-grade values were recorded: 0.2 metres with 35.70 g/t gold from 80.8 metres and 0.5 metres with 9.81 g/t gold from 81.0 metres. Of particular interest is the visible gold in the drill core. During sample processing, visible gold was identified on 21 different intercepts from hole 21, providing additional evidence of the richness of this gold system.

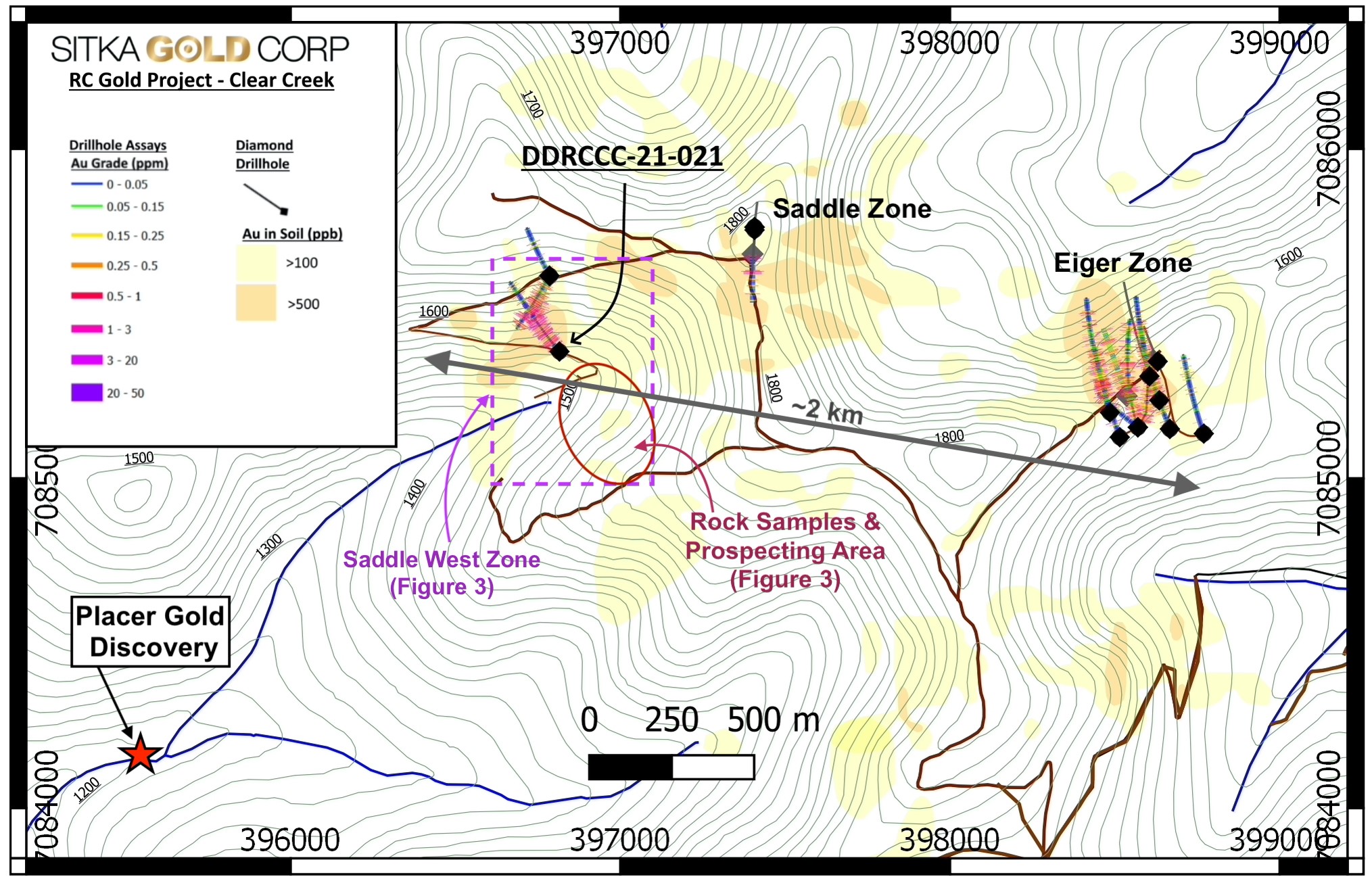

Hole 21 itself was a step out hole, 200 metres south of drill hole DDRCCC-21-007, which returned 318.0 metres of 0.45 g/t gold (see news release dated August 19, 2021), and DDRCCC-20-002, which returned 100.0 metres of 0.82 g/t gold and 2.0 metres of 16.1 g/t gold (see news release dated November 23, 2021). Hole 21 is located in the Saddle West Zone below a surface anomaly with more than 500 ppb gold in soil. This anomaly is part of a larger 2 kilometer by 500 metre gold anomaly that extends from the Saddle West Zone to the Eiger Zone (see Figure 1). This drill hole intersected a newly recognized control structure for mineralization known as the Blackjack Fault. (Figure 2). In addition to the drill results, Sitka has received additional assay results from 10 rock samples collected after hole 21 was completed. These samples, located between 100 and 500 metres south of hole 21, contained up to 11.00 g/t gold and define a new area of gold mineralization at surface that significantly extends the Saddle West zone.

Figure 1: Plan Map of the RC Gold Project’s Saddle-Eiger Zone

Cor Coe, P.Geo., CEO and Director of Sitka commented, “The results from hole 21 are very impressive and reflect what we believe is a structurally controlled, high grade gold corridor running through this large intrusion related gold system. This gold system is currently interpreted to be approximately 2 kilometers long and 500 meters wide based on the gold-in-soil anomaly at surface and drilling completed to date. The discovery of gold values of this caliber in a typically low-grade, large tonnage gold deposit target has exceeded our expectations and reinforces our belief that this newly discovered gold-rich system has the size and grade required for an economic gold deposit of significant size.”

Figure 2: Cross Section of DDRCCC-21-021

The Company has completed a total of 15 diamond drill holes totaling 5,000 metres in length at the Saddle-Eiger Zone on the RC Gold Project during the 2021 exploration season. To date, assay results have been released for the first 9 drill holes (DDRCCC-21-007 to DDRCCC-21-015), with an additional five holes (DDRCCC-21-016 to DDRCCC-21-20) pending release. Including the four discovery holes drilled in 2020, the Company has drilled 19 holes totaling 6,494 meters in the Saddle-Eiger target area to date.

Bottom line: in the past, Sitka Gold has received little love from the market. That should change from now on, as the results from drill hole 21 mark nothing less than a turning point for the company. This is supported by the continuity of mineralization with high grade gold intercepts and the identification of the newly recognized control structure for mineralization known as the Blackjack Fault.

It should not be forgotten that the measured values are almost double the average gold grades of Victoria Gold’s Eagle Gold Mine, which is only 40 kilometers away and has 148 million tonnes of ore at an average grade of 0.64 g/t. Eagle’s open pit mining concept has always been Sitka’s blueprint. Perhaps drill hole 21 marks the beginning of a starter pit? Further drilling will have to show. Now Sitka’s focus is on finding more tonnage as quickly as possible. Exploration enters a new phase for Sitka from hole 21.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.