{kanada_flagge} Group Ten Metals Inc. (TSX.V:PGE ; FRA:5D32) intends to focus even more on the further development of its main battery & precious metals asset, Stillwater-West, in the USA and is divesting non-core projects to financially strong partners. The first transaction of this kind was announced in the form of a binding letter of intent with the private company Heritage Mining Ltd., which has a go public listing shortly after the agreement is finalized which will provide additional clarity on the deal valuation. Heritage is acquiring a two-stage option to purchase 90 percent of the Black Lake-Drayton gold project in Ontario. In principle, Group Ten largely relieves itself of its obligations in connection with the gold project, ensures significant work will be done on the project and receives as compensation primarily an interest in Heritage, along with significant cash bonus on definition of resources.

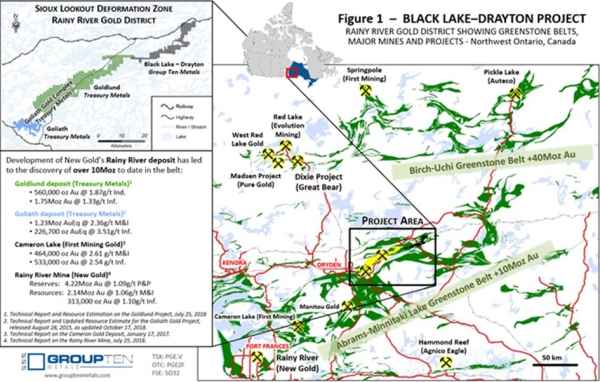

The Black Lake – Drayton project consists of 137 square kilometers in the Abrams-Minnitaki Lake Archaean Greenstone Belt along the northern edge of the Wabigoon sub-province in Ontario, Canada. The property has significant exploration potential with proven high-grade gold in drill results and bulk samples over more than 30 kilometers of unexplored strike length in a geological setting that has similarities to Treasury Metals’ Goliath Gold Complex.

Under the terms of the binding LOI, Heritage can earn an undivided 90% interest in the property by making payments totaling 7.2 million shares and CAD $320,000 in cash to Group Ten, completing exploration and development work totaling CAD $5 million on the property. Pending the submission of a feasibility study, Group Ten will retain a 10% interest in the property.

Michael Rowley, President & CEO of Group Ten, said, “We are pleased to announce the first in a series of deals in which Group Ten seeks to realize value for our non-core assets. This binding letter of intent fulfills our stated objective by enabling Heritage’s experienced team to unlock the significant potential of Black Lake – Drayton for the benefit of all stakeholders, including Group Ten, which will retain significant exposure to the gold market through our equity position, carried interest and potential discovery payments. We look forward to the progress of Heritage’s dedicated group of mining and financial professionals as we focus on our 100% owned Stillwater West project in Montana, which continues to rapidly develop as a low carbon, first world nickel, copper, palladium, platinum, rhodium, gold and cobalt deposit.”

Heritage Mining plans initial public offering

Heritage Mining Ltd. is a private, well-capitalized company focused on acquiring advanced stage and/or junior/micro-producer stage Tier 1 precious and base metal exploration projects. Heritage’s Board and management team have a proven track record of creating shareholder value and have over 100 years of combined experience in the mining and exploration sector.

Peter Schloo, CEO of Heritage Mining, stated, “It is rare that a project of this size and quality becomes available, and we appreciate Group Ten’s confidence in our ability to deliver timely shareholder value. We are excited about the Black Lake-Drayton gold project and look forward to systematically developing the property. This is a critical point in Heritage Mining’s journey and we look forward to the future. We expect to go public shortly after closing, market conditions permitting.”

Details of the Letter of Intent

Heritage is required to make a cash payment of CAD 20,000 to Group Ten within three (3) business days of the signing of the LOI and the LOI shall be exclusive and binding on the parties for a period of 60 days to allow for the execution of the definitive agreement (the “Agreement”).

Heritage will issue 2,800,000 shares to Group Ten within three (3) business days of the signing of the Agreement. Heritage may acquire a 51% interest (the “First Option”) in the Property by completing the following by the third anniversary of the “Agreement”: Issuance of an additional 3.3 million shares to Group Ten; completion of cash payments totaling CAD 300,000; and completion of exploration work totaling CAD 2.5 million.

Upon completion of the First Option, Heritage may earn an additional 39% interest in the Property (the “Second Option”) for a cumulative 90% interest by completing the following on or before the fourth anniversary of the Agreement: Issuing an additional 1.1 million shares to Group Ten; and completing additional exploration work totaling CAD 2.5 million.

In addition, the LOI provides as follows: Upon completion of the second option, Group Ten will retain a 10% free interest in the project with Heritage responsible for all costs of the property until Heritage has completed a positive feasibility study with a NI 43-101 technical report for the property (the “FS”).

A discovery payment of $1.00 per ounce of gold or gold equivalent will be made for mineral resource estimates filed from time to time on the Property and will be paid in cash or shares (or a combination thereof) at Heritage’s discretion, capped at $10 million.

The LOI provides for the formation of a joint venture (“JV”) based on the then legal and beneficial ownership of the Property following the closing of the FS. A JV may also be formed in the event that Heritage does not meet the requirements of the second option. In this case, Heritage is required to incur a minimum exploration and development expenditure of CAD500,000 per annum until completion of the FS in order to retain its status as operator of the JV.

Group Ten is obligated to undertake CAD 300,000 worth of exploration work on the property within the first year of the agreement, with any shortfall by Group Ten reducing Heritage’s obligation on a dollar-for-dollar basis.

The bottom line is that Group Ten owns so many quality exploration projects that, in theory, they could be used to outfit several stand-alone junior mining companies. However, these projects have not appeared to generate value for Group Ten shareholders as a minimum amount of work is done there. Even then, it is questionable whether Group Ten would really have been adequately rewarded for its gold discoveries in Ontario. The market loves to focus on one thing. So it is a right move to divest assets that are not core and to potentially add a very significant amount of cash equivalent to the Company’s balance sheet. Upon Heritage’s go public transaction, the market will have a clear indication of the value of the deal and the ability to monitor Group Ten’s Heritage holdings as the Black Lake-Drayton project gets advanced. We are now eagerly awaiting results from this year’s drilling campaign at Stillwater and the first resource estimate.

Figure 1: The Black Lake – Drayton project is adjacent to Treasury Metals’ Goliath Gold Complex in Ontario.

{letter}

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Group Ten Metals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Group Ten Metals and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Group Ten Metals. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Group Ten Metals. This is another clear conflict of interest.