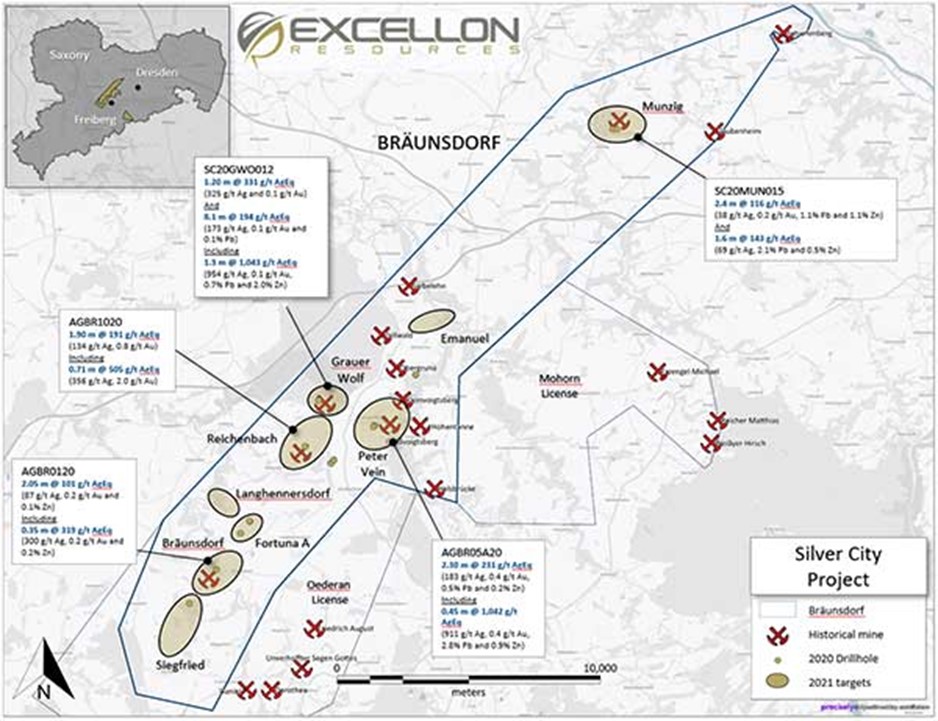

{kanada_flagge} Following successful test drilling last year, Excellon Resources Inc. (TSX:EXN, EXN.WT; NYSE:EXN; FRA:E4X2) plans to follow up with more than three times as much drilling this season at its Silver City project in Saxony. The company plans to drill a total of 12,000 meters, up from 3,700 meters last year. At that time, Excellon had drilled 16 test holes along a 24-kilometer strike and confirmed extremely high-grade silver values in some cases near historic mines. This year, the company plans to focus on four priority targets: Grey Wolf, Reichenbach, Bräunsdorf and Peter Vein. The relevant drilling permits have now been received. (see Figure 1)

Figure 1: Traces of 800 years of mining history northwest of Freiberg in Saxony are visible along a corridor nearly 30 kilometers long. This year, Excellon plans to more than triple the size of its drilling operations. At the same time, the company plans to focus on just four targets: Grauer Wolf, Reichenbach, Bräunsdorf and Peter Vein.

A particular focus of work is planned for the Munzig target area, where anomalous mineralization was identified in several zones during drilling in 2020. In addition, however, drilling is also planned to explore new targets over a strike length of more than 30 kilometers. A mafic-schist contact identified in 2020 at both Reichenbach and Grauer Wolf will serve as the stratigraphic orientation. This large-scale geological structure is considered a favorable environment for the development of epithermal silver mineralization.

Ben Pullinger, SVP Geology & Corporate Development explained, “Our 2020 drill program has confirmed the presence of a large epithermal system. We have encountered high grade silver, including new discoveries at Grey Wolf and Reichenbach. We achieved these milestones with only 16 drill holes over a strike length of 24 kilometers. This year’s program will build on the modeling and integration of these results to expand on our 2020 discoveries and make new discoveries in 2021.”

Highlights from the 2020 drill program

– 1,042 g/t AgEq over 0.45 metres (911 g/t Ag, 0.4 g/t Au, 2.8% Pb and 0.9% Zn), within 231 g/t AgEq over 2.30 metres (183 g/t Ag, 0.4 g/t, Au 0.5% Pb and 0.2% Zn) in initial drilling at Peter Vein;

– 505 g/t AgEq over 0.71 metres (356 g/t Ag, 2.0 g/t Au), within 191 g/t AgEq (134 g/t Ag and 0.8 g/t Au) in the first hole at Reichenbach (Grossvoigtsberg), a new near surface discovery in an area with minimal historic mining;

– 319 g/t AgEq over 0.35 meters (300 g/t Ag, 0.2 g/t Au and 0.2% Zn), within 101 g/t AgEq (87 g/t Ag, 0.2 g/t Au) at Bräunsdorf;

– 1,043 g/t AgEq over 1.3 meters (954 g/t Ag, 0.1 g/t Au, 0.7% Pb and 2.0% Zn) within 100 meters of surface, within 194 g/t AgEq over 8.1 meters (173 g/t Ag, 0.1 g/t, Au, 0.4% Pb and 0. 3% Zn) and 331 g/t AgEq over 1.2 meters (325 g/t Ag, 0.1 g/t Au, 0.03% Pb and 0.03% Zn) in the bedrock layer above the Grey Wolf deposit – a new high-grade discovery in an area with no historical drilling.

Drilling at the Munzig target in late 2020 encountered two zones of mineralization within 75 meters of surface (including 2.43 meters grading 116 g/t AgEq from 70 meters and 1.60 meters grading 143 g/t AgEq from 77 meters in SC20MUN015) separated by an unmineralized dam and potentially consistent with historical records describing some of the widest widths in the Bräunsdorf area.

In addition to drilling planned for 2021, fieldwork including mapping, trenching and geophysical surveys will be conducted on the Bräunsdorf license and the newly acquired Oederan, Mohon and Frauenstein licenses. These programs will be used to extend and define new drill targets into 2022.

Rich history of silver mining near Freiberg

The Silver City project was mined from the 11th to the late 19th century for its high-grade silver deposits. When Germany abandoned the silver standard in 1873 and the value of silver relative to gold plummeted, mining had to cease. Historical records indicate high-grade silver production over considerable widths throughout the area. Excellon has commenced the first modern exploration program focused on precious metals. Excellon holds an option to acquire a 100% interest in the Silver City project from Globex Mining Enterprises Inc. (TSX:GMX; OTCQX:GLBXF; and FRA:G1MN).

Summary: The geologists at Excellon Resources compare the geological potential in the region around Bräunsdorf in Saxony with world-class silver deposits such as exist in Mexico. From a German point of view, this may sound unusual, but the geologists at Excellon know what the are talking about. The company operates its main project, the producing Platosa silver mine, in Mexico and knows the geology there inside out. After last year’s successful test drilling with peak values of more than 1,000 g/t AgEq, the company sees more than ever the opportunity for a significant silver discovery in Germany. Since silver mining in Saxony ended before modern exploration methods could be used, Excellon has something of a “first mover advantage” – despite 800 years of mining history. It cannot be emphasized enough: Excellon Resources is doing pioneering work in Germany. The drilling planned for this season will be the first ever of its kind in the area northwest of Freiberg.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish commentaries, analyses and news on http://www.goldinvest.de. This content serves exclusively to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly, and is not to be understood as an assurance of any price development. Furthermore, it does not in any way replace individual expert investment advice and does not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offerings, as our information only relates to the company and not to the reader’s investment decision.

The purchase of securities involves high risks which can lead to the complete loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the guarantee of the topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares in Excellon Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Furthermore, a contractual relationship exists between Excellon Resources and GOLDINVEST Consulting GmbH which involves GOLDINVEST Consulting GmbH reporting on Excellon Resources. This is another clear conflict of interest.